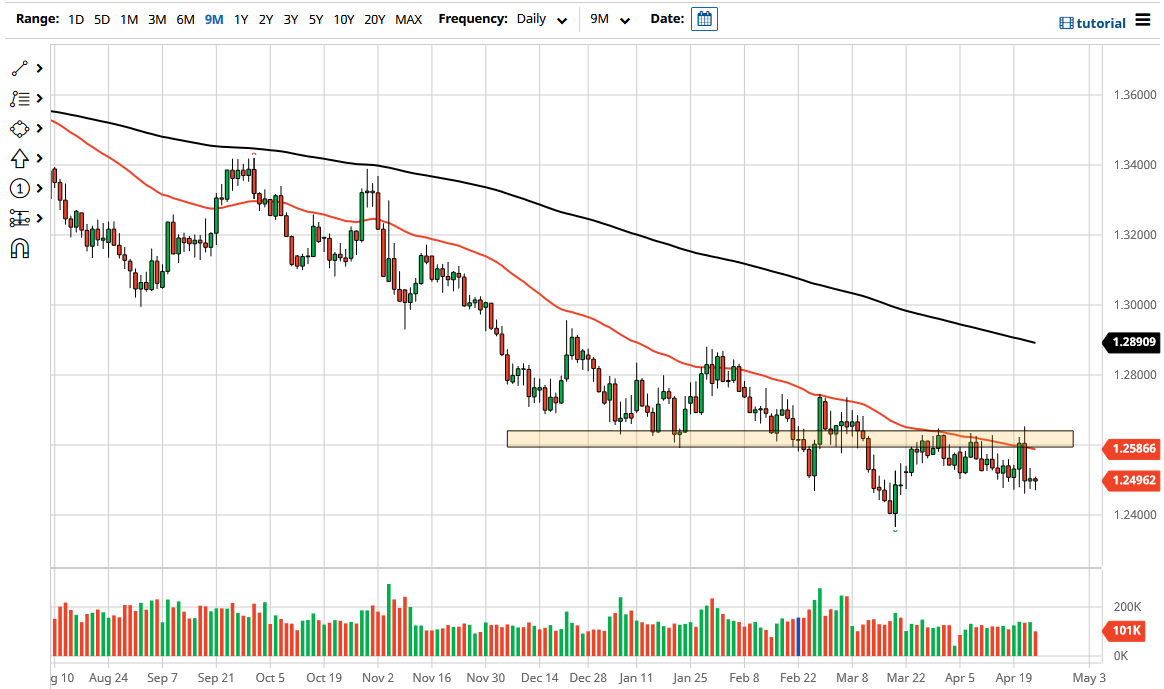

The US dollar fell slightly against the Canadian dollar on Friday as we continue to hang around the 1.25 handle. This has been a massive downtrend going on for months now, but it is obvious that the 1.25 level will continue to be crucial. The market continues to look at the US dollar selling off, but it is worth noting that this area has been extraordinarily difficult to break through. Furthermore, oil markets look a little bit sluggish, due to the fact that the demand picture is still a bit cloudy.

The idea that the coronavirus numbers around the world could continue to drive down demand for crude oil could turn this pair back around. Ultimately, the pair is not only paying attention to oil, but it is also paying attention to the idea of what is going on in Canada with coronavirus lockdowns continuing. While the Bank of Canada has recently suggested that it was going to start tapering on bond purchases, the reality is that the Canadian economy is still under a lot of pressure due to those virus lockdowns and the lack of momentum. In other words, it is likely that we are going to continue to see a lot of back and forth.

If we turn around and break above the candlestick for the trading session on Wednesday, then the market would go much higher, as it would bust through a lot of resistance, not the least of which would be the 50-day EMA. That being said, we would have to see a move towards the 1.28 level. This also would be right along with the idea of US dollar strength overall, and I think you will see a huge move in the greenback one way or the other.

It should be noted that the 1.24 level underneath was the most recent support level, and if we break down below there it is likely that the pair will continue to go much lower, perhaps reaching down towards the 1.20 handle. We are getting close to a major support region on the monthly chart, but there is enough wiggle room to continue to see this market drop a few handles. I think the one thing you can probably count on is a lot of chop.