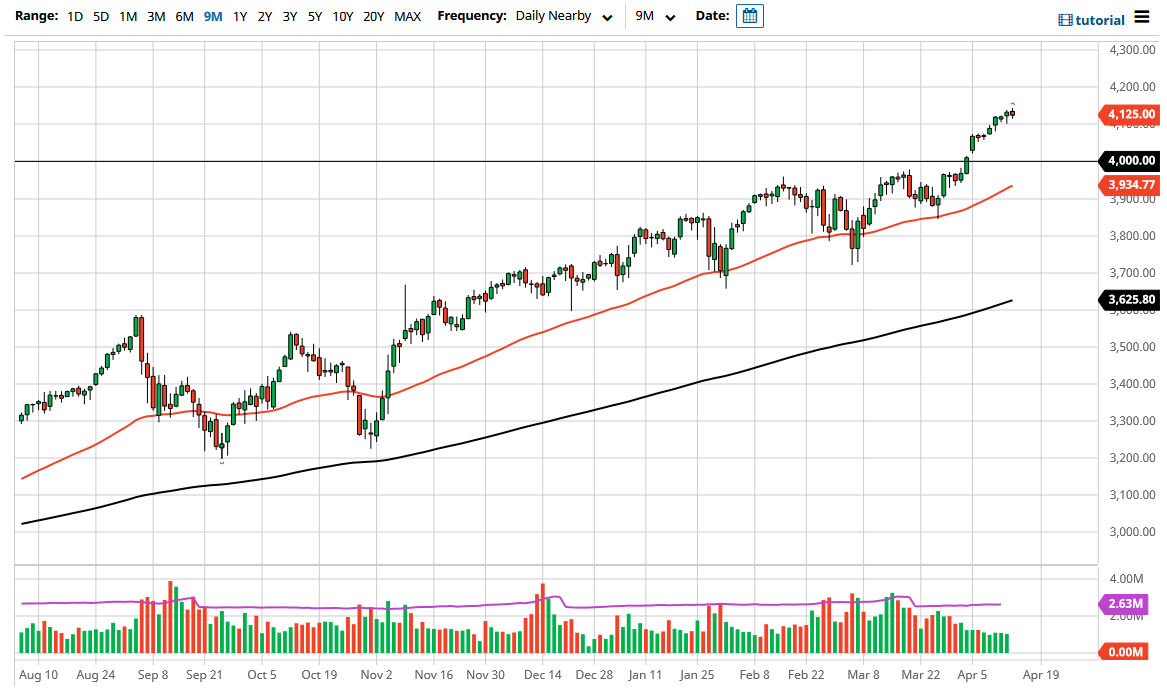

The S&P 500 did pull back just a bit during the trading session on Wednesday, but still remains near all-time highs. The 4125 level seems to be a little bit of a magnet for price, but I think we could see a pullback here in order to find value. As I stated yesterday, I never sell the indices in the United States, because Jerome Powell will do whatever he can to keep them afloat. With that in mind, I look at big figures underneath sometimes or other technical patterns in order to get long.

The first area where I see potential value would be the 4100 level. If we break down below there, then it is likely that we will see a bit of a reaction to the gap underneath which is sitting just above the 4000 handle. The 4000 handle is a large, round, psychologically significant figure, and the gap should come back into place. At this point, the market is likely to see a bit of a bounce, and that bounce will be bought into from what I can see.

Underneath, the 50-day EMA is at the 3934 level, and rising to reach towards the 4000 level. The 3950 level is a little bit of support as well on short-term charts. Regardless, this is a market that I think will eventually go higher given enough time and, as we are in the midst of earnings season, it would not be a huge surprise to see that be the case going forward. The S&P 500 will be very noisy, and financials have been in focus over the last couple of days, but let us not forget that the real noise would have been in the NASDAQ 100 during the trading session as Coinbase was a self-listed IPO. Ultimately, this is a market that will continue to go higher over the longer term, but we are a little bit over-stretched. I think at this point, simply looking for value is the way to go, but then again, I could have said that for the last 13 years. It is not until we break down below the 3900 level that I would be a buyer of puts, as it gives me an opportunity to profit from the downside without actually shorting this market.