The USD/JPY pair abandoned the 110.00 psychological resistance despite the positive US inflation numbers, retreating to the 109.00 support level as of this writing. Investors abandoned the US dollar amid healthy risk appetite. According to official figures, consumer prices in the United States increased by 0.6% in March, the largest rise since 2012, while year-on-year inflation jumped 2.6%. The big gains were expected and largely expected to be temporary rather than a re-awakening of prolonged dormant inflation.

The increase in the US Consumer Price Index followed a 0.4% increase in February and was the largest one-month gain since a 0.6% rise in August 2012.

The annual increase was much larger than the 1.7% increase for the 12-month change in the previous month, and while it easily exceeded the Fed's 2% inflation target, the 2.6% increase in March was more than a jump from a period of time last year when it eased prices at a time when a large part of the world entered into a state of pandemic-related closures.

A year ago, the Fed lowered the key US interest rate to nearly zero and indicated that it does not plan to start raising US interest rates until it sees a sustained rise in inflation above its 2% target. For now, the first interest rate increases by the Federal Reserve are expected not until after 2023.

To avoid turmoil in financial markets due to concerns about rising interest rates, Fed Chairman Jerome Powell has warned for weeks that inflation numbers will rise this spring, but that the increase will be temporary. Accordingly, economists describe the March jump as a major effect due to lower prices at the start of the epidemic. This phenomenon can make inflation appear worse than it is at first glance. For the month of March, energy prices were up 5% led by a 9.1% jump in gasoline prices. The increase in gasoline accounted for nearly half of the monthly price gain. Food prices rose 0.1% in March and 3.5% higher than a year ago.

Economists expect more price gains in the coming months as the country continues to open up, but they believe the Fed will continue to see these gains as temporary. Commenting on this, Robella Farooqui, chief US economist at High Frequency Economics, said price pressures will increase over the few months, reflecting a variety of factors including supply chain constraints and strong demand as economic activity resumes. But she said the Fed would see these rates rise as temporary and "not expected to continue."

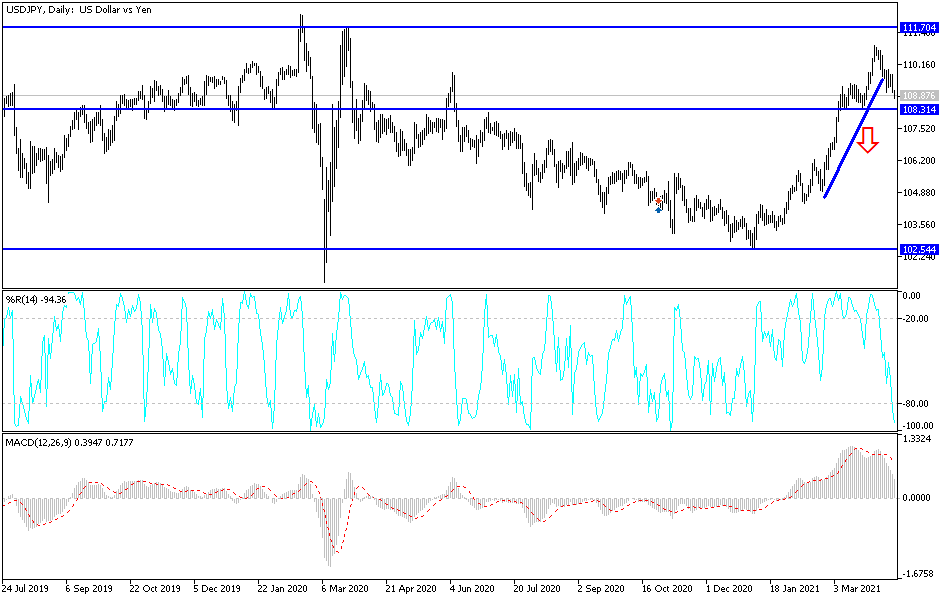

Technical analysis of the pair:

On the daily chart below, it seems clear that there is a break of the general bullish trend, and a move below the support 109.00 will increase selling and push the USD/JPY towards stronger support levels, the closest of which are currently 108.75, 107.90 and 107.00. The last two levels are best for buying and waiting for a rebound, as it will push the technical indicators to strong oversold levels. On the upside, a breach of the 110.00 psychological resistance will be necessary in order for the bulls to regain control of the performance.

The currency pair will be affected today by risk appetite, as well as the market's reaction from statements made by US monetary policy officials led by Federal Reserve Chairman Jerome Powell.