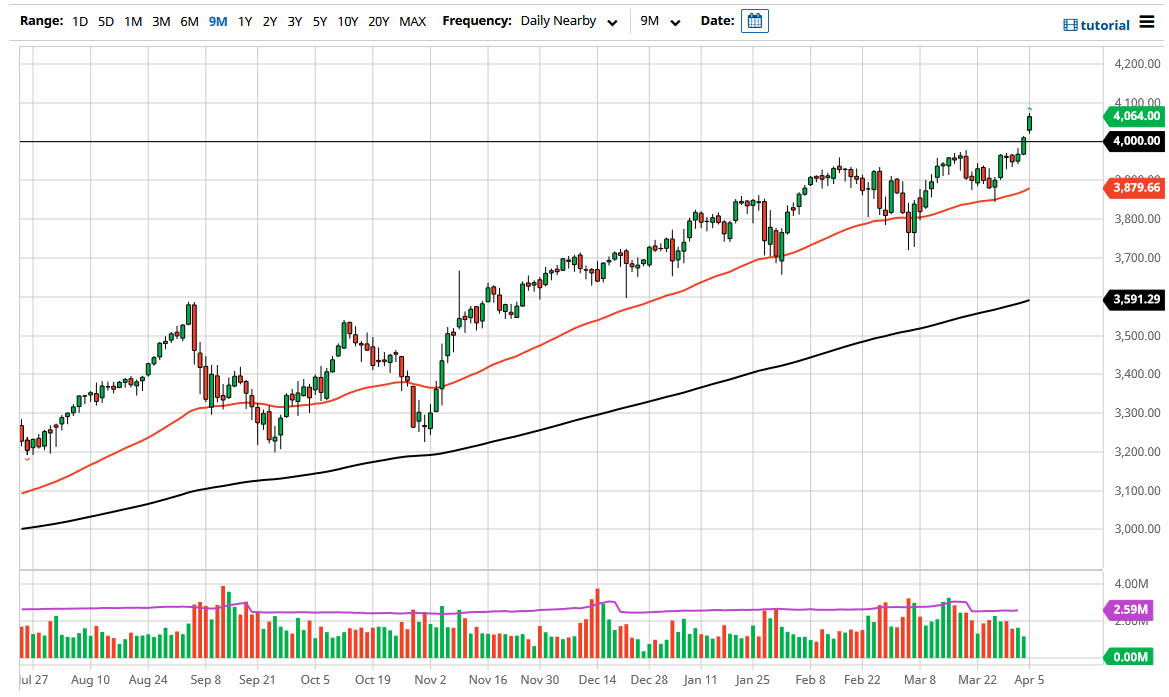

The S&P 500 rallied quite significantly during the course of the trading session on Monday, after gapping right off the bat. This is a very bullish sign and should have traders aiming for the 4100 level. After all, the United States added 916,000 jobs for the month of March, and at this point it looks as if the US economy is going to continue to scream to the upside. Monday was a first day that people had the ability to trade on Wall Street, so it is not a huge surprise to see that we saw a massively bullish session.

At this point, although it is a bit redundant at this point when you think of stock indices, it is a “buy on the dips” scenario, as the gap below that sits just above the 4000 handle should offer support, and of course we are in an uptrend anyway. Below there, you are looking at the 3950 handle, followed by the 3900 level which is rapidly being approached by the technically significant 50 day EMA. The 50 day EMA is an area that attracts a lot of attention, so I do think that it is only a matter of time before the buyers step in and pick up this market “on the cheap.”

If we were to break down below that level, then I could think about the idea of buying puts, but you never short the indices in the United States, because if you look at the last 13 years, you can see that every selloff has been brutal and quick but has been very short-lived to say the least. The market is almost certainly going to continue to see upward pressure, so with that being the case I think that we are looking at a scenario where we should have plenty of opportunities going forward, but we might be just a little bit stretched in the short term, as the markets have gotten heated. At this point, I think any time we see a pullback it is likely to be a buying opportunity and therefore I would start to add to already existing long positions. I think that the fact that we are closing towards the top of the move range also suggests that we have more momentum.