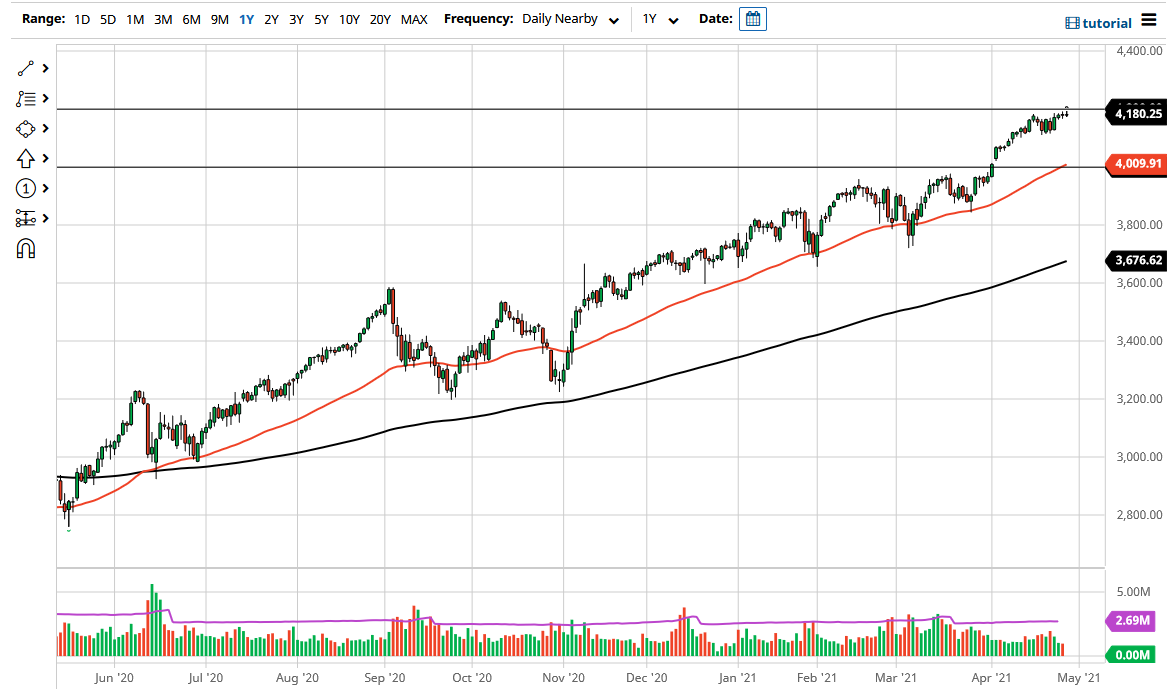

The S&P 500 fluctuated during the trading session on Wednesday as we are essentially sitting sideways and waiting for the next bit of momentum to enter the market. The 4200 level is a massive barrier for traders to overcome, so I do think that if we can get a daily close above that level it should open up a significant move to the upside. If that happens, then I would anticipate a 200-point move based upon what we see on historical charts. However, we need some type of catalyst to make that happen and, after the FOMC statement and press conference, it does not seem as if the Federal Reserve is going to be that catalyst.

Underneath, I see the 4100 level as an area that traders will continue to pay close attention to as it is a large, round, psychologically significant figure, and an area where we have seen some support recently. If we were to break down below there, then I think we will get down to the 4000 handle, which I think is even more important. The 4000 level is not only a psychologically important figure, but it also features the 50-day EMA and a gap on the chart that has yet to be filled. These gaps do get filled eventually, so I think what we are looking at is a potential pullback. This is not to say that I would be short of this market, rather that I would be waiting for that pullback in order to get long again.

If we do get a daily close above the 4200 level, then I would not only be a buyer, but I would probably become relatively aggressive. After all, we have been in an uptrend for what seems like forever, and loose monetary policy will continue to be a major driver of this market to the upside. Earnings season has been extraordinarily strong, and that should continue to be something that a lot of people pay attention to. There is actually no way to short this market anytime soon, so you are simply buying the pullback or buying the breakout, and not much else, as anytime someone has tried to short this index over the last several years more likely than not has lost a significant amount of money.