The S&P 500 rallied significantly to wipe out all of the losses from the previous session, as traders came in to pick up the market on Wednesday and shake off any concern seen in the previous 24 hours. We have a bit of a dichotomy between the various parts of the world right now, as traders are focusing on different things in different parts of the world. For example, the Japanese are concerned about the coronavirus figures rising in Tokyo, just as we are starting to see concerns about other parts of Asia showing higher numbers such as India. That being said, I think that we are seeing a huge shift in attitude overnight, compared to what we see during the cash trading session.

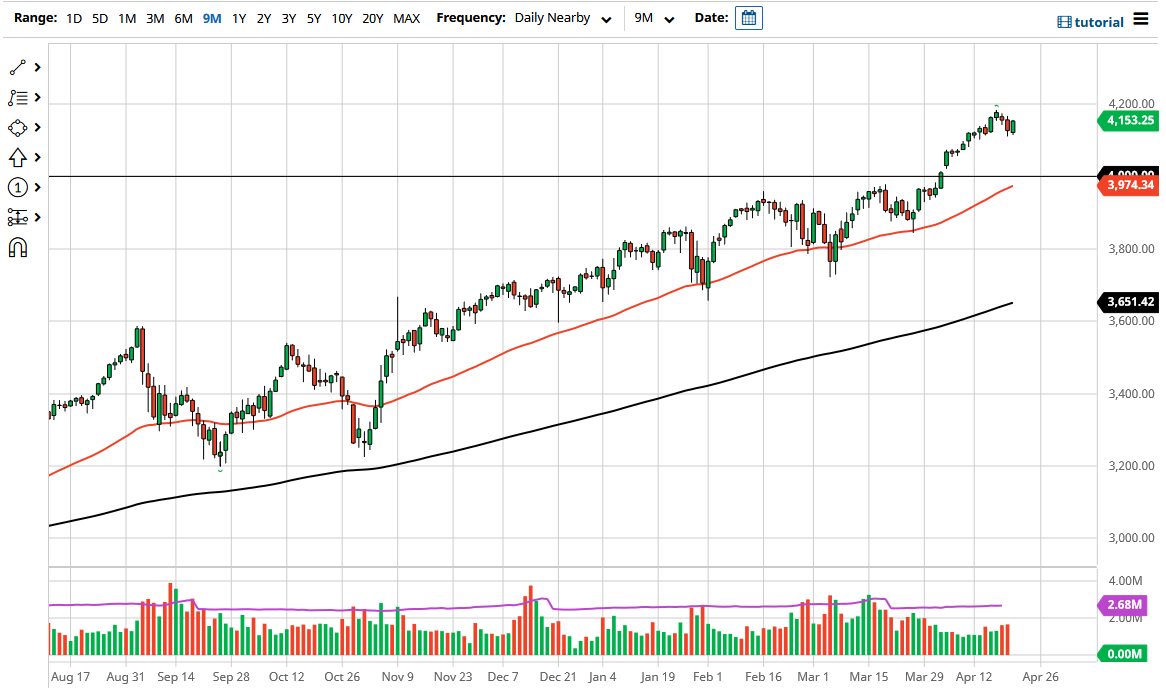

To the upside, believe that the 4200 level is a target, so I think at this point a lot of buyers would be taking profit in that general vicinity. However, if we can break above that level, it is likely that we will go much higher, perhaps breaking out to go towards the 4250 level next. Obviously, we are in the midst of earnings season, so that will continue to attract a certain amount of attention in and of itself and probably have plenty of reasons for people to get bullish one way or another. After that, we also have to keep in mind that the central bank liquidity measures will continue to flood the markets with money, thereby having people put anything they can to work as inflation is probably going to eat up purchasing power.

Yields in America have settled down a bit, which helps the situation as well, so I do think that it is only a matter of time before we break out to a fresh, new high. It should be noted that we closed at the very highs of the trading session, something that typically brings in a bit of follow-through. Short-term pullbacks will be bought into, and I believe that there is a significant amount of support underneath at the gap that sits just above the 4000 handle. Furthermore, the 50-day EMA is reaching towards 4000 handle as well, so that is yet another reason to think that it would be supportive and therefore it is likely to continue going higher.