The decline of the US dollar and renewed fears of increasing COVID infections contributed to moving the price of gold to the $1797 resistance level, closing in on the psychological peak of $1800. Corona infections and renewed restrictions may threaten expectations of a global economic recovery this year. In the same performance of gold, the price of an ounce of silver rose to the level of $26.57, while copper futures settled at $4.2790 a pound.

Investors are now awaiting Thursday's European Central Bank meeting for more clarity on the bloc's stimulus plans. Also, the US Federal Monetary Policy Meeting is scheduled to take place next week, when the bank’s policymakers are expected to adhere to the ultra-easy monetary policy despite the recent positive numbers in the US economic sectors.

Fed Chairman Jerome Powell said recently that the upcoming rise in inflation readings is likely to be temporary and will not cause the US central bank to change its monetary policy.

US President Joe Biden has achieved the goal of administering 200 million doses of coronavirus vaccines in his first 100 days in office. More than 50% of adults are at least partially vaccinated, and about 28 million doses of vaccine are administered each week. In this regard, Biden said in a speech at the White House on Wednesday, "We are entering a new phase of vaccination efforts," noting that the first months of the start of the program were targeting the elderly and essential workers. "Our goal now is to reach everyone, everyone over the age of 16 in America."

Also, the White House announced it was trying to overcome the dwindling demand for COVID-19 doses by offering a tax incentive to companies to give employees paid time off to get vaccinated.

Greece's prime minister said that the country's tourism industry will open on May 15, when the ban on travel between different regions of the country will be lifted. Accordingly, Greek Prime Minister Kyriakos Mitsotakis announced in a televised address that restaurants and cafes will be allowed to reopen outside areas starting from May 3. Despite the lockdown measures, Greece has struggled to contain the flare-up in cases that began in late January. The death rate remains above the European Union average.

The total confirmed death toll in Greece reached 9,713 as of Wednesday.

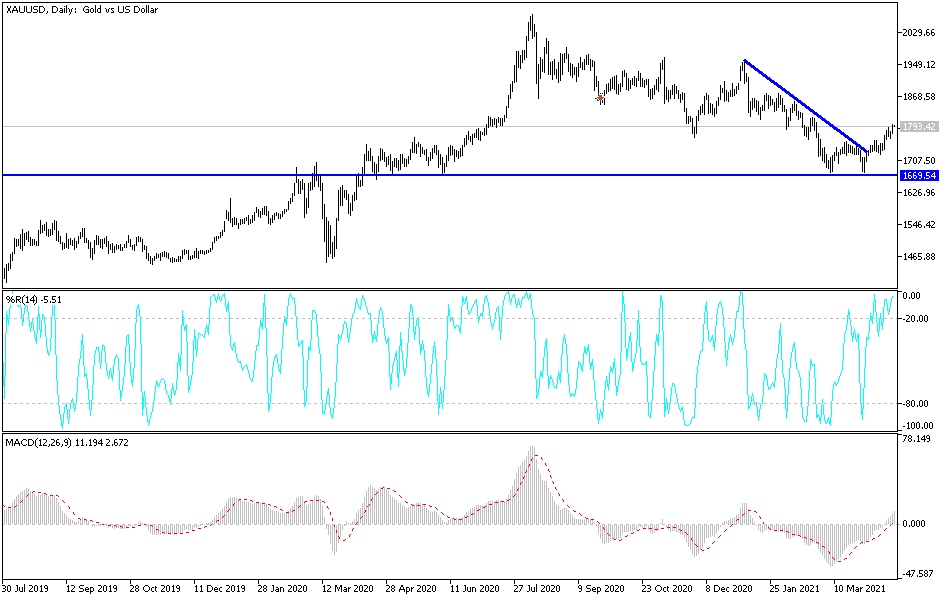

Technical Analysis of gold:

The price of gold is likely to move up from $1800 to reach stronger bullish levels, the closest of which are currently $1818, $1832 and $1855. Technical indicators still have the opportunity to move higher before reaching overbought levels. On the downside, according to the performance on the daily chart, there will be no first reversal of the bullish trend without moving below the support level of $1722 an ounce.

The price of gold will be affected today by the strength of the dollar and market risk appetite, as well as the reaction to the announcement of the monetary policy decisions of the European Central Bank and the number of US jobless claims.