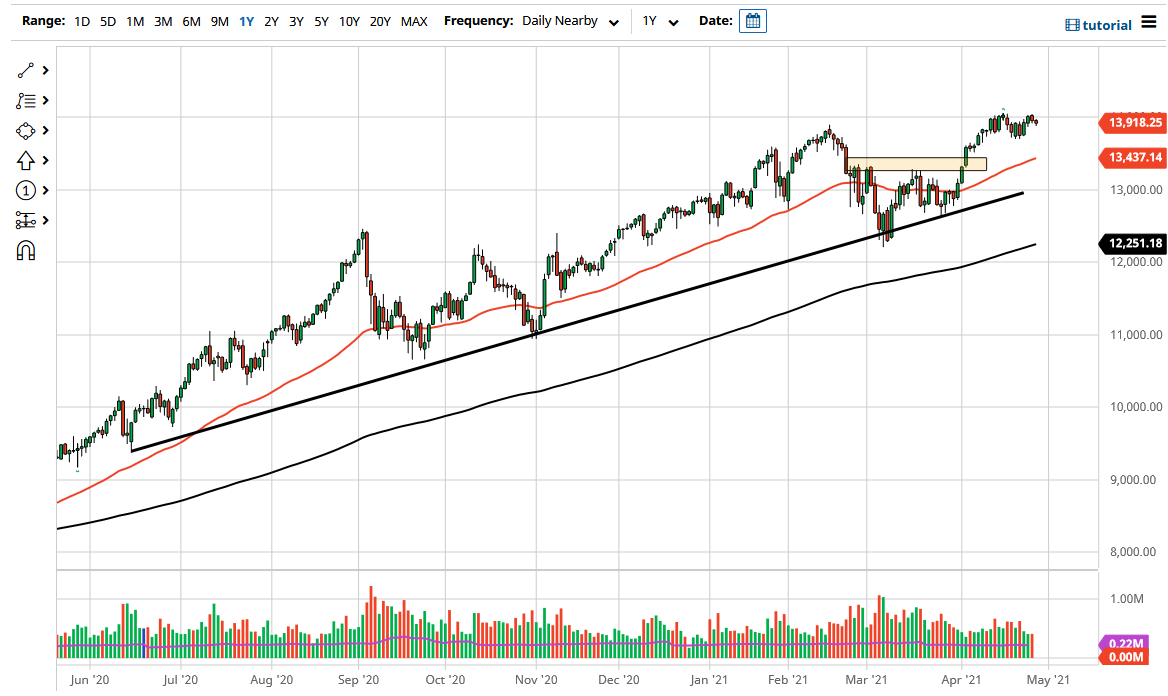

The NASDAQ 100 fell slightly during the trading session but then recovered as the Federal Reserve Open Market Committee came and went without much in the way of change. With that being the case, the market is essentially looking for some type of catalyst, which one would think we should continue to see as the overall attitude of the market continues right along with that liquidity push. However, if we do pull back from here, I would anticipate that the 13,333 level should be massive support, assuming that we even get there. Keep in mind that the 13,750 level and the 50-day EMA both are between here and there, and both of those could cause a certain amount of support.

Remember, the NASDAQ 100 is lifted by a handful of stocks, so as long as the usual FANG-type stocks do well, this index will lift based upon the fact that it is not equally weighted. I think if we get a daily close above the 14,000 level, then it is likely to send this market much higher, perhaps opening up the possibility of a move much higher. At that point, I would anticipate that the NASDAQ 100 would almost certainly go looking towards the 15,000 level, as it is the next major round figure.

To the downside, I would not be a seller under any circumstances, unless we break down below the 200-day EMA. At that point, I would be a buyer of puts, not someone who goes short of this market, because there are far too many destroyed accounts every time that happens. The central banks will not let the market melt down, from the United States to Germany to Japan. We find ourselves in a world of liquidity more than anything else, so we will continue to go higher, right along with inflation from everything that I see. Because of this, I will continue to buy dips and breakouts going forward. The 14,000 level has been very difficult, but the longer we spend time here, the more likely we are to work off some of the excess froth so that we can go higher, opening up the next leg to the upside that the market so desperately seems to want to go.