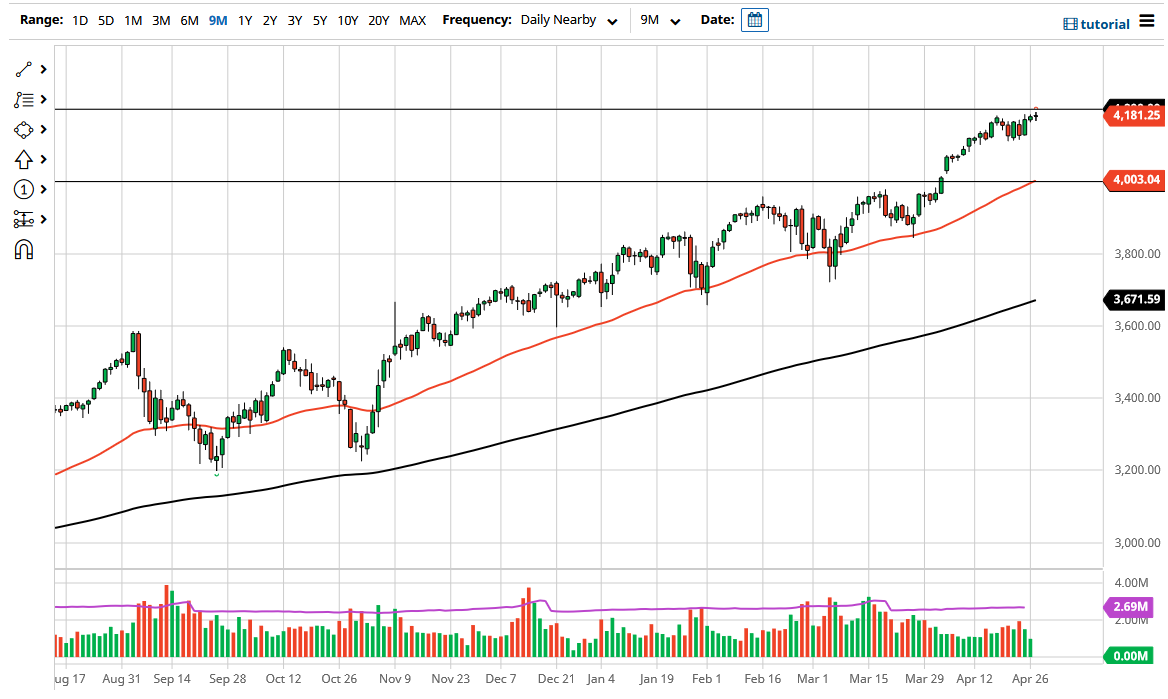

The S&P 500 has done almost nothing during the trading session on Tuesday as traders await the results of the Federal Reserve meeting on Wednesday. Ultimately, the 4200 level continues to be a massive amount of resistance, and I do think that given enough time we could continue to go much higher, but we need to get past that 4200 level on a daily close before it can happen.

To the downside, the market has plenty of support at the 4100 level, as well as the 4000 level underneath. The 4000 level has a gap sitting just above it and the 50-day EMA there as well. This is a market that I think you cannot sell, and it is only a matter of time before we see traders jumping back into the market in order to pick up bits and pieces of value as they occur. The market has been in an uptrend for ages, and it looks like we are simply killing time in order to build up enough momentum in order to go higher. If we do, then the market is likely to continue towards the 4400 level, as the market tends to move in 200-point increments.

The candlestick for the session on Tuesday is a neutral one, so this tells me that the market is simply waiting. As you can see, we had shot straight up in the air, but then went sideways to perhaps work off some of the froth, but at the end of the day I think this is simply a pause in what is a huge longer-term uptrend. With that in mind, you have to keep the market in perspective, as it is likely to continue to see the same type of behavior going forward. It is not until we break down below the 3800 level that I would be negative, and even at that point I would only be a buyer of puts, because you cannot short a market that is being heavily manipulated by central banks and liquidity measures. Furthermore, there are a handful of “cult stocks” that will continue to move this market to the upside. Buying the dips continues to be the way I would play this market.