After an upward correction had the USD/JPY pair testing the 109.07 resistance level, it quickly retreated to the 108.55 support level as of this writing. The US dollar suffered a setback after the announcement of the monetary policy decisions of the Federal Reserve and the statements of ChairmanJerome Powell. Powell has made clear that the US Federal Reserve is not even close to starting a rollback of very low interest rate policies.

In its statement after the latest policy meeting, the US Federal Reserve said it will keep its short-term benchmark interest rate near zero, as it has been suspended since the outbreak of the pandemic broke out nearly a year ago. The goal is to help keep loan rates low, for individuals and businesses, to encourage borrowing and spending. The Fed also said it will continue to buy $120 billion in bonds per month to try to keep long-term borrowing rates low as well.

At a press conference, Powell stressed that the Fed will need to see more evidence of continuous and fundamental improvements in the labor market and the general economy before it considers reducing its bond purchases. In the past, Powell said that the Fed's eventual pullback from its economic support would begin with a cut in bond purchases and only then in a possible interest rate hike. “We're just going to need to see more data,” Powell said. "It's not more complicated than that.”

Accordingly, Paul Ashworth, an economist at Capital Economics, noted that “although he took a more optimistic tone about the economic outlook and acknowledged rising inflation, the Fed gave no hints that it is considering slowing the pace of asset purchases, let alone thinking about raising interest rates."

Powell highlighted the improvement in the economy in recent months but said more progress was necessary.

"Since the beginning of the year, indicators of economic activity and employment have been strengthened," Powell added. Household spending on commodities rose strongly.” He also highlighted the amazing progress the nation has made against the pandemic - a key point given that the bank's chairman has often said that economic recovery depends on controlling the virus.

All in all, the US economy has made unexpectedly strong gains in recent weeks, with rising employment, spending and manufacturing measures. Most economists say they are discovering the early stages of what would be a strong and sustainable recovery, with fewer coronavirus cases, increasing vaccinations, and Americans spending their stimulus-boosted savings.

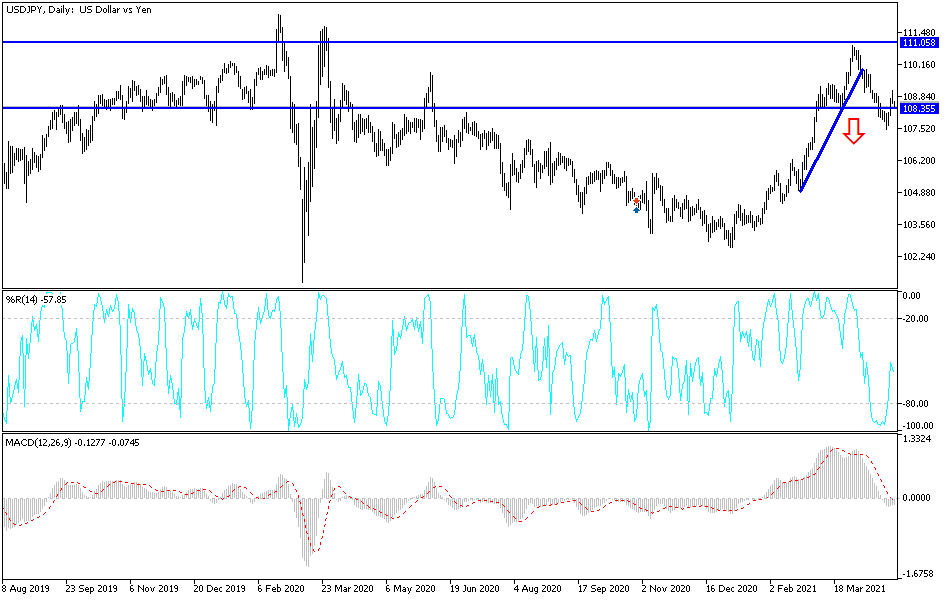

Technical analysis of the pair:

The price of the USD/JPY is still suffering from weak momentum, which precludes it from moving within an upward channel. This will depend on the breach of the psychological resistance 110.00. This did not happen even with the recent collapse in the currency pair, which pushed the technical indicators to strong oversold levels. Nevertheless, I would still prefer to buy the currency pair from every downside level, the closest of which are 108.25, 107.45 and 106.90. The foundations for the dollar’s gains are still strong and firm, and confidence in the economic performance and the US administration’s plans for stimulation and vaccinations are paving the way for a strong US economic recovery, which will be positive for the dollar against the rest of the other major currencies.

The currency pair will be affected today by risk appetite, along with the announcement of the US GDP growth rate, weekly US jobless claims and pending home sales.