After a strong bullish moves last week, the price of gold has returned to the support level of $1765 as of this writing. The price of gold tumbled after having witnessed its best trading week since December. Gold prices are under pressure amid sell-offs and anticipation of the next major development in global financial markets. Gold prices last week enjoyed gains of nearly 3%, marking their best weekly performance in four months. Since the beginning of the year 2021 to date, gold has decreased by about 7%.

Silver, the sister commodity to gold, has slipped below $26 an ounce at the start of trading this week, and failed to sustain gains in overnight trading. Accordingly, silver futures fell to $25.905 an ounce. The white metal also rose around 4% last week, to trim its loss in 2021 to less than 3%.

The yellow metal had very few trends to spot on Monday for a concrete trend.

Among the factors affecting the price of gold was the dollar maintaining its bearish path since last week, with the decline in the US Dollar Index (DXY) to 91.10, from an opening at 91.58. The DXY, which measures the performance of the greenback against a basket of six major rival currencies, fell by more than 1% last week. Nevertheless, the index is still up 1.3% year-to-date.

The weakness of the index is beneficial for dollar-denominated commodities, as it makes them cheaper for foreign investors to purchase.

We noticed a variation in the performance of the US bond market, as the benchmark yield for 10 years increased by 0.01% to 1.583%. The one-year yield fell 0.002% to 0.061%, while the 30-year yield jumped 0.016% to 2.279%. Bond yields are critical to non-yielding commodities because they increase the opportunity cost.

But at the same time, market analysts say that the growing geopolitical tensions between Russia and the United States could be one of the main catalysts to stimulate a renewed recovery in precious metals. Moreover, disappointing COVID-19 vaccine launch campaigns around the world and health concerns related to some coronavirus vaccines could raise gold prices as well.

Commenting on the performance, Lukman Otunuga, Senior Research Analyst at FXTM, wrote in a research note, "Gold has drawn significant strength from the decline in Treasury yields and the weakening of the dollar last week."

The commodity has gained more than 4% this month and has the potential to rally amid mounting tensions between the United States and Russia. However, bears could still emerge, as economic data from the two largest economies in the world remain very encouraging and may boost global sentiment. If risk becomes dominant in the markets, it could pressure the appetite for safe-haven gold.

Could inflation be another important metric for gold in the second and third quarters?

The US Federal Reserve has reassured financial markets that it will not “stop” monetary support to the economy. In addition, commodity inflation is spread across the global market, leading to safe haven speculation.

Relative to the prices of other metal commodities, copper futures rose to $4,248 a pound. Platinum futures for May were steady at $1,209.60 an ounce. Palladium futures rose to $2809.50 an ounce.

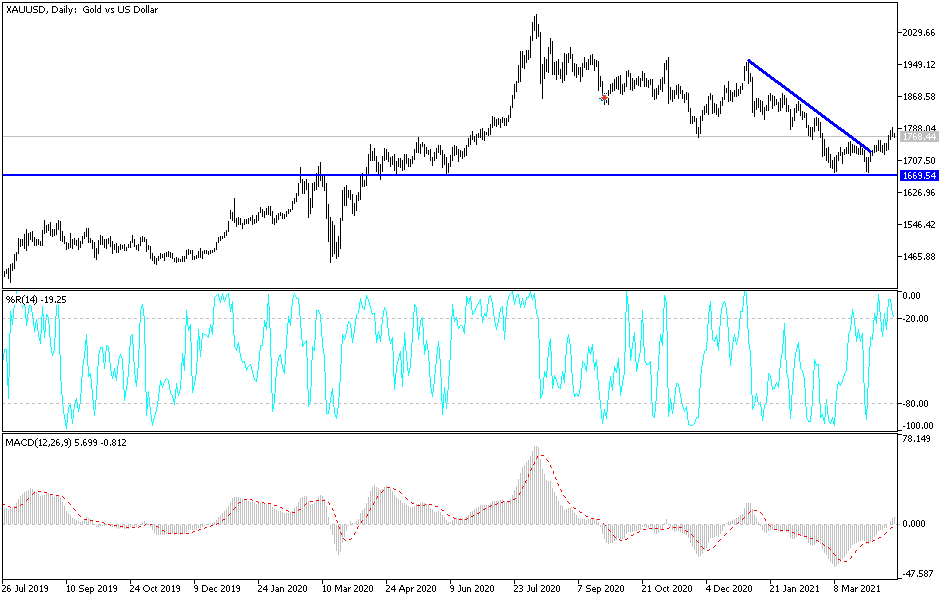

Technical analysis of gold:

According to the performance on the daily chart, the price of gold is still moving within its recently formed ascending channel. The bulls' control over the performance will strengthen in the event that the price moves above the psychological resistance of $1800, because it may push the gold price to stronger ascending levels such as $1825, $1855 and $1880. Gold's gains and bullish expectations are facing obstacles from improving investor morale due to progress in vaccinations and easing COVID restrictions. The bears' control over the performance will be strengthened in the event that the gold price moves towards the support level of $1735. At the moment, the gold's gains may face pressures, which is why we recommended selling recently.