At the end of last week’s trading, and amid continuous positive results of US economic data, the USD/JPY tried to correct upwards and failed to breach the psychological resistance of 110.00 again. The pair’s sell-off last week extended to the 109.00 support level and stabilized at the beginning of this week’s trading around the 109.65 level. Renewed manifestations of the US-China rift have recently boosted the Japanese yen's gains as a safe haven. The new US administration has not abandoned former President Trump's tariffs that put pressure on China's exports, but rather has included many Chinese companies on the blacklist. The recent skirmishes have attracted investors' attention to what will happen.

The United States has imposed export restrictions on many Chinese companies and government facilities involved in helping China develop a new supercomputer (it would be capable of performing one trillion calculations per second). There are many civilian and military applications which irritate the United States, so Biden is working to expand the approach that began with Trump.

Meanwhile, Ford and General Motors announced further plant closures due to a shortage of some resources. Separately, the bill recently introduced in the US Senate and scheduled to be debated in the committee this week (the Strategic Competition Act) represents an escalation of US efforts to curb China's expansion and aggression. It includes measures to build closer ties with Taiwan, funds to "strengthen Hong Kong's democracy," and more sanctions.

In a rare admission of the weakness of China's COVID-19 vaccines, the country's top disease control official said their efficacy is low and that the government is considering mixing them to get a boost. In this regard, the director of the Chinese Centers for Disease Control, Zhao Fu, said at a conference on Saturday in Chengdu, southwest China, that Chinese vaccines "do not have very high protection rates."

Beijing has distributed hundreds of millions of doses abroad as it tried to raise doubts about the effectiveness of a Pfizer-BioNTech vaccine made using a previous experimental messenger process, or mRNA. At a news conference on Sunday, officials did not directly respond to questions about Gao's comment or possible changes to the official plans. But another CDC official said developers are working on mRNA-based vaccines.

Accordingly, experts say that mixing vaccines or serial immunization may enhance efficacy. In Britain, researchers are studying a possible combination of Pfizer-BioNTech and the conventional AstraZeneca vaccine.

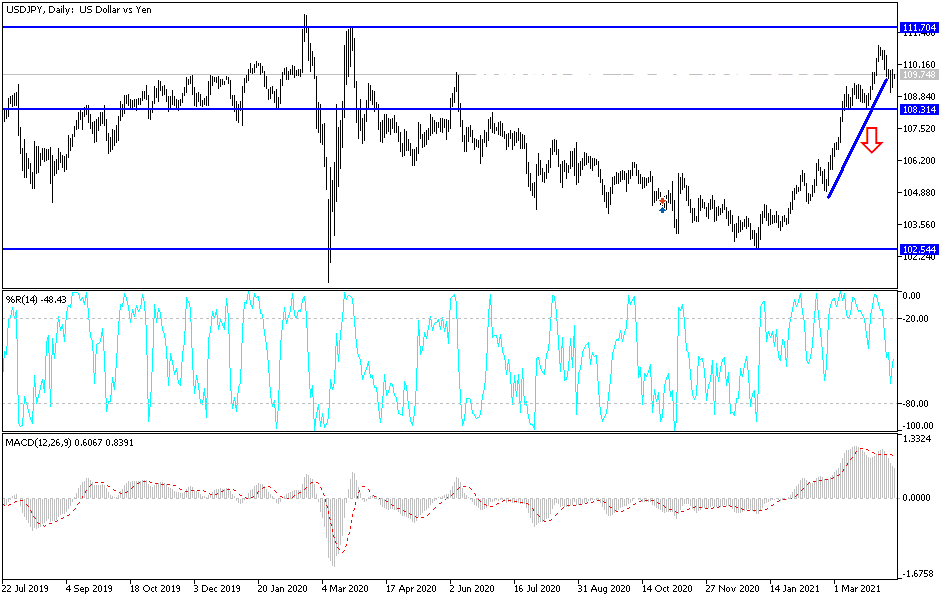

Technical analysis of the pair:

On the daily chart, the USD/JPY, still needs to stabilize above the 110.00 psychological resistance to return to its bullish channel again. A breach of the 108.80 support will increase the bears' control over the performance and thus move the pair towards stronger support levels, the closest of which are 108.45 and 107.75, which are the most appropriate buying levels. I still prefer to buy the currency pair from every downside.

The strong and continuous US stimulus plans will remain an important and influential factor for the future of the US dollar against the rest of the other major currencies. Relatively calm movements are expected for the currency pair today, amid the absence of the economic calendar today of important and influential data.