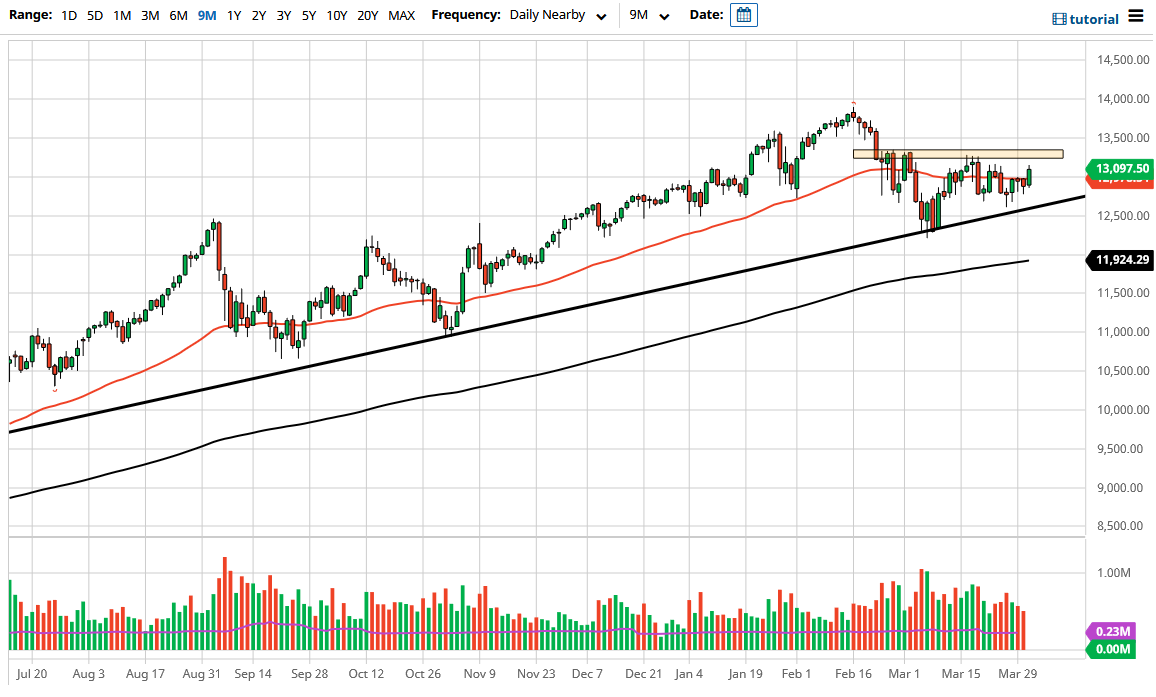

The NASDAQ 100 has rallied significantly during the trading session on Wednesday to break above the 50 day EMA, ending the first quarter on a strong note. That being said, the NASDAQ 100 still has significant resistance above that traders around the world will have to pay attention to, especially near the 13,333 level. If we can break above that level, then it is likely that we would go to the upside, perhaps reaching towards the 13,750 level again.

To the downside, I see plenty of support, not the least of which would be the uptrend line, and then of course the three hammers that we have formed in the last four trading sessions previous. The NASDAQ 100 is a little bit of a laggard at this point though, because quite frankly the yields in America continue to make the idea of high growth companies a little bit dangerous, but at the end of the day there are still plenty of buyers out there for stock markets. Because of this, I think this is a scenario where traders will continue to look it dips as buying opportunities, especially if we can stay above that previously mentioned uptrend line.

Also backing of the uptrend line is the 12,500 level, so if we were to break down below that level then I think you may see a bit more of a selloff. If we do get that I would be a buyer of puts, because quite frankly shorting the markets would be a great way to lose money nine times out of 10. This does not mean that we cannot have a red candlestick, it is just that we are in an uptrend and US indices are typically manipulated in the sense that the Federal Reserve will come in and support any major selloff that occur, just as they have been doing over the last 13 years.

All things been equal, as we enter the second quarter, I believe that new money coming into the market will probably push the market to the upside, and therefore I do believe that the resistance gets broken sooner rather than later. That being said, I think this is a market that will eventually reach fresh, new highs, but may need some type of catalyst to get moving. Beginning of quarter flows might be that catalyst.