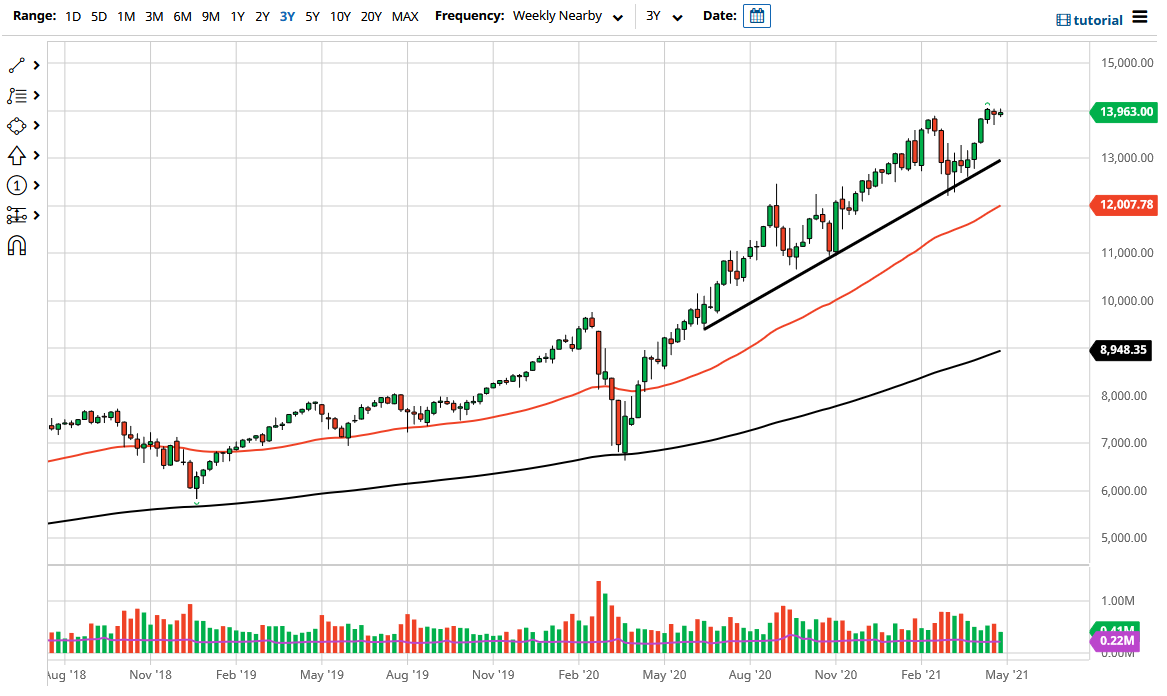

The NASDAQ 100 has been relatively quiet over the last couple of weeks in April as the 14,000 level continues offering resistance. That being said, I do believe that this market will be able to break above there during the month of May, assuming that we would have to wait that long. At this point, it has become obvious to me that this market will continue to grind to the upside, and perhaps what we are seeing currently is that the market is trying to break above the large figure, allowing the market to go much higher.

To the downside, I see multiple areas where this market should find support, not the least of which would be the massive uptrend line that I have marked on the chart. Furthermore, the 13,000 level is a large, round, psychologically significant figure, and an area where we had previously seen a lot of resistance. At this point, the market is likely to continue to find plenty of buyers on dips as the Federal Reserve has had its FOMC meeting and has left the market with the impression that they are going to continue to flood the markets with liquidity. In fact, interest rate hikes are so far away right now that it seems like the only game in town is to buy stocks.

To the upside, I do recognize that the 15,000 level will more than likely be significant psychological pressure, but I would not be surprised at all to see this market try to get there during the month. I would also anticipate that there should be a bit of noise at the 14,500 level, but that will only be a minor speedbump on the way higher.

As per usual, I have no interest in trying to short this market, but if we broke down below the 50-week EMA, which is currently sitting at the 12,000 handle, one would have to recognize that we could see a significant selloff. I would be a buyer of puts at that point, trying to take advantage of the downward pressure, but not risking anything more than absolutely necessary. At that point, then I am waiting for the market to bounce before I consider buying again. That is the game we have been playing for 13 years, and that is most certainly the game we will be playing during the month of May, assuming we even get any negativity.