During the trading session on Wednesday, we got the Coinbase IPO at the NASDAQ, which would have attracted a lot of attention. However, technology stocks did not do so well, pulling back towards the bottom of the previous trading session. We have bounced from the very low, though, so that is a good-looking short-term candlestick. If we can break above the 14,000 level, then the market is likely to go higher. That would be a fresh, new high, which is something this market tends to do quite often.

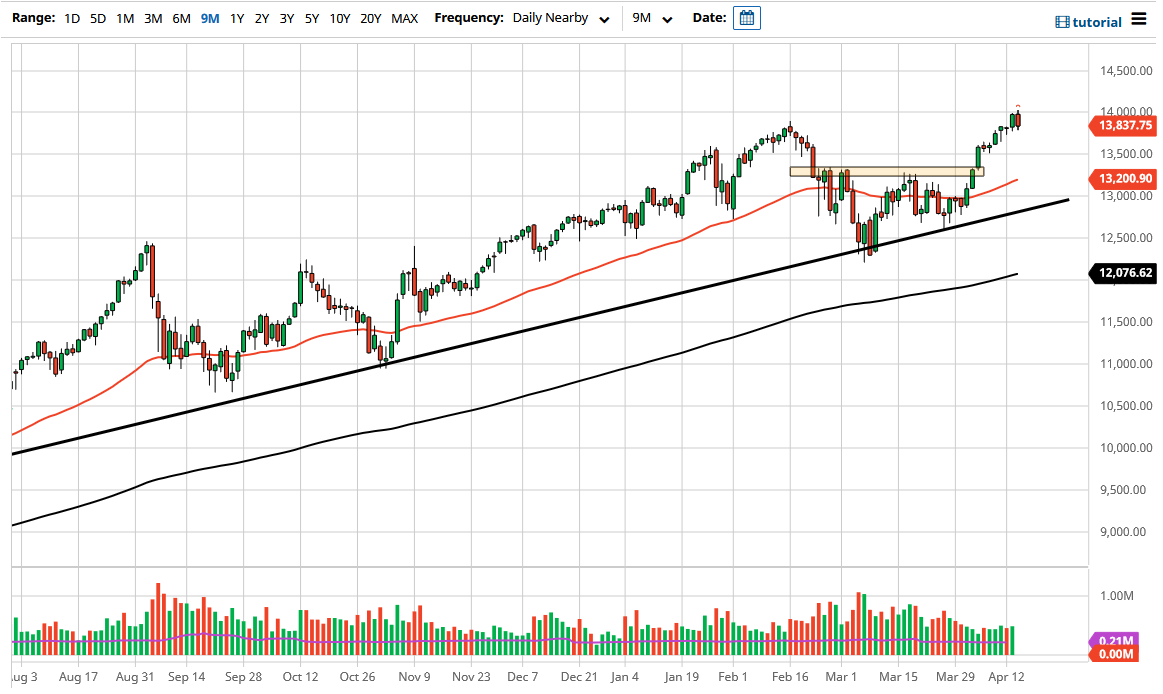

If we do get a pullback, I am more than willing to buy it, especially near the 13,500 level and the 13,333 level. That is the neckline of the inverted head and shoulders that I have marked on the chart, and an area where the 50-day EMA is starting to reach towards. After that, we have the psychologically important 13,000 level as support and the uptrend line that sits just below there. In other words, there are many different reasons to think that this market is going to continue to go higher based upon all of the support levels. Pullbacks offer value, and as we are in the midst of earnings season, it does make sense that we may get the occasional pullback.

On a breakout to the upside, the market goes looking towards the 14,500 level, and then eventually the 15,000 level, which is my longer-term target. I have no interest in shorting this market, but if we were to break down below the 12,500 level, then I would be a buyer of puts, as it allows me to take advantage of the downside without trying to short a market directly that could turn around and rip your face off. Cheap money continues to flow into the stock market, which continues to drive the market higher in general. With that in mind, I am a “buy on the dips” type of trader, and have been for multiple years now. While there are times you can make money on the short side, it is more the exception than the rule. This is a market that I think continues to see plenty of buyers every time we drop due to simple habit more than anything else.