The NASDAQ 100 rallied significantly during the trading session on Monday to break above the 14,000 level yet again. At this point, the market is closing at the very top of the range for the session, so that is a very bullish sign as well. Keep in mind that it is the midst of earnings season, so there could be a lot of noise out there that could come into play. With this being the case, I think that it is only a matter of time before we see the market break above there and continue to go much higher.

This does not mean that it has to happen today, because we could see a lot of consolidation and back and forth during the course of the week. Not only do we have major technology giants reporting over the next couple of days, but we also have the Federal Reserve meeting for the next couple of sessions. Nonetheless, we are very much in an uptrend, and there is no way to short this market anyway. The Federal Reserve will do whatever it has to do to keep the market afloat, but that does not necessarily mean that you jump in with both feet and trade with reckless abandon.

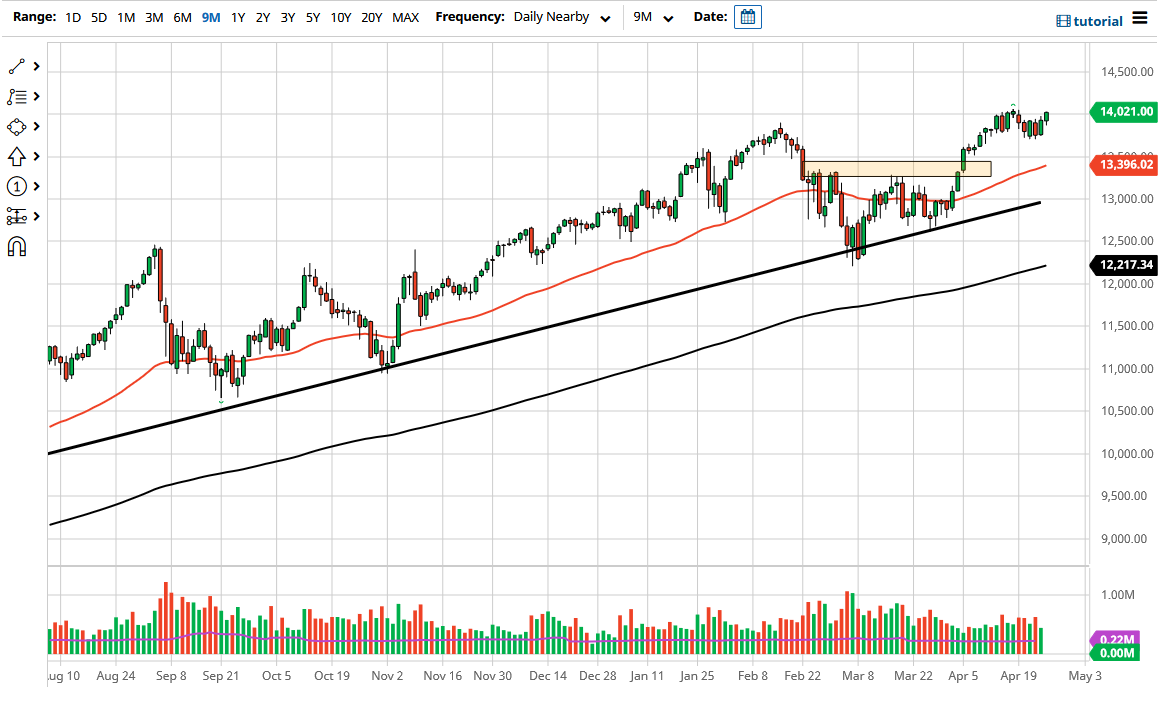

To the downside, the market is likely to go looking towards the 50-day EMA if we break down, and then perhaps the 13,333 level, followed by the uptrend line that is sitting on the chart as well. I have no interest whatsoever in trying to short this market, and it is not until we break down below the 13,000 level that I would be a buyer of puts. At that point, I can take advantage of the downward motion, without exposing myself to the whims of the Federal Reserve and whatever it is they decide to do to bail out Wall Street. That being said, this is still a “buy on the dips” type of market, and I do not see that changing anytime soon. We have seen the same loose monetary policy since the Great Financial Crisis, and I do not see that changing anytime soon, possibly not even in my lifetime at this rate. Having said that, you have to be “long only” when it comes to this market.