The USD/JPY pair retreated to the support level of 109.96 before settling around the 110.20 level at the beginning of Tuesday's trading. This came amid the selling of the US dollar at the beginning of trading this week and after Monday's holiday, which contributed to a very limited movement for three consecutive trading sessions. The gains of the bullish bounce last week stalled on the threshold of 111.00 resistance with less than three points. It is the highest for the currency pair in more than a year. The recent sharp gains of the US dollar were supported by better-than-expected US job numbers and improved investor morale from passing more economic stimulus plans and efforts to vaccinate the largest number of Americans in a short time to work on returning activity to the largest economy in the world.

However, higher spending has an upside down for the dollar, making it likely that there will come a point when investors realize that holding the dollar is not the best way to position the global economic recovery, even if this recovery is led by the United States. Where more attractive assets can be found elsewhere, this will be especially true in 2021 as the dollar supply to investors is undermined by the new medium inflation targeting policy strategy pursued by the US Federal Reserve.

The Fed's strategy creates a negative correlation between the pace of US growth and progress toward the federal inflation target on the one hand, and the real returns offered to investors holding US government bonds on the other hand. Inflation expectations, if not raised further, will be supported by increased spending and a commitment by the Fed to effectively keep interest rates at zero until inflation rises above the 2% target for a period, which is not expected to happen before late 2023.

US employment data for March determined what we all knew, which is that the world's largest economy is improving. The 916K increase in US non-farm payrolls was significantly higher than most forecasts, and job growth in January and February was revised upwards (+156K). The report, along with the increase in auto sales (17.75 million, an increase of 2 million from February and more than a million above the median forecast in a Bloomberg survey), is likely to set the tone for the upcoming high-impact data.

Moreover, early projections call for job growth to continue to accelerate this month as the vaccine rollout expands and more people return to their jobs. The United States of America lost about 22.4 million jobs last spring, and nearly 14 million people returned to work. This leaves US employment less than 8.4 million compared to February 2020.

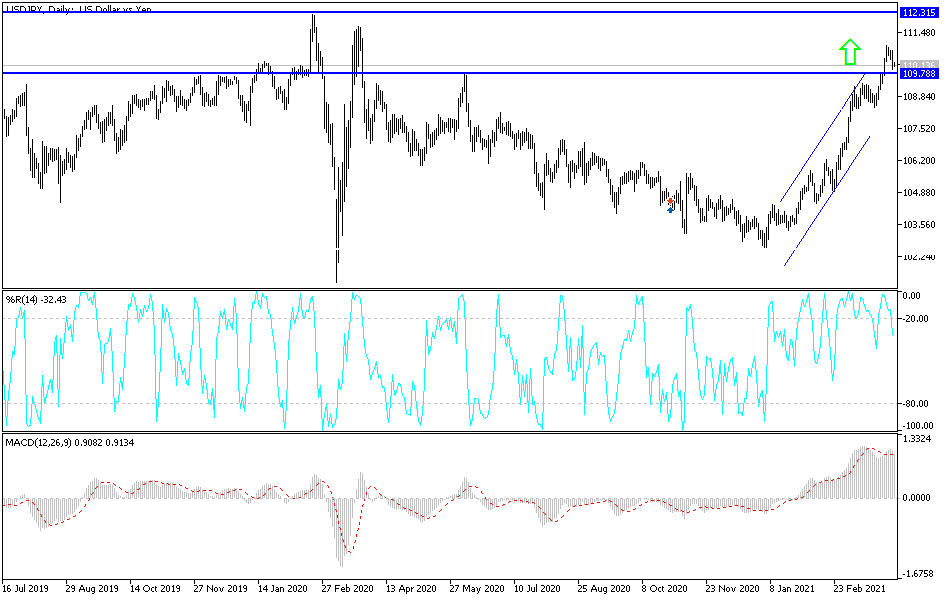

Technical analysis of the pair:

The USD/JPY did not exit its sharp bullish channel. For this to happen, as I mentioned before, the bears still need to breach the support levels of 109.55 and 108.00. Stability around and above the psychological resistance of 110.00 will still support the bulls' continued domination of performance. I still prefer to buy the currency pair from every downside. The recent gains pushed the technical indicators to overbought levels, so the latest correction may be healthy for profit-taking.

Momentum indicators extended excessively but did not decline. Touching the resistance 111.00 again will give the bulls the necessary momentum to move towards the resistance levels 111.75 and 112.45.

Today's economic calendar data is relatively calm. From Japan, average wages will be announced along with the average Japanese household spending. Then, at a later time, the number of American jobs will be announced.