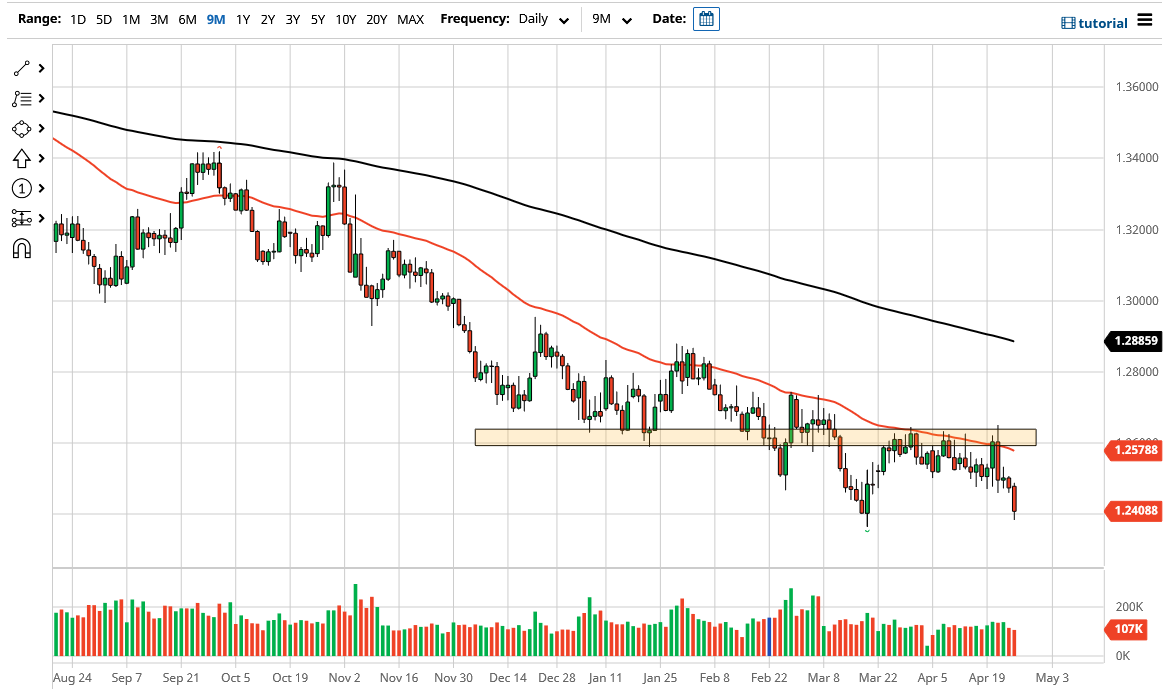

The US dollar has fallen significantly against the Loonie again during the Monday session to reach down towards the $1.24 level. This is an area that recently had been supportive, so if we were to break down below here it could open up fresh selling yet again. The market clearly is ready to continue going lower based upon the way we are closing, but the question now is whether or not we get some type of bounce between now and then. If we do, then there are plenty of places above that I would imagine should be resistive, not the least of which would be the 50-day EMA and the 1.25 level.

On the other hand, if we simply slice down to a fresh, new low, then the market is likely to go looking towards the 1.22 handle. When you look at the monthly chart, we still have plenty of room to go down to the 1.20 handle given enough time, but there are some bumps along the way. This pair does not move very well, so it should not be a surprise at all if we get a lot of choppy action.

This probably has a lot less to do with crude oil right now than it does the fact that the Bank of Canada is talking about tapering off bond purchases, which is the same thing as monetary policy tightening in the type of world we find ourselves in. With that being the case, and the fact that the US is nowhere near doing so, it does make sense that the Canadian dollar should continue to strengthen in general.

Adding even more fuel to the fire is the fact that the US dollar has been falling during the trading session against most other currencies as well, so there is no reason to think that it would be any different over here. Because of this, I think that you could probably scale down to shorter time frames and look for exhaustion after short-term rallies, or a break to a fresh low in order to get involved. If oil starts to pick up, then that will probably help the situation as well. Remember that the Federal Reserve has a meeting over the next two days, although no major surprises are expected.