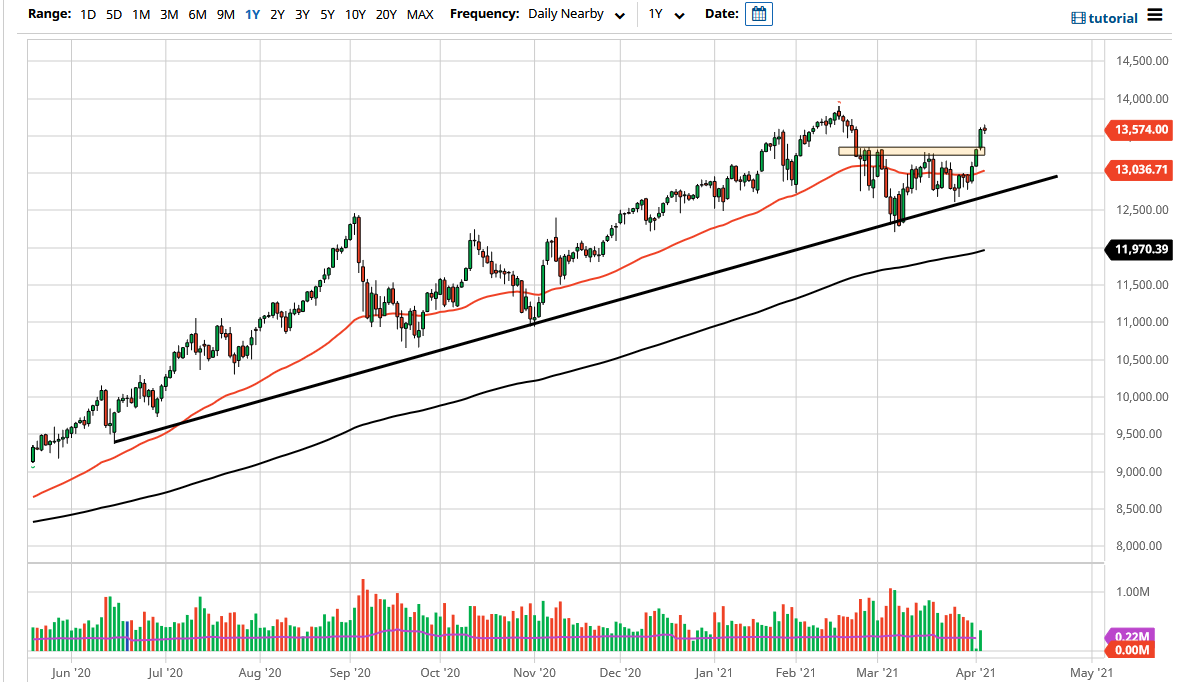

The NASDAQ 100 slowed down a bit during the trading session on Tuesday, culminating in a massive move over the last three previous trading days. This is not to say that we need to be concerned about the NASDAQ 100, just that we finally ran out of momentum. I think at this point it is likely that the 13,333 level will offer a bit of support, due to the fact that it had previously been so resistive. A pullback to that area that show signs of support will have me getting long of this index, especially if we continue to see yields in the bond markets drift lower.

To the upside, I believe that the high near 13,900 will be the initial target, but I think that we had just gotten a little bit ahead of ourselves. After that, it is likely that the market will go looking towards the 14,000 level, and then beyond. Long term, I believe that we are going to go looking towards the 15,000 level, which is something worth paying attention to. The 50-day EMA underneath is sitting just above the 13,000 level, so I think that is your first “floor in the market” if we were to break down below that previous resistance barrier. Breaking down below there then brings in the uptrend line. The uptrend line being broken to the downside would be negative, and it is only at that point that I would be a buyer of puts.

The shape of the candlestick tells me that we are running out of momentum, so I am planning on simply sitting on the sidelines and waiting for a little bit of value to get involved, perhaps near the 13,333 level. I may wait for a daily candlestick to make that decision, but this would simply be yet another example of “a breakout and a retest” type of scenario. That is a very basic technical analysis strategy, and I think that a lot of people will be looking at this chart in that same mindset. We do start earnings season next week, so that could come into play as well, but at the end of the day we are in an uptrend and have seen a confirmation of the buying pressure over the previous several sessions.