The S&P 500 pulled back a bit during the trading session on Thursday as we may have gotten a little bit ahead of ourselves. There are concerns overseas about coronavirus numbers picking back up, but at the end of the day Wall Street will find some type of narrative to push this higher. After all, its earnings season, so there is probably some type of catalyst coming out over the next couple of days to get everybody excited again. Furthermore, everybody knows that the Federal Reserve has one major job these days, and that is to inflate the stock market. With that in mind, there is the proverbial “Powell put” in place, and therefore it is only a matter of sitting back and waiting for a buying opportunity.

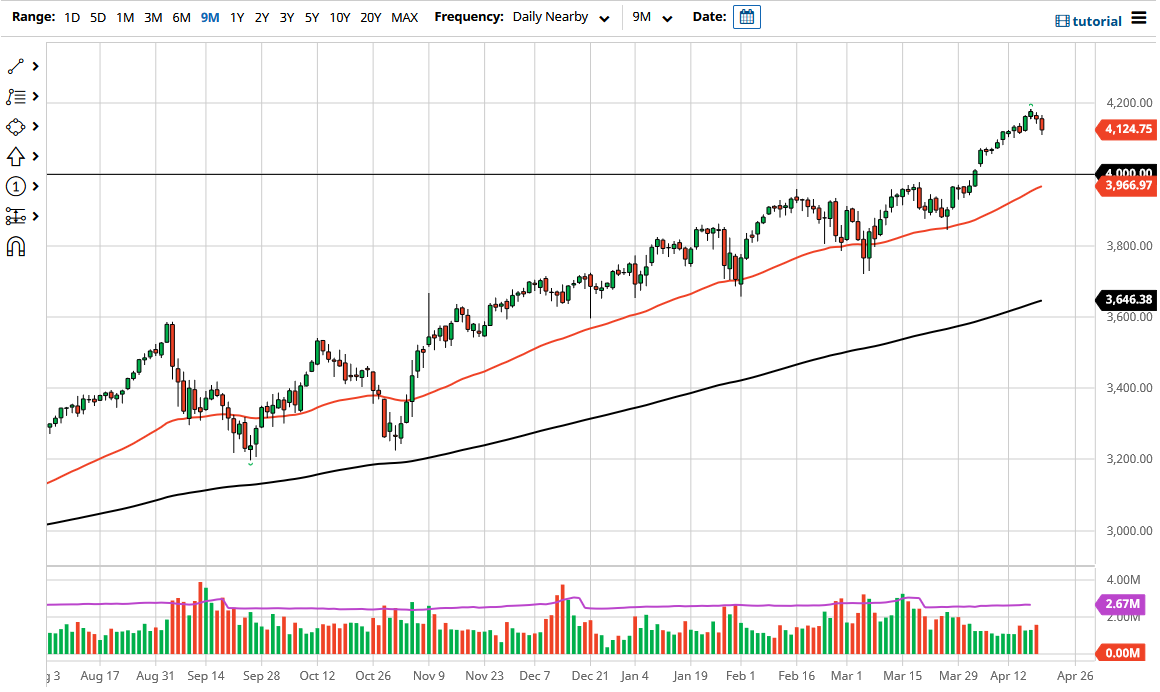

The trend is most certainly to the upside, and it is worth noting that there is not only the 4100 level underneath that could offer a bit of psychological support, but we also have the 4000 level underneath that offers even more psychological importance. Beyond that, there is also a gap sitting just above there and the 50-day EMA is racing towards that area as well. With that being the case, it is very likely that there would be a lot of buyers interested in buying the S&P 500 in that general vicinity. In fact, I think you could make an argument for the 4000 level being the “floor in the market” at the moment.

If we were to break down below the 4000 level, then it is likely that the market will probably go looking towards the 3800 level for the next round of massive support. Underneath there, I would be a buyer of puts, but that is about as aggressive as I would get to the downside on this market, as US indices are so highly liquefied and manipulated that it is very difficult to make money to the downside. You are simply better off waiting for buying opportunities after massive breakdowns. As long as the central bank is willing to interfere in price discovery, it is very difficult to get in front of this market on the downside. Yes, someday there might be a major meltdown, but trying to bet on that it is a great way to lose money, as we have seen over the last 13 years.