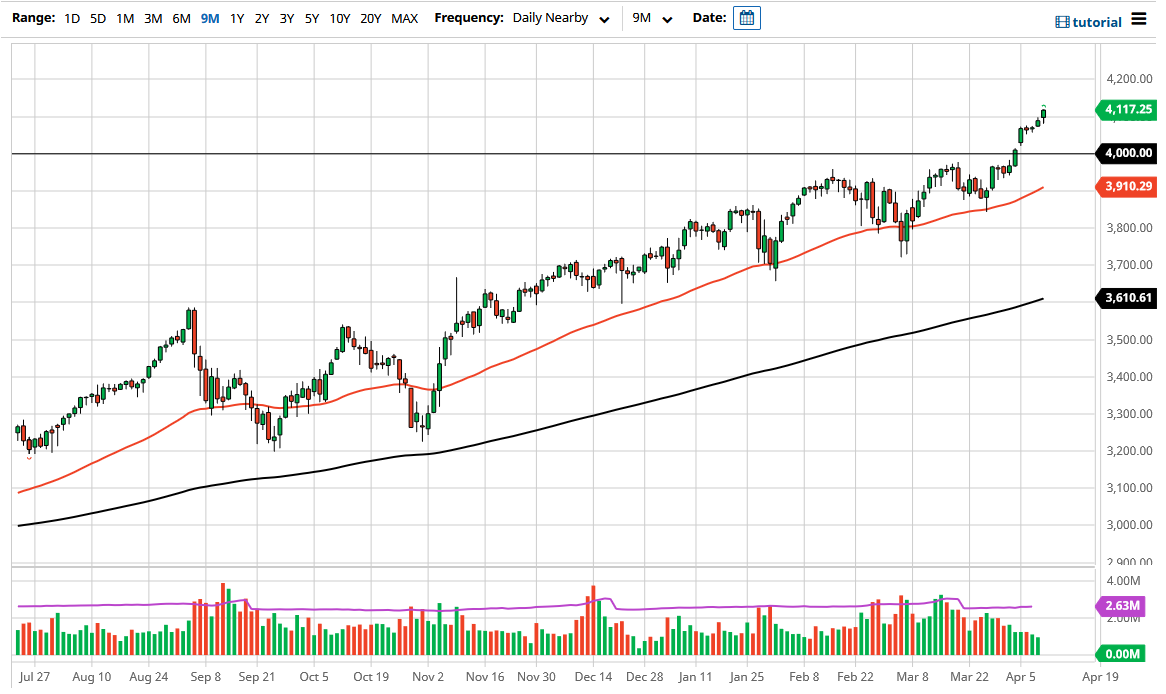

The S&P 500 initially pulled back during the trading session on Friday but then turned around to take out the 4100 level. This is a market that has been running away, and it looks as if it is ready to continue going higher yet again. We close at the top of the range, and that is a very bullish sign. However, we have earnings season starting next week, which can have a major influence on what happens next.

One thing that we do know is that stock markets only go up over the longer term. (I say that with a little bit of sarcasm, but over the last 13 years that has certainly been the case.) Because of this, statistically speaking, it makes much more sense that you would see gains to the upside instead of trying to short this market. Add the Federal Reserve into the mix and you have no other alternative but to look at dips as potential buying opportunities. With that in mind, I think that we could drop significantly during earnings season but that would only be temporary. The 4000 level underneath would be massive support based upon not only the round figure, but the fact that we have a gap at that area. The next support level is to be found at the 3900 level, which coincides with the 50-day EMA.

On the other hand, we could just simple go straight up in the air, but one would have to think that sooner or later we are getting a little stretched. The idea is that if you are not an investor but are a trader, you need to find value. If you are an investor, you just simply buy and hold. Because most of you are traders and not investors, you need to recognize when the market has gotten a little bit ahead of itself. It most certainly has now, as the last week has seen a 120-point jump. This is not to say that it cannot continue going higher, but “chasing the trade” at this point has much more downside risk than up. Simply waiting for a pullback to take advantage of value going forward is going to continue to work as it has for most of the last 13 years since the Great Financial Crisis.