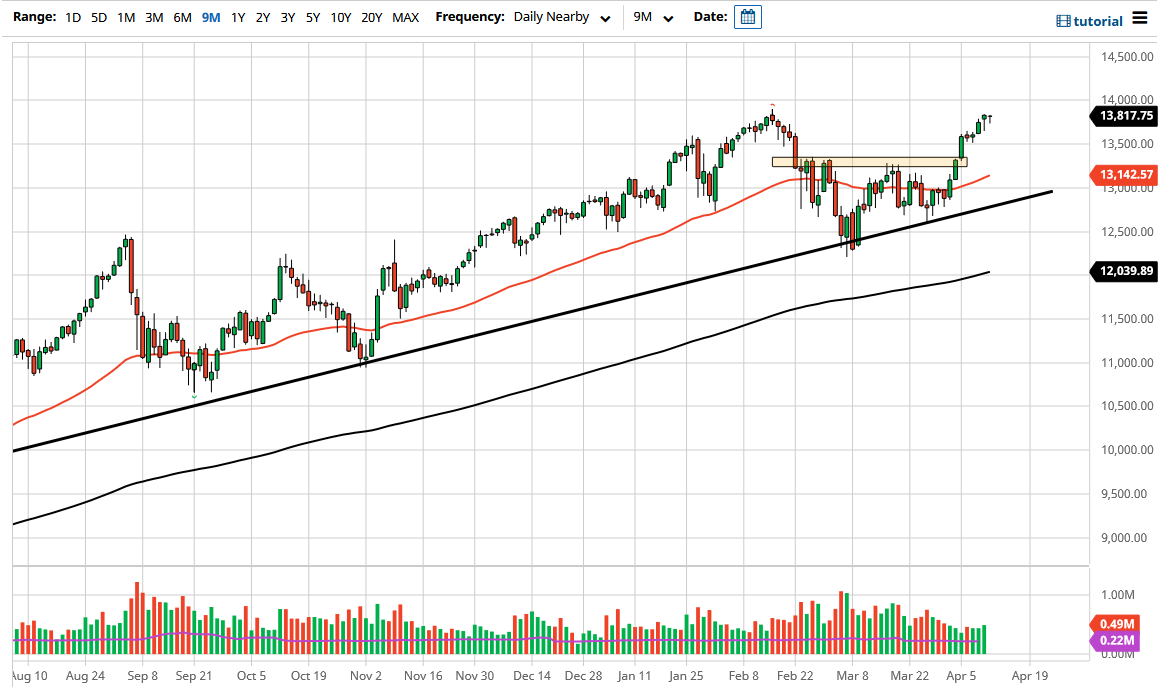

The NASDAQ 100 initially pulled back during the trading session on Monday as earnings season has kicked off, but that we turned around to show signs of life again. Ultimately, this is a market that formed a hammer for the second day in a row at all-time highs. If we were to break out above the last couple of candlesticks, it opens up the possibility of a move towards the 14,000 handle. I do think that eventually we get there, and of course break above it.

In the short term though, it is possible that we may see the occasional pullback that traders get involved in, especially near the 13,500 level. After that, we have the 13,333 level that also offers support, as it was previous resistance. The 50 day EMA is starting to race towards that area as well, so ultimately it is likely that we will see buyers in that general vicinity trying to take advantage of the market as its cheap. This is a market that I think continues to be very noisy, but generally positive.

It was announced early in the trading session that Microsoft was buying Nuance, the text-to-speech software company. At this point, it was a little bit of fuel for the uptrend, but it is worth noting that we did not really take off from that point. This is suggesting that perhaps we need a little bit of a pullback, but I think that will only be jumped on as so many people are looking at taking advantage of the bubble that we are currently inflating. Longer-term, I believe that we are looking for a move towards the 15,000 handle, which of course is a large, round, psychologically significant figure.

I do not have a situation in which a willing to start shorting this market, but I would be a buyer of puts on a breakdown below the uptrend line, because it could kick off a little bit of a “flash crash” in the market, but we have seen multiple times that the Federal Reserve will do something to lift the market if it falls too quickly. That being the case, we continue to see a lot of people use the “Powell put” as an excuse to get long. Interest rates continue to rise in America so as long as they do not rally too quickly, I think Wall Street would deal with it.