Despite the decline of the US dollar with the return of traders from the holiday, the price of gold only rose to the $1733 level before settling around $1728 as of this writing. Gold is waiting for more momentum to achieve stronger gains or to complete the recent downward path that pushed it to the $1678 support level last week. Gold's gains were limited as investors chose riskier assets such as stocks thanks to the latest batch of positive economic data, better than all expectations.

The US Dollar Index (DXY) fell to 92.54, after showing some strength earlier thanks to upbeat US jobs data and a report showing strong growth in the US manufacturing sector. In terms of the bond market, one of the strong influencing factors on gold recently, as the bond market was characterized by mixed performance at the beginning of trading this week, with US 10-year bond yields increasing 0.002% to 1.725%. The one-year yields were unchanged at 0.068%, while the 30-year note jumped 0.009% to 2.374%. The recent increase in Treasury yields has affected the metals due to the opportunity cost. Non-yielding bullions are usually affected by higher Treasury yields.

In the same performance as gold, silver futures ended lower at $24,780 an ounce, while copper futures settled at $4.1375 a pound.

Data from the US Labor Department on Friday showed that employment in the US rose much more than expected in March. The data showed that non-farm employment increased by 916,000 jobs in March, after it increased by 468,000 jobs adjusted for the increase in February. Economists had expected US employment to jump by 647,000 jobs, compared to the addition of 379,000 originally reported jobs for the previous month.

Yesterday, a report issued by the Institute of Supply Management showed that the growth of service sector activity in the United States of America witnessed a significant acceleration in the month of March. The ISM said its Services PMI rose to 63.7 to an all-time high in March from 55.3 in February. Economists had expected the index to rise to a reading of 58.5. The previous record high was 60.9, set in October 2018.

According to a report by the Commerce Department, US factory orders fell 0.8% in February after rising by an upwardly revised 2.7% in January. Economists had expected factory orders to drop 0.5% compared to the 2.6% jump originally registered for the previous month.

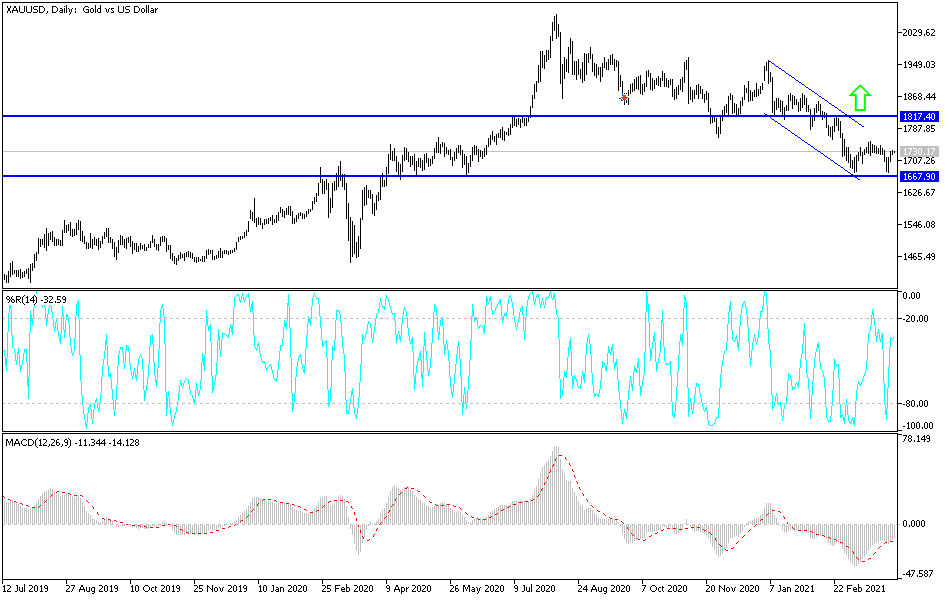

Technical analysis of gold:

On the daily chart, there is no change in the movement of the gold price, as it is still moving within a sharp downward channel since it abandoned the level of psychological resistance of $1800 an ounce, which is important for the bulls' control over the price. There will be no rebound in the general trend of gold without breaching that resistance. The closest targets of the bears are currently the support levels of $1710, $1692 and $1673.

Global vaccination efforts, risk appetite, the return of global economic activity, and the strength of the US dollar will be the most important factors affecting the performance of the gold price in the coming days.