The US dollar retreated after the Federal Reserve announced its monetary policy decision, which contributed to the price of gold rebounding up to the resistance level of $1788 as of this writing. Gold is now moving ever closer to testing the psychological resistance level of $1800 again. US benchmark 10-year Treasury yields jumped to their highest levels since April 13th, and the dollar rose against rivals, reducing the appeal of safe-haven assets like gold.

Gold is trading in a cautious manner as investors await the US Q1 GDP announcement. The latest figures for initial and continuing unemployment claims will also appear, as well as preliminary personal consumption expenditures for the first quarter. Personal spending, income and personal data for March will be published on Friday.

During this week, the US durable goods orders numbers for March were released, which beat expectations of 2.5% with 0.5%. Non-defense capital goods orders from aircraft also came in below expectations of 1.5% at 0.9%.

Yesterday, the Federal Reserve announced its monetary policy decisions, through which it maintained interest rates and bond-buying plans, and emphasized the continuation of support for the US economy despite the improvement in performance due to the huge stimulus plans presented by the Biden administration, as well as the acceleration in vaccinations.

The Fed raised its assessment of the US economy but maintained its ultra-loose monetary policy as widely expected. The bank left its target range for interest rates at 0 to 0.25%. Having previously said that inflation was still falling below 2%, the Fed is now acknowledging that inflation has risen but attributed the increase to "transitional factors".

The Fed’s statement also said that risks to the economic outlook remain due to the ongoing public health crisis, although this reflects an improvement from last month, when the Fed indicated "significant risks to the economic outlook."

The Fed also said it plans to continue its bond purchases at a rate of at least $120 billion per month until “another major progress” is made toward its goals of maximizing employment and price stability.

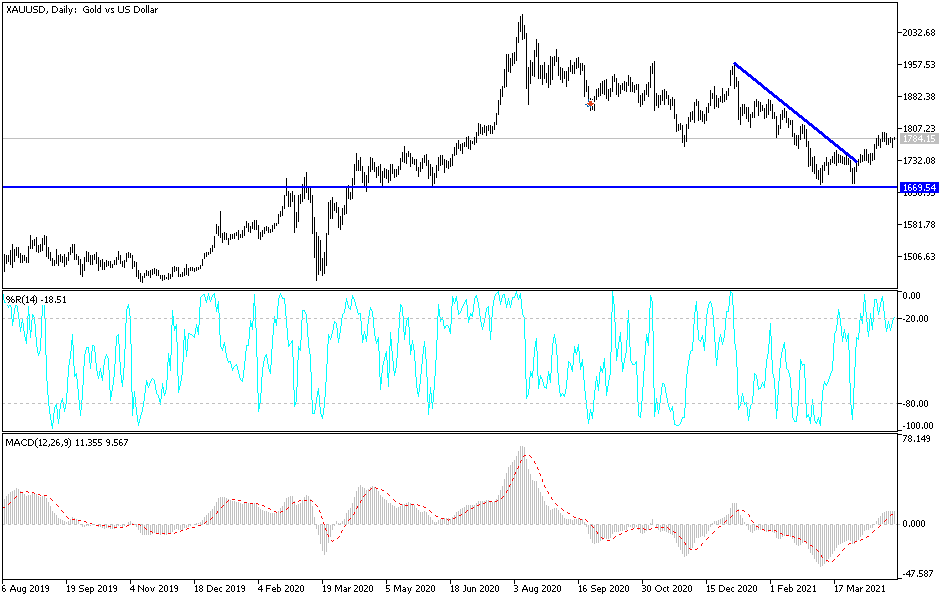

Technical analysis of gold:

In the short term, and according to the performance on the hourly chart, it appears that the price of gold is trading within the formation of a descending channel, which indicates a slight short-term downward momentum in market sentiment. The price of gold has now stabilized above the 100-hour simple moving average, away from the 23.60% Fibonacci retracement level. Accordingly, the bulls will target short-term gains at $1790 or higher at 0.00% Fibonacci at $1797. On the other hand, the bears will be looking for profits at around 38.20% and 50% Fibonacci at $1770 and $1760, respectively.

In the long term, and according to the performance on the daily chart, it appears that the price of gold is trading within a descending channel formation, which indicates a significant long-term bearish bias in market sentiment. It now sits above 50% Fibonacci level on the way down. Therefore, the bears will look to extend the current downside movement towards $1746 an ounce or less to the 61.80% Fibonacci level at $1697. On the other hand, the bulls will target profits at 38.20% Fibonacci at $1,837 or higher at $1883 an ounce.

The price of gold will be affected today by the extent of investor risk appetite and the strength of the US dollar, after the announcement of the US GDP growth rate and the number of US jobless claims weekly.