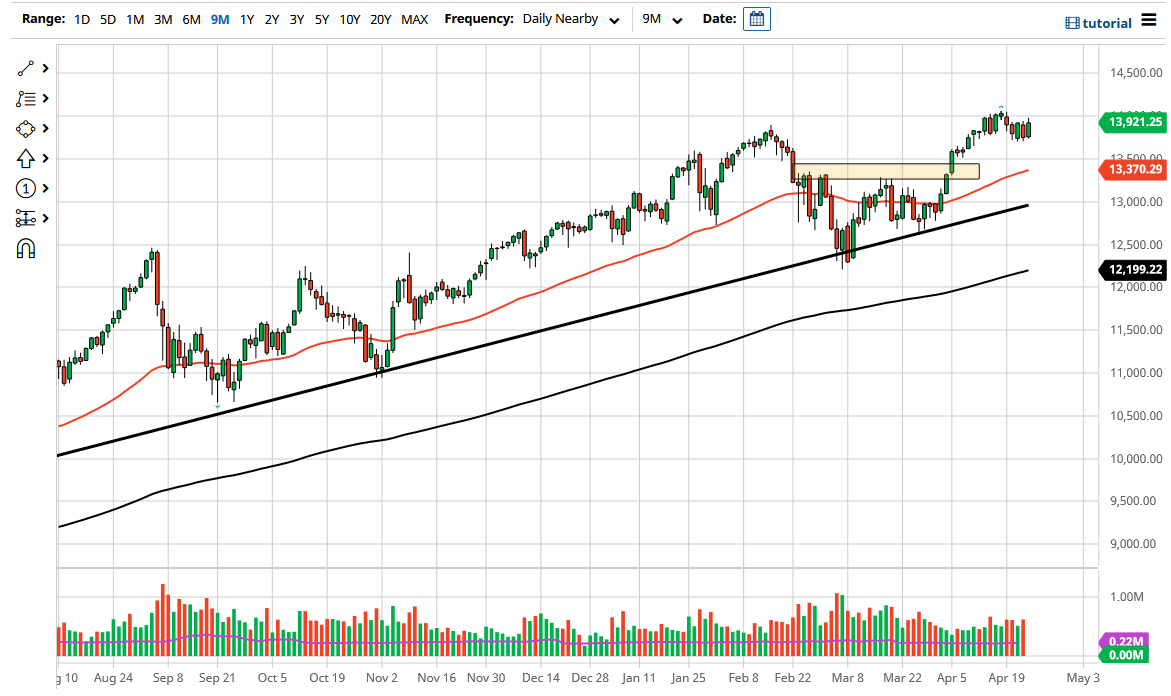

The NASDAQ 100 rallied a bit during the trading session on Friday again, but still remains below the 14,000 level. The market is simply killing time as we march through earnings season, and I think at this point we may get the occasional pullback that you could be buy. We are still in an uptrend, so there is no need to think about shorting anytime soon, and I think that we will eventually have the buyers jump into push much higher.

If we can eventually break above the 14,000 level on a daily close, then I think the NASDAQ 100 is ready to go much higher. The 50-day EMA is starting to cover the 13,333 level, which is an area that was previously a neckline for an inverted head and shoulders pattern, which will attract the attention of a lot of traders. Furthermore, it is worth noting that the uptrend line underneath would also offer a significant amount of support, so I think this is a market that will continue to see momentum to the upside over the longer term, and what we may be seeing is a little bit of hesitation as the world digests the most recent shot higher.

The tech-heavy index has a lot of sensitivity to interest rates, so pay attention to what is going on with yields in America. Ultimately, this is a market that continues to see a lot of volatility just as everything else does right now, so I think that we are probably going to continue to see a lot of back and forth. Nonetheless, what I would really like to see is some type of major sell-off in the next few days that I can take advantage of. Until then, I would be a bit hesitant to jump all in, but I do think that we would probably see more money, if we can finally clear that 14,000 handle. With that being said, I think that we will continue to be more upward than down, but you need to pick your places to get involved. I think it would be very likely to see an opportunity to get long sooner or later, so simply take your time.