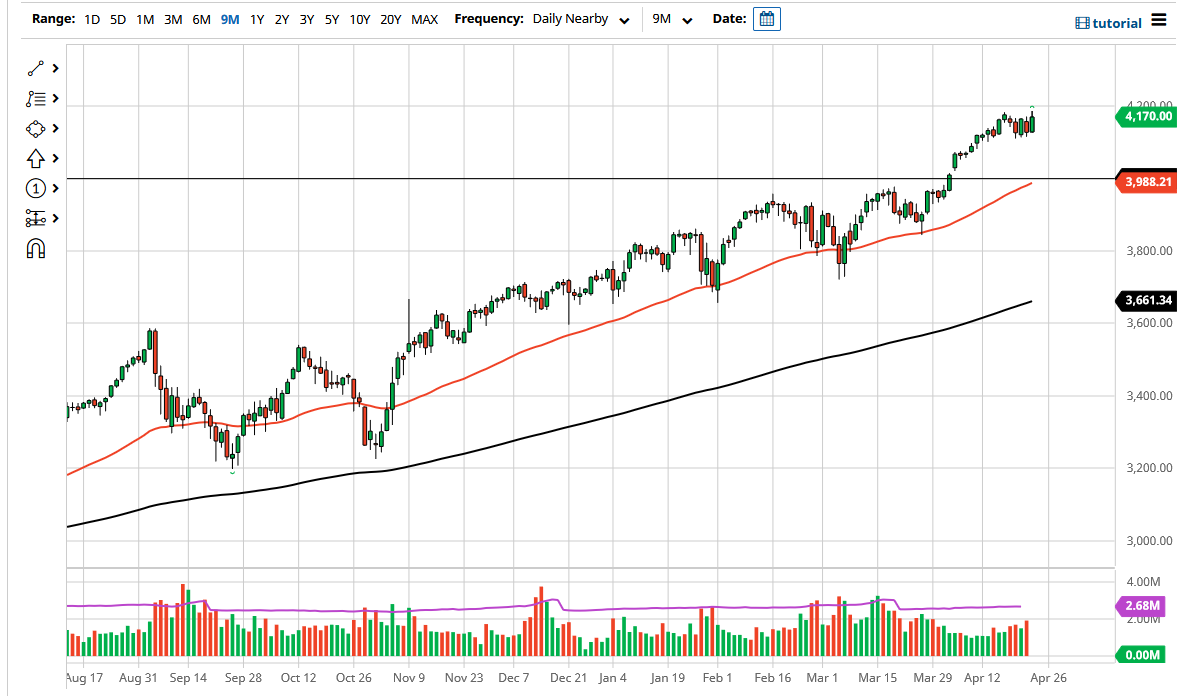

The S&P 500 rallied a bit during the trading session on Friday to gain roughly 1%. The market is looking like it is going to continue to see a lot of resistance above, with the 4200 level being a large, round, significant big figure. If we were to break above there, then the market would be free to go much higher. With the overall trend being so strong, you clearly cannot be a seller of the S&P 500, but it would not be overly surprising for the breakout to occur sometime soon.

The 4200 level being broken to the upside allows the market to go much higher, perhaps reaching towards the 4250 level, and then eventually the 4500 level. As earnings season is typically very noisy, it should not be a huge surprise to see that we have gone sideways in general. Furthermore, we still have a gap underneath that we need to try to fill, so there is the real possibility that we will try to pull back. The 4000 level sits just below there, just as the 50-day EMA does, so it is very likely that we will eventually see significant pressure.

With that being said, if the market breaks down below the 50-day EMA, then it is likely that we could go looking towards the 3800 level underneath.This is a very strong market, so it is not until we break down below the 3800 level that I would consider doing anything along the lines of shorting, but even then, I would only be a buyer of puts, because flat-out shorting this market is a road to ruin. With the Federal Reserve willing to support the market anyway it can, you are fighting a losing battle trying to short anytime soon.

I am looking for value in this market to take advantage of, and that is exactly what I will be doing over the next couple of sessions. The market pulling back could have some people freak out, but at the end of the day it is only “weak hands” that would be shaken out. I want to see some type of hammer on the daily chart or the like in order to get long, and then I most certainly will.