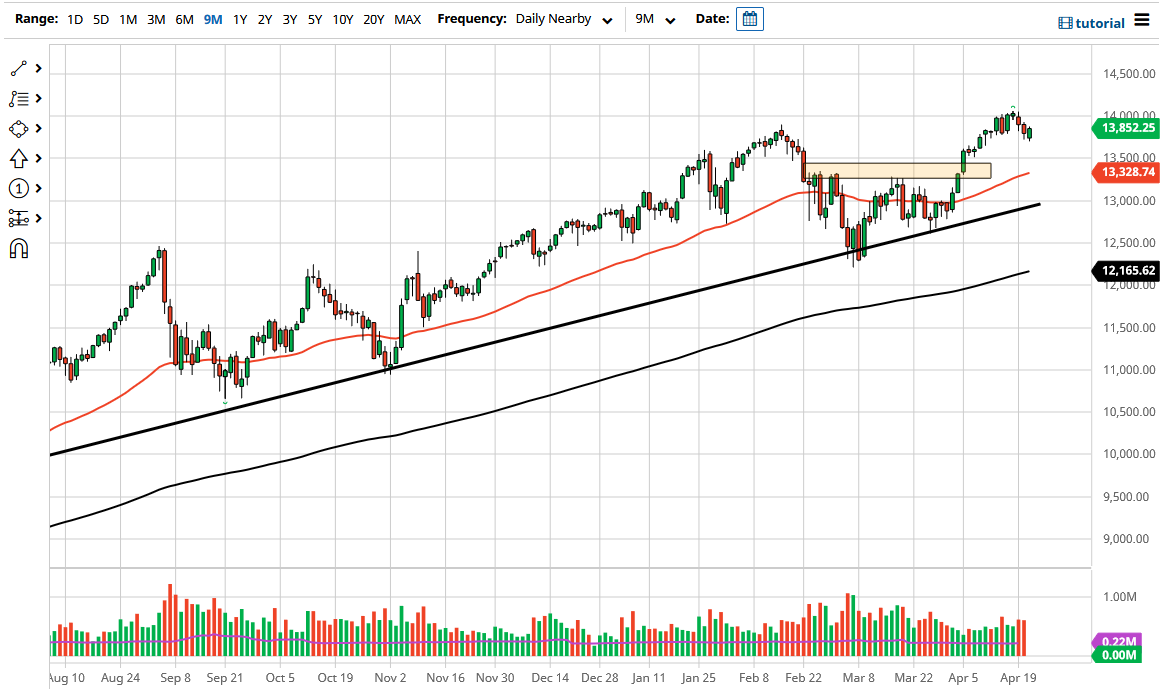

The NASDAQ 100 has rallied significantly during the course of the trading session on Wednesday to reach towards the 13,915 handle. We closed at the very top of the range for the day, which is a very bullish sign. This suggests that the market is ready to go higher and try to take out that 14,000 level above. The NASDAQ 100 does tend to be more volatile than some of the other indices, so I think at this point it is very likely that we will see an attempt to break out.

If we do get that breakout above 14,000, we are likely to continue to see the uptrend continue for the longer term. At that point in time, I believe that the NASDAQ 100 would probably go looking towards the 15,000 level, but obviously it will not happen overnight. This is a market that I think will continue to see plenty of upward momentum, but every time we get a little bit of a pullback, I think there will be plenty of buyers willing to get involved as well. In fact, I believe that we not only have seen a sign that we are going higher, but even if we did break down, I think there is plenty of support at the 13,333 level, and the 50-day EMA which is sitting right in the same area. The 13,333 level is a neckline for an inverted head and shoulders, so it should be very important.

The candlestick did wipe out all of the losses from the previous session, which in and of itself is rather important. The market will more than likely look towards after-hours earnings, and what is going on with the US dollar. The US dollar does look as if it is starting to fall again, so that will quite often pick up stock markets as well as Wall Street loves a shrinking greenback.

I have no interest whatsoever in shorting this market as per usual, so it simply a matter of if the market falls, we just look for a bounce or some type of support to get long. Otherwise, you buy a breakout of the resistance that we see just above. Selling is something that I won't do as long as the Federal Reserve is so active.