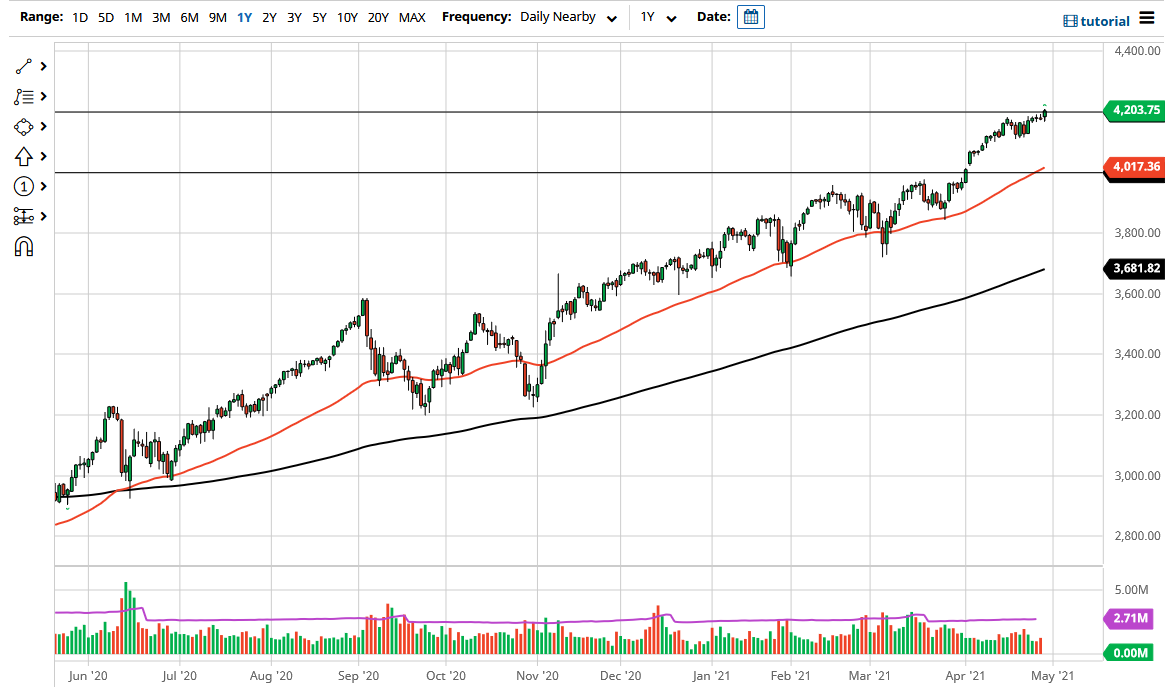

The S&P 500 had initially pulled back a bit during the course of the trading session but then turned around to break above the 4200 level. If we can break above the 4200 level, then it is likely that we can get a move to much higher levels, perhaps up to do 4400 level. At this point time, the market is likely to continue to see plenty of buyers based upon blowout earnings on a lot of the large companies showing strength, and of course the fact that the Federal Reserve is looking to reinflate the market anyway they can.

Looking at this chart, we initially pulled back but then turned around to break higher. If we can break above the highs of the trading session, then I see no reason why we will continue to go higher. This is a market that I think also sees this is a market that is going to be all about liquidity, which is not a huge surprise considering that is how this market has been moving over the last 13 years, which of course has been all about liquidity, and occasionally about earnings.

One thing that you need to keep in mind is that the stock market has long since passed on fundamentals and has become an algorithmic machine. A huge portion of trading in the stock market these days has been all about algorithms, which quite frankly do not care about fundamentals. This is why sometimes you will see stocks continue to go higher even though a company has no real prospect of earning any real money. Furthermore, the market has been in a massive uptrend for quite some time, and it makes no sense that we would be a seller of this market. This is a market that cannot be shorted but if we were to break down below the massive gap at the 4000 level, then it would be a very negative sign. If we did break down, it is very likely that the 4000 level would see plenty of buyers in order to send this market higher. Regardless, there is no scenario in which I am shorting this market, so I look for signs of either a breakout war some type of pullback that shows stabilization going forward.