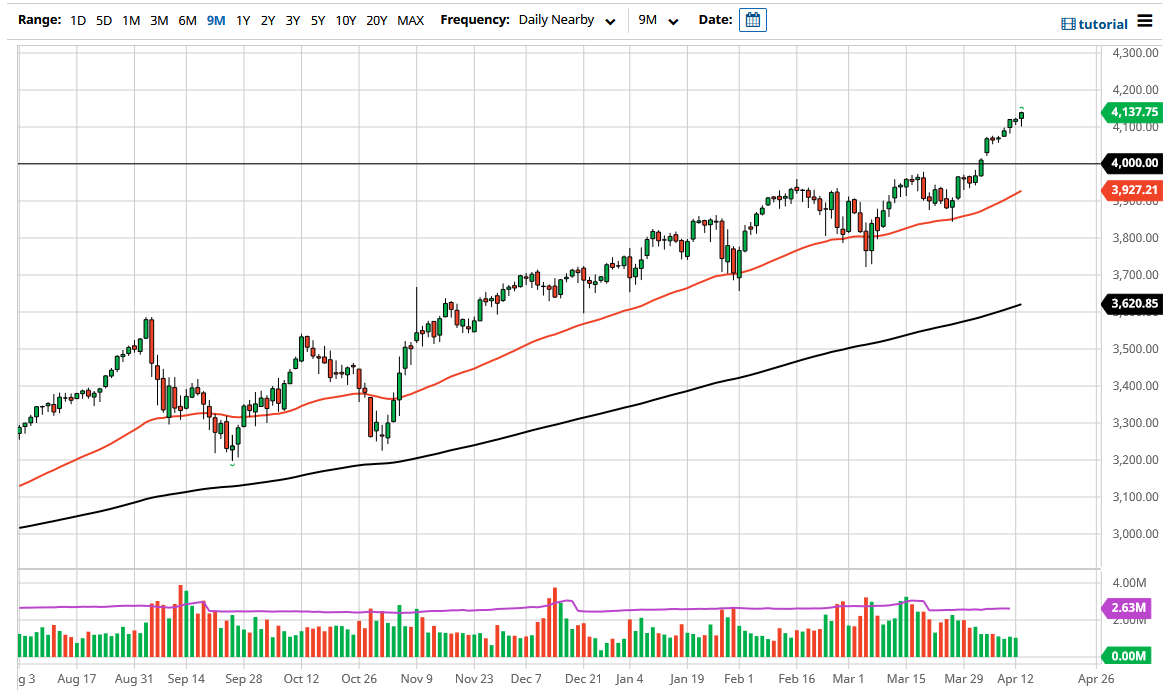

The S&P 500, and Wall Street in general, are seemingly willing to overlook almost anything right now, as we continue to see buyers come in on the dips. With that in mind, it is more of the same that we have seen over the last 13 years, as the cheap money coming out of the Federal Reserve will continue to lift these indices. That being said, we are a little bit over-extended, so a short-term pullback could be in the works.

If we were to pull back in the short term, I think what we will see is the gap just above the 4000 level offer a bit of a “floor in the market”, especially as the 4000 level is a large, round, psychologically significant figure, and an area that will attract a lot of attention. Underneath there, we should see the 3950 level offer support followed by the 5- day EMA. The 3900 level after that is where I would start to buy puts if we do in fact break down significantly.

The reason I would buy puts and not short the market is because the Federal Reserve will step in and say or do something to save Wall Street. We have seen this happen multiple times over the last 13 years, and there is no reason to think that will change anytime soon. In fact, Jerome Powell stated over the weekend that the Federal Reserve was more than willing to keep monetary policy loose, regardless of what happens with inflation readings.

Wall Street saw that as a reason to start celebrating again, and as a result we are looking at a market that is threatening a move that will be somewhat parabolic if we do not get a pullback. The 4200 level would be the initial target, and then after that the 4250 level would be the target. The market is clearly supported by governments and central banks around the world, so at this point it is a “one-way game”, although we will have the occasional pullback. This is why you need to be cautious about your leverage size, but clearly the upside has paid off more often than not, and there is no reason to overcomplicate the situation as the profit has been so easily obtained by holding onto a long position.