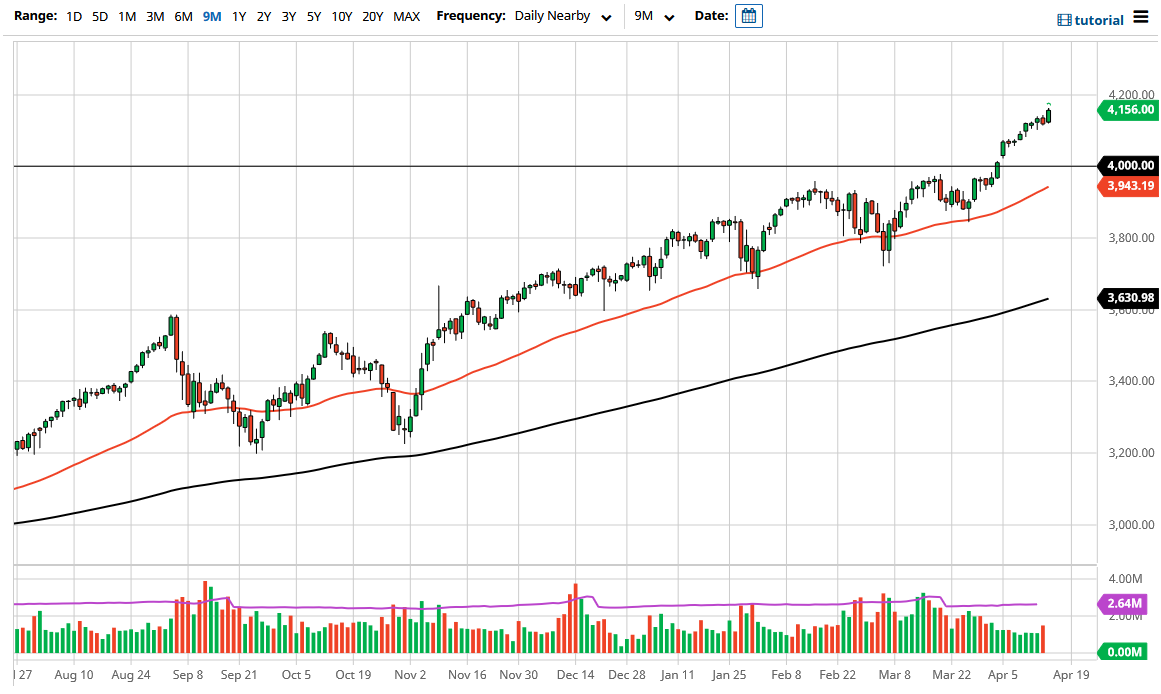

The S&P 500 has rallied significantly during the course of the trading session on Thursday again, as the market has now broken above the 4150 handle. The 4150 handle is a “midcentury mark” that a lot of people would pay close attention to. Nonetheless, I think the bottom of the candlestick during the trading session on Thursday will be a short-term floor, but if we break down below there, I think there are plenty of areas that I would be taking a look at buying.

If we were to break down below there, the market is going to take a look at the massive gap sitting just above the 4000 level that people kicked off last week with. The gap of course sits right above that psychologically important level, and it should also be noted that the 50 day EMA is sitting near the 3950 level, so I think there is going to be a significant area to pay attention to. If we were to break down below it, then I think the market is going to reach towards the 3800 level. Breaking down below that level then has me buying puts, because quite frankly the shorting of this market is almost impossible to do.

To the upside I believe that the market is going to go looking towards the 4200 level, and then eventually the 4250 level. Longer-term, we probably have further to go but we are starting to get a little bit over stretched, so it is worth paying attention to the fact that a pullback is probably necessary. Then pullback is going to end up being reasons to get involved, as we are in the midst of earnings season and one thing that we have learned about earnings season over the last several years is that any time it sells off, buyers will come back in to pick up value. This is because they know that the Federal Reserve is going to flood the market with liquidity to push the market higher under any circumstances.

Because of this, adding a little bit to your position as it pulls back repeatedly is probably the most profitable way to play this market as it is so long-term bullish. In fact, there has only been a couple of times where you would have made significant gains to the downside, so I think that is the most important thing to keep in mind.