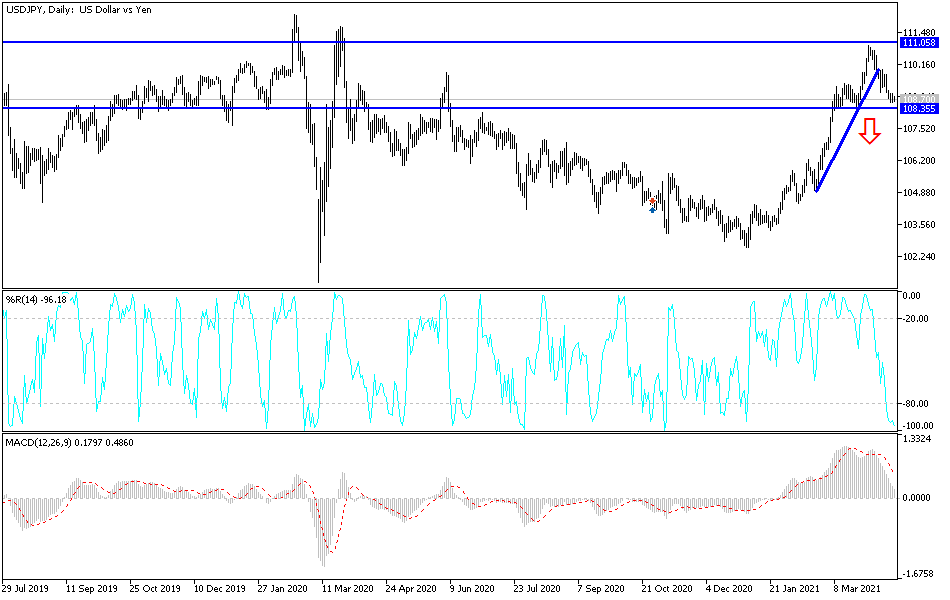

The USD/JPY pair had a bearish start to the week as it fell towards the 108.61 support before closing trading around 108.80. I have mentioned that stability below the 108.00 support will increase the bears' control over the performance and at the same time may push technical indicators to strong oversold levels. Fears of a new Russian war with Ukraine and the US administration’s determination to maintain tarriffs on Chinese products and blacklist more Chinese companies contributed to the popularity of safe havens, the most important of which being the Japanese yen.

The huge fiscal stimulus plans approved by the US administration have greatly contributed to the recovery of important sectors of the largest economy in the world. The most notable improvements were retail sales, consumer confidence and the US jobs numbers.

By the end of last week, housing construction in the United States was announced in March to have achieved the fastest pace since 2006 as home builders recovered from the unusual harshness of February that shut down projects. Accordingly, the Department of Commerce reported that construction companies began building new homes and apartments at a seasonally adjusted annual rate of 1.74 million units in March, an increase of 19.4% from February when housing construction decreased by 11.3%. The fastest pace of housing construction at 1.8 million was recorded in June 2006 during the last housing boom.

Severe storms swept across the country in February, prompting further construction work. According to the report, building permit applications, a good sign of future activity, increased 2.7% to a seasonally adjusted annual rate of 1.77 million units. Accordingly, economists expect housing construction to remain robust this year given the record low level of homes for sale.

A new report from mortgage giant Freddie Mac has concluded that the US housing market lacks the 3.8 million single-family homes that are needed to meet demand - a 52% increase from the massive housing shortage in 2018. Commenting on the numbers, Nancy Fanden said. Hooten, chief economist at Oxford Economics, said in a research note: "We expect the pace of housing starts to be a little moderate compared to 2021, but we're still looking for starts of more than 6% this year."

The housing sector was one of the stars of last year's performance in an economy plagued by a global pandemic. Home construction rose 6.9% to 1.38 million units for the year.

Yesterday, the US government announced that half of all adults in the United States of America had received at least one dose of COVID-19, which marks another milestone in the largest vaccination campaign ever in the country. The Centers for Disease Control and Prevention reported that nearly 130 million people 18 years of age or older have received at least one dose of the vaccine, or 50.4% of the total adult population. Nearly 84 million adults, or about 32.5% of the population, were vaccinated.

The United States surpassed the 50% mark just one day after the reported global death toll from the coronavirus exceeded 3 million, according to totals compiled by Johns Hopkins University, although the actual number is believed to be much higher. The country's vaccination rate, which is 61.6 doses per 100 people, currently lags behind Israel, which tops among countries with at least 5 million people, with a rate of 119.2. The United States also follows the United Arab Emirates, Chile and the United Kingdom, which have vaccinated at a rate of 62 doses per 100 people, according to Our World in Data, an internet research site in this regard.

Technical analysis of the pair:

So far, the bears dominate the performance of the USD/JPY, and are looking to break through the psychological support level of 108.00, which will push the technical indicators to strong oversold levels. Therefore, I prefer to buy the pair from any downward level. According to the performance over the same period of time, the bulls will regain control of the performance by testing the 110.10 resistance level.

The currency pair does not expect any important economic data today, and investor sentiment will have the biggest impact on the pair’s performance.