For four trading sessions in a row, the USD/JPY has been moving in a bearish correction range, which settled around the 109.58 support level as of this writing. This confirms the extent to which investors have abandoned the US dollar, which witnessed a strong recovery in recent trading weeks, amidst the strength of the US economic data, led by job numbers, and the passage of more economic stimulus plans by the US administration and working to vaccinate more American people in less time.

Ahead of the announcement of the Federal Reserve's most recent meeting minutes, the International Monetary Fund has warned that a potential sudden tightening by US Federal Reserve policy could lead to higher interest rates and capital outflows from emerging markets, underlining the need for clear communications from the central bank. The International Monetary Fund said in a statement that the interest rate hike in the US market so far has been driven by positive news about the economic outlook and COVID-19 vaccines, which tend to boost portfolio flows and reduce spreads on US dollar-denominated debt for most emerging markets.

For its part, the US central bank said that it will keep interest rates close to zero until the US economy reaches its maximum employment opportunities and inflation is on its way to exceed the 2% for some time. But if central banks in advanced economies suddenly signal greater concern about the risks of inflation, the world could see a sudden tightening of financial conditions along the lines of a “gradual tantrum” in 2013, IMF Economists Philip Engler, Roberto Piazza and Galen Scheire wrote.

“Monetary policy surprises,” as measured by the increase in interest rates on days of regularly scheduled Federal Reserve decisions, have found that for every one percentage point increase in US interest rates, long-term interest rates rise by a third of a point on average. The International Monetary Fund said the increase was two-thirds of a point in emerging markets with low and speculative credit ratings.

The International Monetary Fund added that to avoid triggering a deterioration in investor sentiment regarding emerging markets, central banks in advanced economies can provide clear and transparent communications about future monetary policy under different scenarios. The fund has cited Federal Reserve guidance on preconditions to a rate increase as an example. The International Monetary Fund said more federal guidance on potential future scenarios would be beneficial for everyone.

Half of new coronavirus infections in the United States seem largely condensed within just five states - a situation that is pressing the US government to consider changing the way vaccines are distributed by sending more doses to hotspots. New York, Michigan, Florida, Pennsylvania and New Jersey together reported 44% of new COVID-19 infections in the country, or nearly 197,500 new cases, in the most recent seven-day available period, according to government health agency data compiled by Johns Hopkins University. The total number of infections in the United States during the same week reached more than 452,000.

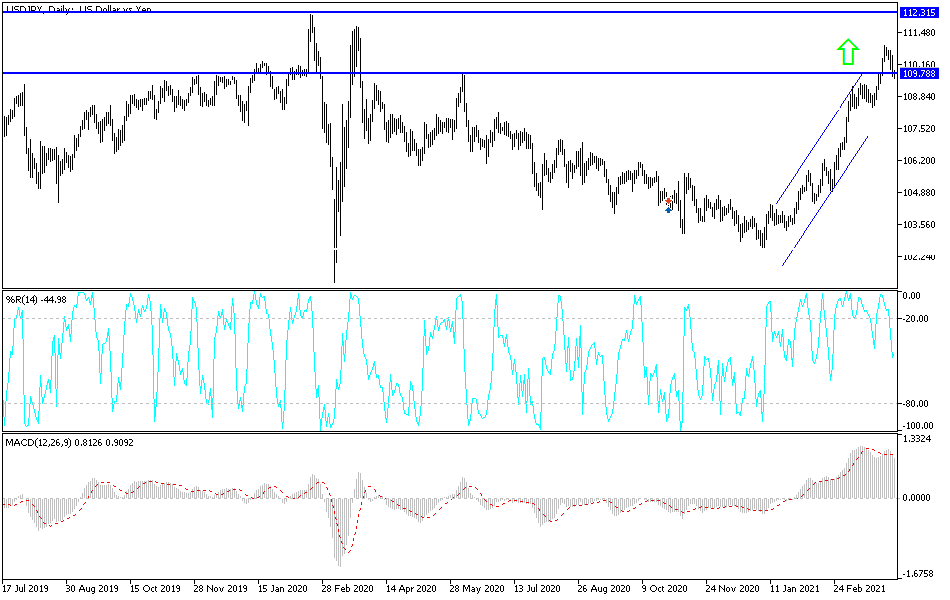

Technical analysis of the pair:

On the daily chart, despite the recent decline, the USD/JPY is still in the range of its ascending channel, and a strong breakout of the trend will not occur without the currency pair moving below the support level of 108.65 according to the performance over the same period of time. The return of stability above the psychological resistance of 110.00 will remain important for the bulls to dominate the performance. I still prefer buying the currency pair from every downside level, and the best buying levels are currently 109.20, 108.75 and 107.90.

The USD/JPY pair may remain in a narrow range until the content of the minutes of the last US Federal Reserve meeting is released later in the day.