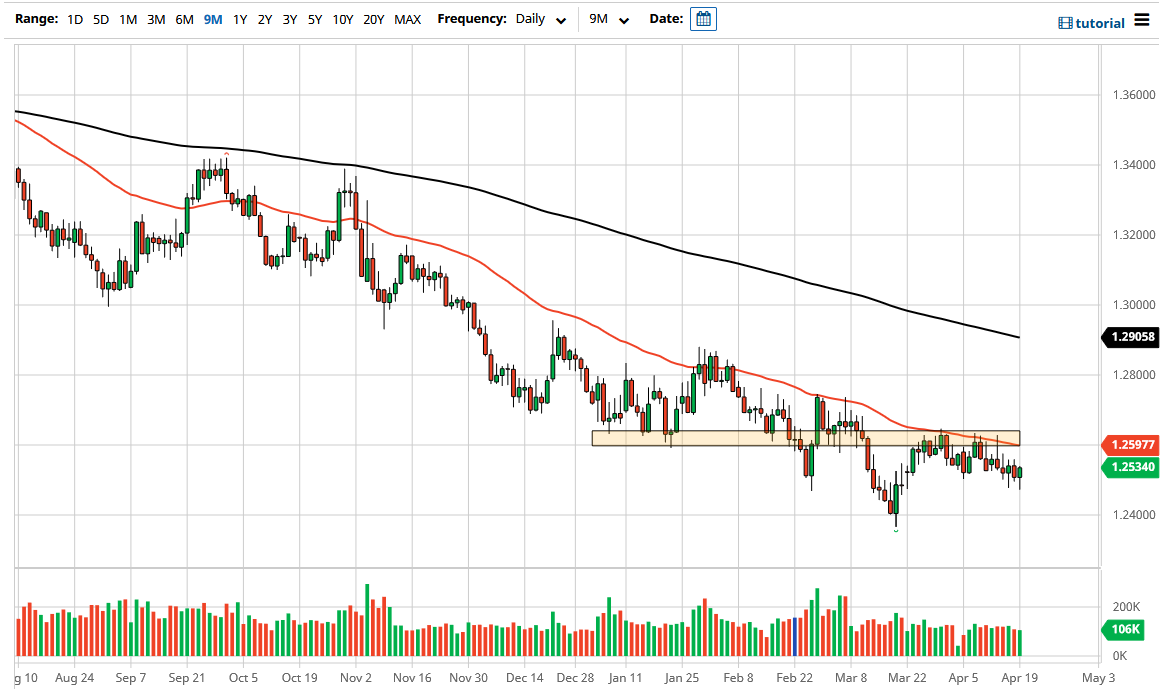

The US dollar fell initially against the Canadian dollar on Monday, but then turned around to show signs of support. The 1.25 level being broken to the downside was a very negative sign, but yet again we have seen this market turn around and show signs of stabilization. That being said, I do not necessarily think that you should be a buyer of this pair, just that the 1.25 level continues to be a huge thorn in the side of sellers.

The 50-day EMA is an indicator that a lot of people pay close attention to. It sits near the 1.26 level above, so I think you should pay close attention to that area if we do get a little bit of a bounce. The 50-day EMA has been dynamic resistance all the way down, so any sign of exhaustion in that area would be a selling opportunity for me. However, if we were to turn around and break above the 50-day EMA, it could open up the possibility of buying at that point. At that juncture, the market is likely to see the breaking of the 50-day EMA as a good sign, but we still have a long way to go before breaking above the 200-day EMA, which is the traditional trend determination indicator.

On a break above that 50-day EMA, I suspect that a move to the 1.27 level and the 1.28 level both are very likely targets. That being said, you also need to see the crude oil markets falling in order to make that a feasible trade. It is worth noting that the crude oil has been quiet over the last couple of days but have not exactly looked weak.

To the downside, if we can break below the wick on Monday, then in theory it should open up a move down to the 1.24 handle, and then eventually the 1.20 level. Obviously, this is a market that is in a major downtrend, so it does make sense that you continue to fade signs of exhaustion. I do think the one thing that you can count on here is a lot of noise, as the US dollar has been noticeably weak against most currencies during the session, with this pair being a notable exception.