The USD/JPY's bearish performance was strengthened after it breached the 108.00 psychological support level, with losses to the 107.88 support level, before stabilizing around 108.05 as of this writing. The US dollar fell against the rest of the other major currencies after traders chose to buy riskier assets despite growing concerns about an increase in coronavirus infections. The US Federal Reserve monetary policy meeting is due to take place next week, when the bank’s policymakers are expected to adhere to the ultra-easy monetary policy despite the progress in the economy. For his part, Fed Chairman Jerome Powell said recently that the upcoming rise in inflation readings is likely to be fleeting and will not cause the US central bank to change its monetary policy.

Commenting on the performance of the US dollar, an analysis from ABN AMRO shows that the recent weak correction in the dollar is likely to be temporary, but when the currency finds the opportunity again, it is likely to be more modest than it was previously. Accordingly, the Netherlands-based international lender and international financial services provider ABN AMRO informed clients in a weekly briefing that the current weakness of the US dollar will be temporary.

The firm stated that the US economy will strongly surpass the economies of the Eurozone, the United Kingdom, Japan and other economies. “In addition, we expect real returns to remain supportive of the dollar in the future,” says Georgette Boyle, Senior Forex Market Analyst at ABN AMRO. "We suspect the Fed will be slow to start raising interest rates, but that will be before long. It is in contrast to the negative interest rates followed by the European Central Bank, the Bank of Japan and the Swiss National Bank. Therefore, the dollar should rise over time.”

The US dollar rose sharply in the first months of 2021, driven by a sharp rise in the yield on 5-year US government bonds. The rise in bond yields was an indication that investors were preparing for higher US inflation rates over the coming months and years as the nation's economic recovery accelerated.

Although ABN AMRO expects the dollar to re-consolidate this first-quarter advance, subsequent gains are likely to be less robust. The rise in 10-year bond yields is expected to be limited, mainly driven by lower inflation expectations rather than higher nominal yields. Meanwhile, financial markets are often expected to expect the strong economic performance of the United States versus other countries.

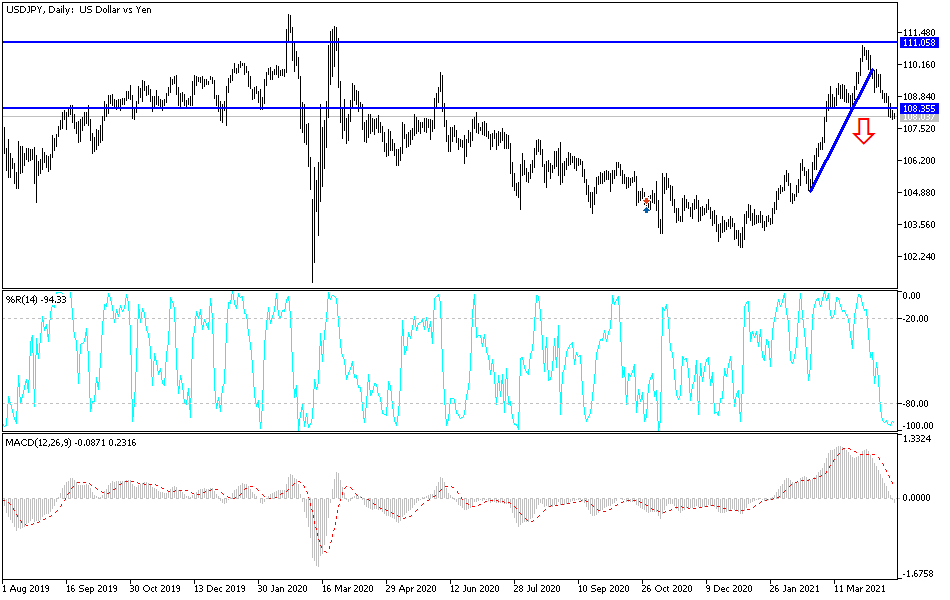

Technical analysis of the pair:

So far, according to the performance on the daily chart, the general trend of the USD/JPY remains bearish, and stability around and below the psychological support level 108.00 confirms the bears' domination of performance. Some technical indicators have reached strong oversold levels, while others see that the pair still has an opportunity to retreat to reach these levels. I prefer to buy the currency pair from every downside level, and the closest buying levels are 107.75, 107.20 and 106.45.

The first reversal of the general bearish trend depends on the bulls' breaching the psychological resistance of 110.00.

Today's currency pair will be affected by market risk appetite, as well as the reaction to the announcement of the number of US weekly jobless claims and US existing home sales.