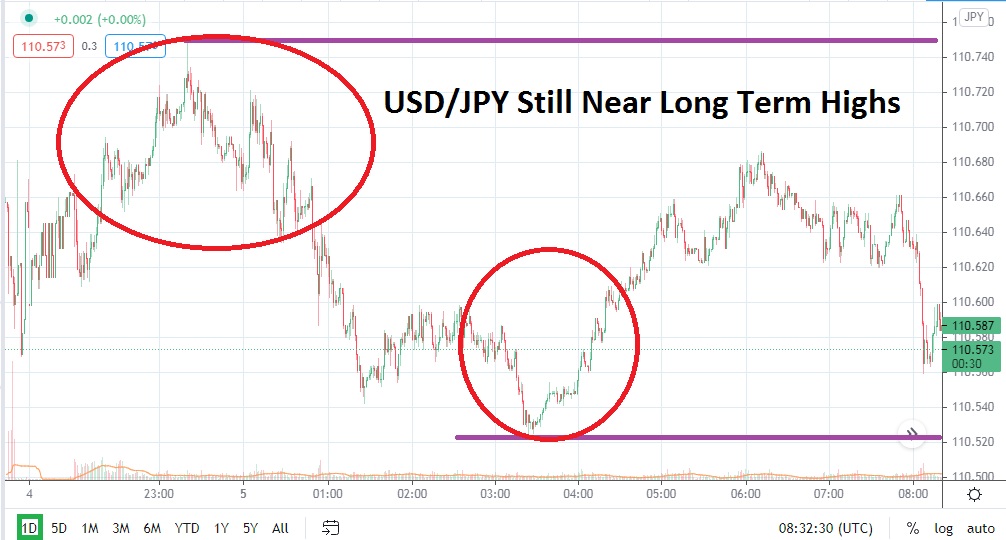

Bullish sentiment continues to dominate the trading landscape for the USD/JPY. Short-term bearish speculators who are trying to fight the trend which has emerged in earnest since late December of 2020 have likely given up by now, but as the Forex pair approaches long-term highs they might be contemplating selling positions again.

However, this may prove to be an unwise decision, except for very experienced traders who have the capacity to maneuver their positions with the speed of light when seeking short-term reversals lower. The USD/JPY has a long history of producing trends which are fully engaged and powerful and the current bullish trajectory may not be ready to finish. The USD/JPY has seen some downside movement today, but traders also need to acknowledge that volumes are lighter than normal due to the long holiday weekend.

In February of 2020, the USD/JPY was trading near the 111.250 juncture. This ratio may feel rather far away for speculators who are pursuing upward movement from the USD/JPY but it may also be a legitimate target being used by financial institutions which are participating within the Forex pair. The USD/JPY has resistance currently near the 110.800 level which it must overtake and prove it can sustain values above this juncture; if it is able to accomplish this task, the 111.000 mark will certainly become a talking point.

Near-term speculative forces may be inclined to remain cautious in the USD/JPY as they await full volumes to reengage within Forex, but when transactions are set into motion by financial houses, they may also be contemplating technical resistance above as attractive. Traders cannot be faulted for pursuing the upward trajectory of the USD/JPY and the 111.000 ratio does look enticing. Speculators need to make sure they have their risk management tactics firmly in place, but looking for additional movement higher with buying positions ready to be launched via limit orders near support levels could prove to be worthwhile.

Conservative traders may wish to wait for marks around the 110.500 level to be touched before they initiate their buying positions. However, if a trader feels now is the time to enter a speculative buying position they cannot be blamed, but they should have stop losses working near the 110.480 juncture to make sure they do not get hurt badly from potential reversals lower which can still factor into the USD/JPY.

USD/JPY Short-Term Outlook:

Current Resistance: 110.800

Current Support: 110.480

High Target: 111.050

Low Target: 110.170