This is its lowest level in three weeks before stabilizing around 108.95 level at the time of writing and prior to the announcement of the results of an important package of US economic data. Despite the remarkable performance of the US economy recently amid record stimulus plans by the US administration, there is a 50:50 probability that the Federal Reserve will raise US interest rates by the end of 2022, but for this to happen, the bank will first need to cut $ 120 billion a month from Quantitative easing program. Given the necessarily gradual pace of such a sequence, it may need to start with the end of the year if the market schedule is to be met.

This leaves a lot to be determined by the inflation data and other economic numbers during the year, with little room for continuous or sequential disappointments.

In the latest survey of the US Federal Reserve Bank, or the so-called The Beige Book, economic activity in the United States of America accelerated to a moderate pace from late February to early April. The Beige Book, which is a collection of anecdotal evidence of economic conditions in each of the federal provinces, highlighted Twelve, it highlights the improvement in a variety of areas, including consumer spending, auto sales and manufacturing activity.

The Fed also indicated that reports on tourism were more optimistic, supported by a recovery in leisure and travel demand. The contacts attributed the increase in demand to the spring break, easing of restrictions linked to the epidemic, increased vaccinations, and recent stimulus payments, among other factors.

The report also stated that US job growth rebounded during the reporting period, with most regions indicating modest to moderate increases in employment. The Fed also said that job growth was generally stronger in the manufacturing, construction, entertainment, and hospitality sectors, although employment remains a widespread challenge.

"Wage growth generally accelerated slightly, with wage pressures most important in sectors such as manufacturing and construction where finding and retaining workers was particularly difficult," the Fed added in the survey results.

The Beige Book also reported that overall prices have also accelerated slightly since the last report, with several areas reporting moderate price increases and some saying prices rose even more strongly. Looking ahead, the Fed said expectations were more optimistic than in the previous report, supported in part by the acceleration of COVID-19 vaccines.

The release of the Beige Book comes two weeks before the next monetary policy meeting of the Federal Reserve Board, which is scheduled for April 27-28.

US health officials are weighing next steps as they investigate a few unusual blood clots in women who received the Johnson & Johnson COVID-19 vaccine. Reports are extremely rare - to date, six out of more than 7 million vaccinations. It is not clear if it is related to the Johnson & Johnson vaccine.

In the same context, European regulators declared that such blood clots pose a rare but possible risk with the similarly manufactured AstraZeneca vaccine. In the United States, the Centers for Disease Control and Prevention will discuss at a public meeting how to handle the Johnson & Johnson vaccine while authorities investigate.

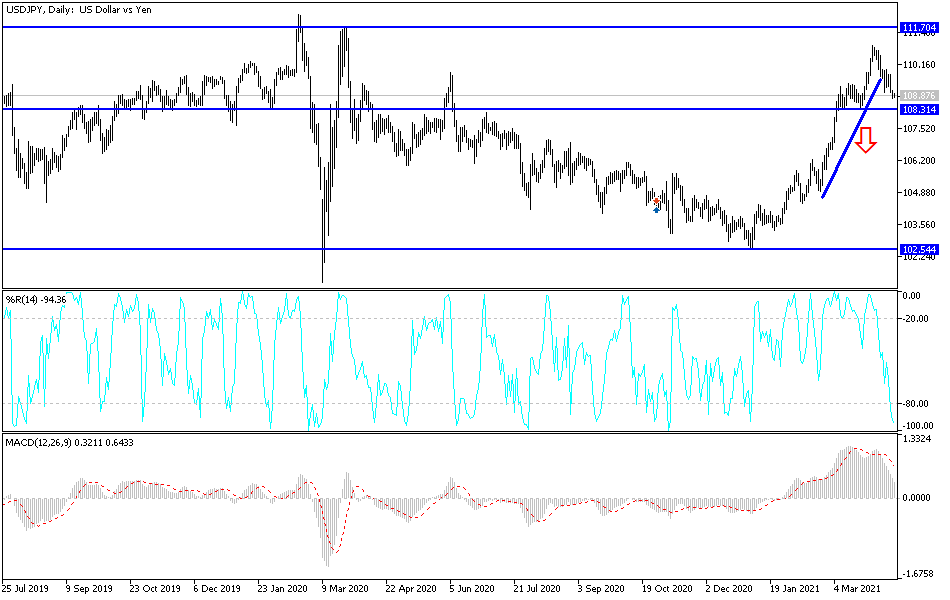

Technical analysis of the pair: On the daily timeframe chart, there is a clear break of the upward trend of the dollar against the Japanese yen, and the current stability below the support level 109.00 increases the bears' control over the performance and warns of a stronger downward move. The closest support levels for the currency pair are currently 108.60, 107.90 and 107.00, and despite the recent performance, I am still preferring to buy the currency pair from every downside level. The economic divergence, monetary policy, vaccination and stimulus between the United States and Japan are in favor of the currency pair's future gains.

On the upside, the psychological resistance of 110.00 remains the most important for the bulls to control the performance again. The currency pair will be affected by the announcement of retail sales, the number of US weekly jobless claims, the reading of the Philadelphia industrial index and the industrial production rate in the United States.