The recovery of the US dollar stopped gold's attempts to rebound higher, and recent attempts to break through the psychological resistance of $1800, crucial for the bullish trend, failed. The price of gold stabilized around the level of $1780 as of this writing, awaiting new developments. Markets and investors are currently interacting with developments on the ground regarding the increasing number of global infections with the coronavirus and the reaction to imposing more restrictions on global economic activity.

Investor confidence has increased as governments roll out coronavirus vaccines that they hope will allow business activity to return to normal. This has alleviated unease over the possibility of higher inflation and interest rates. Nevertheless, investors expect the US Federal Reserve to keep the key lending rate near zero and to pump more money into the financial system by buying bonds after the two-day meeting that begins on Tuesday.

US Federal Reserve Chairman Jerome Powell is sure to reiterate his view that the US economy is far from fully recovering and needs continued central bank support in the form of lower borrowing costs. There are still 8 million fewer jobs than there were before the outbreak. The country's unemployment rate is at 6%, although it is much lower than it was a year ago. Powell stressed that more gains in the labor market are needed to help the many Americans - particularly low-income workers - who have been disproportionately affected by job and income losses and have yet to benefit from the early stages of the recovery.

US monetary policymakers themselves have become more optimistic about the recovery. In the past month, they raised their forecasts for growth and inflation significantly. They estimated that the US economy will grow 6.5% this year, up sharply from their previous December forecast of 4.2%. They raised their inflation forecasts by the end of this year from 1.8% to 2.4%. So far, the economic recovery has been occurring more quickly than economists had anticipated. In March, employers added nearly 1 million jobs - a number almost unheard of before the pandemic - and US jobless claims fell to their lowest levels since the COVID-19 virus emerged.

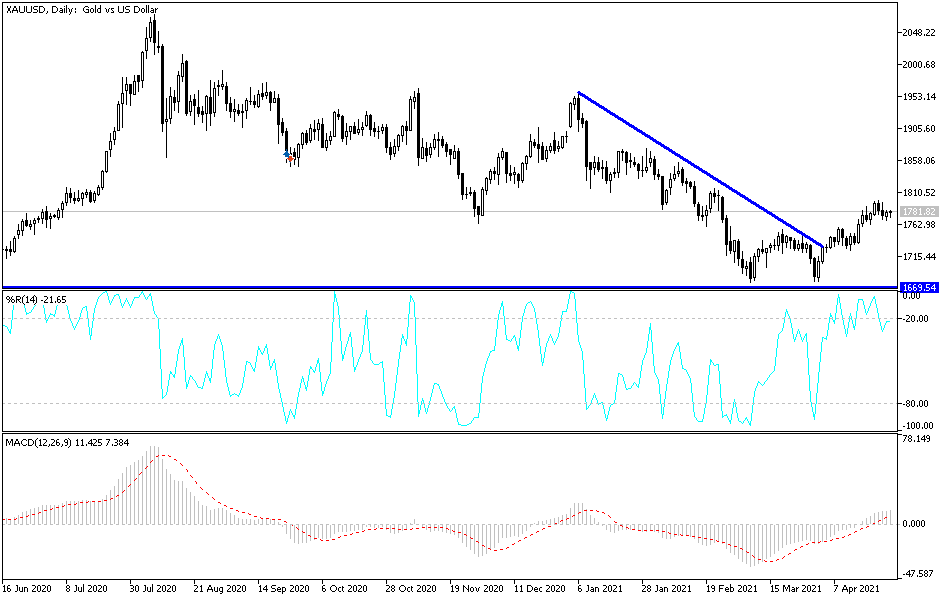

Technical analysis of gold:

To strengthen the bullish outlook, bulls are trying to break through the psychological resistance level of $1800, which may increase buying and thus a move to stronger bullish levels, the closest of which are currently $1815,$ 1829 and $1845. On the downside, bullish hopes will be dashed if the gold price moves below the support level of $1718 over the same period of time. So far, I still prefer to buy gold from every downside.

The price of gold will be affected today by the strength of the US dollar and risk appetite.