The NASDAQ 100 rallied during the trading session on Thursday as we head into Easter. With Friday being Good Friday, but also featuring the jobs number, the fact that traders were willing to buy and hold on to the NASDAQ 100 suggests that there is plenty of confidence in the stock market going forward, and in a sense, I think that breaking out is probably going to be a self-fulfilling prophecy. At this point, pullbacks will more than likely continue to be looked at as buying opportunities, and therefore I think that a lot of value hunters are out there waiting to get involved.

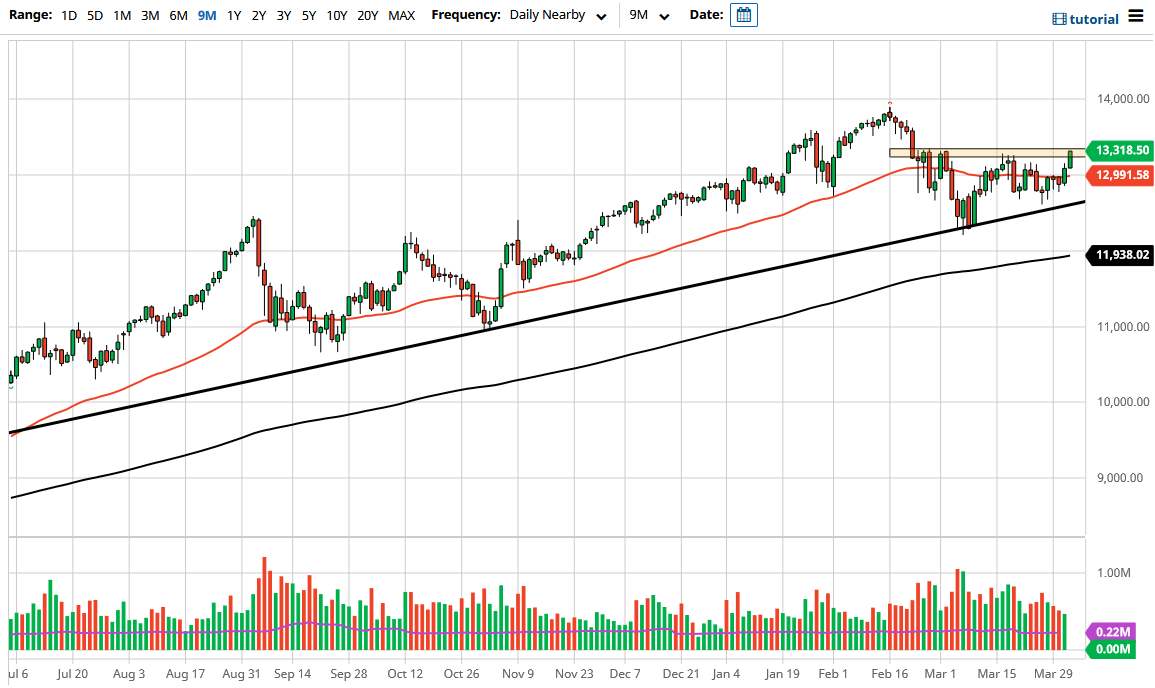

Underneath, we have the 50 day EMA at the 12,991 level, and that should be an area that will attract a certain amount of attention, followed by the 12,850 level. Furthermore, the uptrend line underneath should continue to offer support, so I think all things been equal, it is only a matter of time before the buyers return. Not that I would short the US index anyways, but clearly you cannot do it here. That being said, if we do break down below the uptrend line that I will be a buyer of puts.

Pay close attention to the 10 year yield, because it has a negative correlation to the NASDAQ 100 as of late, so having said that I think it is worth paying close attention to both charts. Monday will be the first shot that cash traders get an opportunity to express their opinion on the jobs number, but this sets up for a move much higher, so I think it is only a matter of time before we reach towards the highs again. I look at pullbacks as value that a lot of people will probably look at in the same general attitude, so I think at this point it is probably only a matter of time. I think ultimately, we will be seeing a lot of noise in general, but it is clearly a one-way market as has been the case for most of the last 13 years. If we can break above the 14,000 level, then kick off the next leg higher for a longer-term move towards 15,000 above. The 200 day EMA currently sits at the 11,938 handle, which is the biggest barrier on the chart from what I can see.