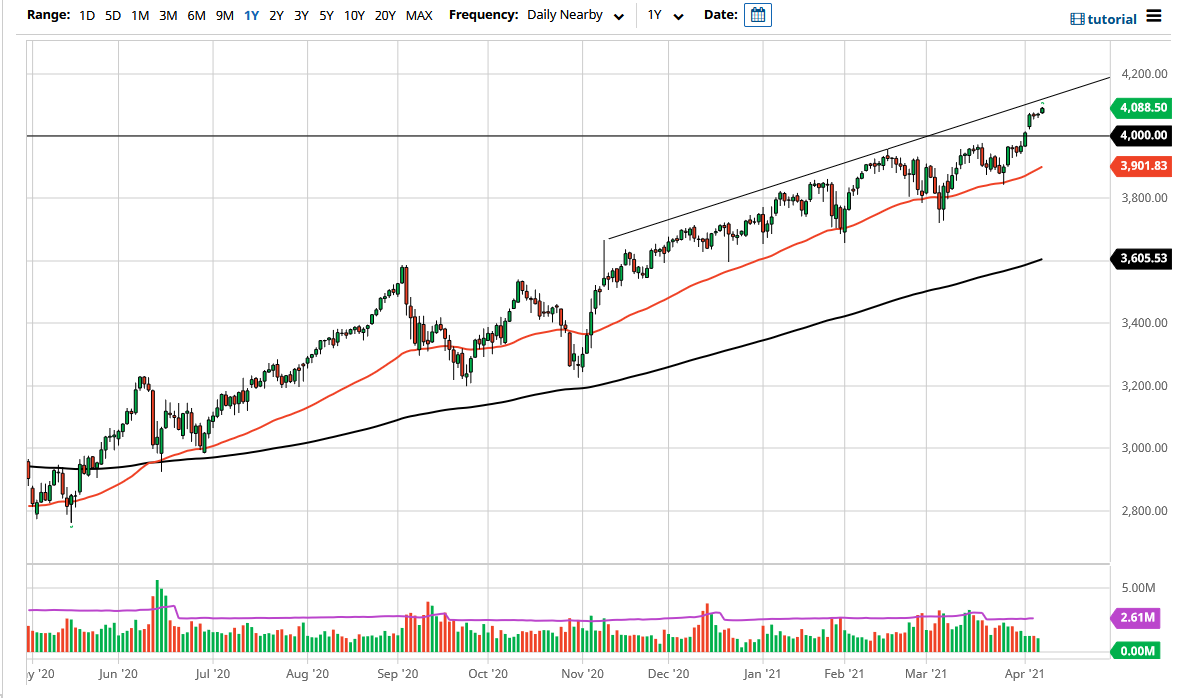

The S&P 500 has rallied slightly during the trading session on Thursday to show signs of strength again, as we continue to see a push to the upside. The market has seen a strong move higher over the last several weeks, so I think that we will continue to see buyers on these dips. However, it is worth noting that next week is earnings week, so that could cause a little bit of noise from time to time.

Because of this, I think that you need to look at the overall attitude of the market as one that needs to find some type of value to get involved. The underneath should continue to see plenty of support, especially when we get to the gap just above the 4000 handle. The 4000 level of course is a large, round, psychologically significant figure, and will attract quite a bit of attention in and of itself.

Even if we were to break down below that level, it is likely that we would see plenty of support at various places, as we have been in such a huge uptrend. The 50 day EMA currently sits at the 3900 level, and therefore I think we need to pay special attention to that. The market breaking down below there then could open up the possibility of move down to the 3800 level. Breaking down below there could get me to start buying puts, but at this point in time I have no interest in shorting this market. It is difficult to short US indices as they are so heavily manipulated.

As long as the Federal Reserve is willing to step in and support markets, the very difficult to imagine a scenario where the stock markets will collapse for any significant amount of time, especially as the market has known this for 13 years. Dips being bought is the typical norm of this market, so I like the idea of finding value on the occasional pullback. Nonetheless, we are getting close to the top of the overall channel, so I wonder how much further we can go to the upside without seeing a little bit of a pullback? Because of this, I am slightly hesitant to get overly bullish, but I do recognize that we are more than likely going to continue to see buyers over time.