Stock markets continue to look very bullish, and as I write this, we just have gotten the results of the FOMC meeting for the month of April, with the central bank standing on the sidelines and promising more quantitative easing going forward. It seems as if the Federal Reserve is focusing on jobs, which are not being filled at the moment.

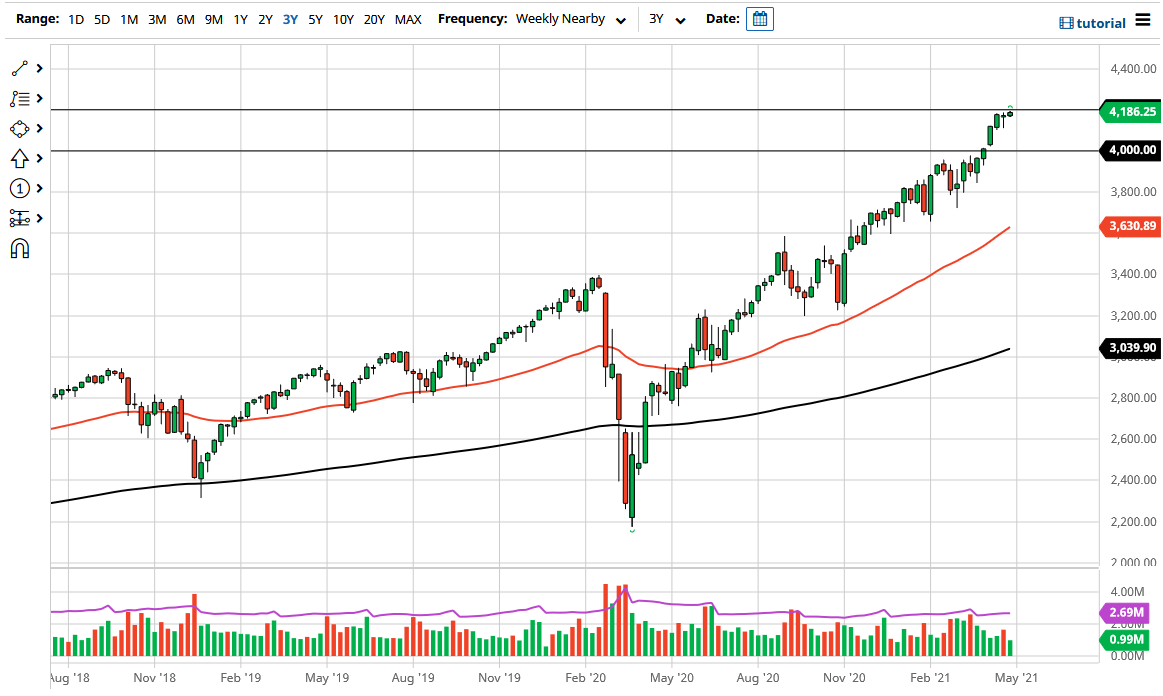

With that in mind, the liquidity measures should continue for quite some time, and the S&P 500 will almost certainly react in a positive manner due to this. We are in the midst of earnings season, but by the time we get deep into the month of May, that will simply be an afterthought. It currently looks as if the market is trying to break above the 4200 level, and I do think it will happen during the month.

However, do not be surprised if we see a bit of a short-term pullback, but that short-term pullback will end up being a simple buying opportunity, as the 4000 level underneath is without a doubt an area that I think will attract a lot of attention. In fact, we still have a gap down there that we are waiting to fill. The 4000 level is a large, round, psychologically significant figure and this will attract enough attention in and of itself as well. In fact, I would look at the 4000 level as a potential “floor in the market.”

To the upside, I believe that the market will go looking towards the 4400 level, as the market does tend to move in 200-point increments. It almost looks as if we are starting to see the beginning of an impulsive move higher, possibly leading to something along the lines of a “blow off top.” Having said that, I do not necessarily expect some type of major breakdown, just that there might be some volatility going forward. With that being the case, I think that you should look at potential significant pullbacks as opportunities to get long of a market that will continue to be very bullish going forward. The NASDAQ 100 is not equally weighted, so keep an eye on the “big five” stocks that everybody else trades to make sure that it is going to go higher. For what it is worth, Facebook and Microsoft have both had great earnings.