Gold futures fell to the support level of $ 1723 an ounce at the time of writing the analysis, after achieving modest weekly gains. In general, the yellow metal is trying to find support amid the weakness of the US dollar and the mixed performance of the bond market.

The yellow metal posted a weekly gain of 1% last week, to reduce its loss over the year 2021 to less than 9%. In the same performance, silver, the sister commodity to gold, is also declining with the start of trading this week. Silver futures fell to $ 25.18 an ounce. Accordingly, the white metal rose by about 1% last week, reducing its decline during 2021 to about 5%.

On the other hand, affecting the performance of the metals market, Fed Chairman Jerome Powell recently spoke on the 60 Minutes program, stating that the US economy is at a "tipping point", adding that he hopes inflation and the labor market will accelerate in the coming months. Although the inflation target is 2%, the US central bank implemented a policy last year that allows inflation to exceed the target rate before intervention.

So far, the US dollar and bonds will still be the main driver of gold prices..

The US dollar index (DXY) is down to 92.06 after dropping 0.1% last week, but has remained up 2.4% to date. A weaker dollar is beneficial to dollar-denominated goods because it makes them cheaper for foreign investors to purchase. Yesterday's Treasury yields were also mixed, with the benchmark 10-year yield down to 1.664%. The one-year yield increased to 0.061%, while the 30-year yield declined 0.008% to 2.331%. The Treasury market has dominated business headlines over the past two months due to its rally. A higher yield is bad for zero-return bullion because it increases the opportunity cost for investors.

So, the question now is, has the bullish cycle of gold ended? After posting the biggest quarterly loss since 2016, bearish sentiment has cast a shadow over the gold market. This could be a divide between East and West, says Kevin Rich, a consultant to the global gold market in the Perth Mint. In the United States and Europe, the demand for investment in gold has decreased, but the Asian markets have moved to buying and boosting demand

Although inflation concerns continue to support gold, the positive economic outlook may hamper the precious metal's future gains.

Relative to other metal market prices, copper futures fell to $ 4,018 a pound. May platinum futures were down $ 23.30, or 1.93%, to $ 1,186.00 an ounce. Palladium futures rose to $ 2,637.00 an ounce.

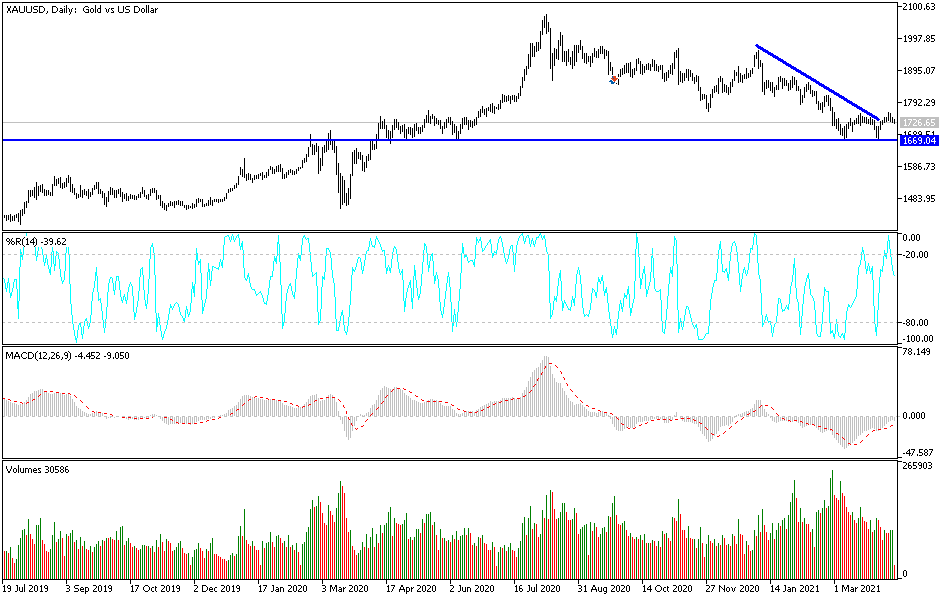

According to technical analysis of gold: Gold investor sentiment will be affected today by the announcement of the growth rate of the British economy, Chinese trade figures, German ZEW reading and US inflation figures. So far, the downward pressure for gold is in place, and the selling rate will increase if it moves below the support level 1710, which may push it to breach the support 1685 quickly. I prefer to buy gold, despite the weak attempts to correct it up recently. On the other hand, the bulls' most important target now is to test the psychological resistance of $ 1,800 an ounce, which may increase the broader purchase of the yellow metal