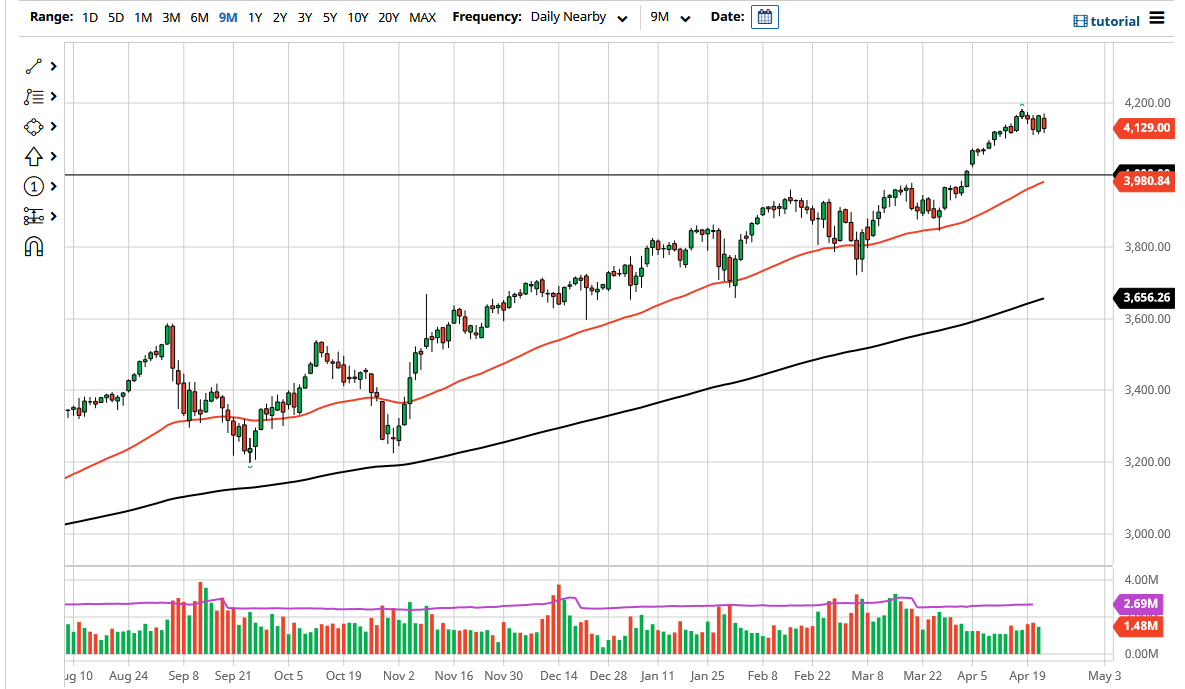

The S&P 500 initially tried to rally during the course of the trading session, but then fell towards the 4100 level. The 4100 level of course is a large, round, psychologically significant figure, and therefore I think there is a certain amount of attention in that area. If we were to break down below the 4100 level, then it is likely that we go looking towards the 4000 handle underneath which is a large, round, psychologically significant in and of itself. There is also a gap there, so I think that is another reason to think that this area holds as support.

The market is one that cannot be shorted, because US indices are so highly manipulated. It is also earnings season so one would have to think that it is only a matter of time before somebody says something or announce something to push markets to the upside. Remember, the volatility issues will almost certainly come into play, but I think what we are looking at here is that we may have gotten a little bit ahead of ourselves, so I think some type of pullback will be good for the longer-term sustainability of the trend.

If we did break down below the 4000 handle, then it is likely that we go looking towards the 50 day EMA which is essentially right there as well. Nonetheless, I do think that it is almost impossible to short this market and therefore the only way that I played to the short side is if we break down below the 3800 level, and even then, I would not be a seller, rather I would be a buyer of puts. This way, you can keep a lot of the dangers of being short of the market at bay, while still taking advantage of the depreciation of the index. This is because we have seen multiple times in the past where the market starts falling but the Federal Reserve says or does something to throw the market straight back up in the air. Eventually, as a trader you begin to realize that indices are not constructed to go down, that is why they are not equally weighted. As long as that is going to be the case, then you need to recognize the game for what it is.