Gold futures fell at the end of last week’s trading and settled around the $1732 level after gains boosted it to $1758, its highest in a month-and-a-half. The gold price retreated due to the strength of the US dollar and the high yields of bonds. The strength also affected the stock markets amid continued optimism about economic growth. Despite Friday's decline, the price of gold recorded weekly gains of approximately 1%. In the same performance, silver futures contracts ended lower at $25,325 an ounce, while copper futures settled at $4.0400 a pound.

Data from China showed that consumer prices rose 0.4% year-on-year in March, beating expectations of a 0.3% increase. China's National Bureau of Statistics also said that producer prices jumped 4.4% in March - beating expectations of a 3.5% increase and sharply higher than the 1.7% gains of the previous month.

The Labor Department released a report showing that producer prices jumped much more than expected in March. The Labor Department said the Producer Price Index for final demand rose 1% in March after jumping 0.5% in February. Economists had expected another increase of 0.5%. In general, inflation in the United States is increasing according to the new data, which led one economist to say that pressure will now increase on the Fed to raise US interest rates.

US producer price inflation - which measures the prices of goods bought and sold by manufacturers - rose sharply in March, which is a strong indication that prices paid by consumers will rise in the coming months. Commenting on the latest figures, James Knightley, chief international economist at ING, says that the PPI data for March matches other business surveys that indicate continued price pressures, with some surveys indicating greater ability to pass higher costs on to consumers. He also added that this would add to the upside risks of the CPI in the coming months and increasingly refer to previous Fed policy actions.

While fuel costs have contributed significantly, there is evidence in the data of expanding price pressures. Accordingly, economists believe that inflation could remain close to 3% during most of the next two years in an environment of strong growth and rapid job creation, and therefore risks are increasingly leaning towards raising interest rates in late 2022 instead of 2024.

But Sarah House, chief economist at Wells Fargo Securities, says the Fed will likely want to see evidence of whether the rise in inflation this year is really a temporary blowout linked to fully reopening the economy versus shifting to a higher inflation environment after COVID. This should keep the FOMC on the sidelines in the coming months, even as inflation rises.

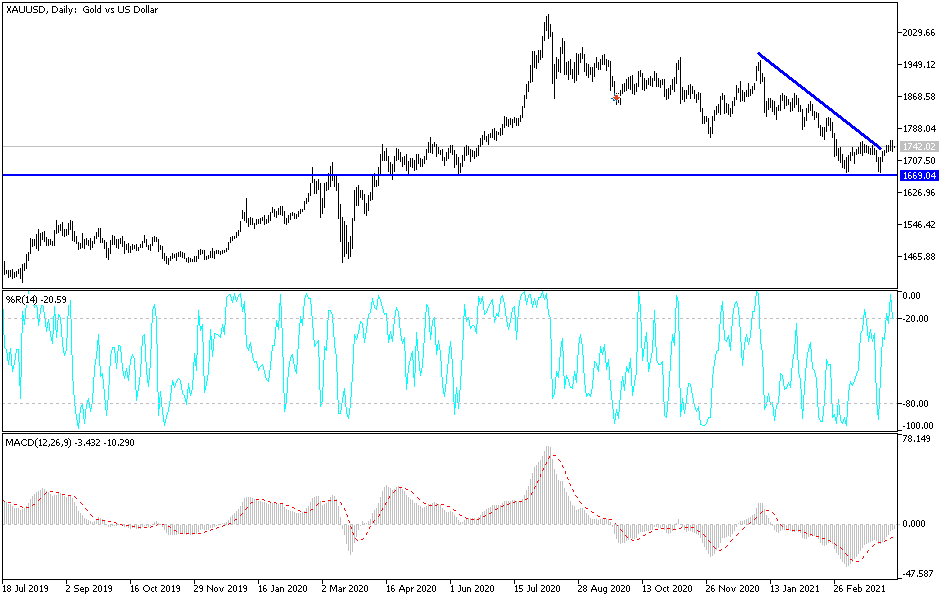

Technical analysis of gold:

On the daily chart, the price of gold is still moving in a relatively neutral range with a bearish inclination, which may possibly breach the support levels of $1733, $1720 and $1700. With the recent gains, the gold price still lacks the momentum to move towards the psychological resistance of $1800, which is the most important for the return of bulls' control over performance. I still prefer to buy gold from every downside.