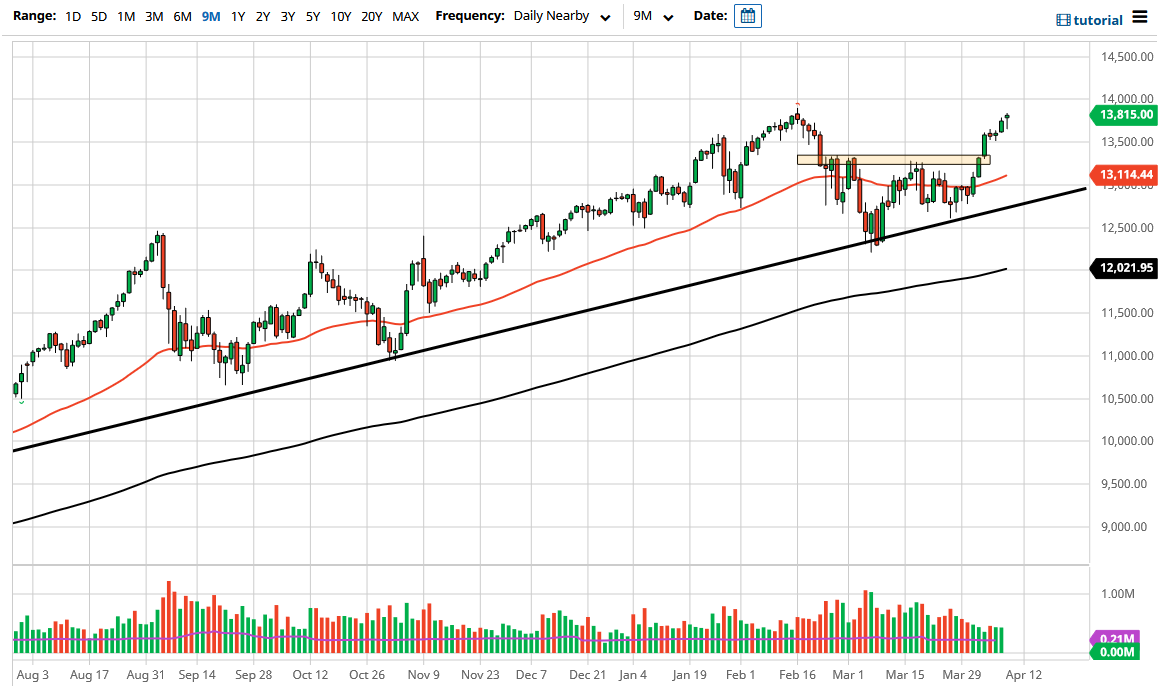

The NASDAQ 100 initially fell during the trading session on Friday but then turned around to form a bit of a hammer-shaped candlestick. This is interesting, considering that we are heading into the earnings season next week, and that suggests that we are going to continue to see a lot of volatility. After all, the earnings season will drive markets back and forth, but now that the yield situation in America seem to be stabilizing, that may have markets calming down a bit.

If we break down below the bottom of the candlestick for the trading session, that could open up a move down to the 13,333 level, an area that was previous resistance. In fact, it was a bit of a neckline for an inverted head and shoulders pattern, so that will attract a lot of attention in and of itself. We have not reached the projected target quite yet, so we still have further to go due to that alone. However, if the earnings numbers are extraordinarily good, and perhaps even guidance is strong from a lot of the world’s largest tech companies, then we might see an opportunity for this market to go even higher.

If we were to break down below the 13,333 level, the market is likely to go looking towards the 50-day EMA underneath. That is an area that would cause a little bit of support, and therefore I would anticipate a lot of value hunters in that area, as well as the uptrend line just underneath. The uptrend line has been important for quite some time, so I think that the market will eventually find buyers on dips as per usual. After all, any serious sell-off in the markets will attract the Federal Reserve and they will jump in and save everyone.

If we break down below the uptrend line, though, I would be a buyer of puts, just in case I can make some significant gains in a short amount of time. Furthermore, buying a put option gives you the ability to make money on the downside without getting blown up by the Federal Reserve or some other entity jump in the market with more hope. That is the least likely of scenarios and it is much more likely that we will see 14,250 before we test that trendline.