The USD/JPY's continued bearish performance pushed it towards the 107.87 support, a near 2-month high, before settling around the 108.25 level as of this writing. Forex traders are currently analyzing the economic disparity and monetary policies between global economies in the era of vaccinations and the easing of COVID restrictions. The US administration is currently boasting that the US economy will recover quickly from the effects of the global medical pandemic.

In this regard, US President Joe Biden stated, "In the first two months of our administration, we created more jobs than the first two months of any administration in American history."

According to official figures, what Biden mentioned is correct, but the records are not what they were before. The pandemic has resulted in unprecedented economic losses and gains. In light of the turmoil, President Donald Trump was also able to make record progress in some economic indicators when the virus began to decline last year, but it has reappeared.

Biden thanked lawmakers for supporting the pandemic relief package that provided $1,400 to most Americans and other aid, saying the job gains are "because of all of you." But the numbers Biden praised also reflected the easing of restrictions on state and local businesses that his administration had opposed. When some public health experts pleaded with the administration to send more vaccines to Michigan to help the infection spread there, for example, the director of the Centers for Disease Control and Prevention said, "The answer to that is really shutting things down."

The pandemic has caused a recession so fast and deep that nearly all of the jobs data for the past year were unprecedented. The same applies to the first two months of Biden's presidency.

Employers added nearly 1.4 million jobs in March and April, which is impressive by all accounts.

But it is at least part of the confirmation of the massive losses that occurred in March and April of last year, when 22.4 million jobs were cut in just two months. Despite the strong gains Biden cited, there are still 8.4 million fewer jobs than there were before the pandemic, roughly the number of jobs lost in the 2008-2009 Great Recession.

Hiring has accelerated in the past two months as vaccinations increase, states and cities loosen trade restrictions, and Americans begin to spend more. Biden's $1.9 trillion relief package approved in March, together with big stimulus measures, may have helped speed up the economy's recovery and may have encouraged some employment.

In contrast, the western city of Osaka, Japan, has decided to ask the government to declare a state of emergency in the region after continuous warning measures failed to control the spread of the virus. The governor of Osaka's decision to request the third state of emergency comes just 50 days after the previous state of emergency ended. Under a law tightened in February, the new state of emergency will allow authorities to issue binding orders for business owners to shut down or shorten service hours. Public measures, including wearing masks and staying home, will remain non-mandatory requests.

Nationwide, Japan has recorded 537,317 cases, including 9,671 deaths - good results by global standards but worse than some other Asian countries - without any forced lockdowns. But people are losing patience and becoming less cooperative in responding to requests. Osaka is expected to close its theme parks, shopping centers and other commercial facilities to drastically curb public activity for a few weeks.

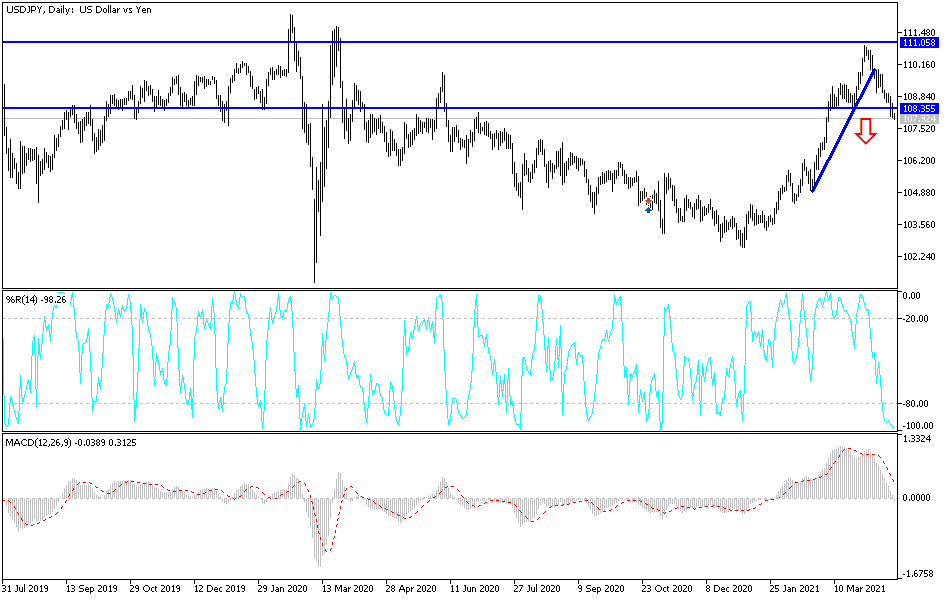

Technical analysis of the pair:

Moving below the support level of 108.00 confirms the extent of the bearish performance, and moving towards the support levels of 107.75, 107.00 and 106.55 will push the technical indicators to strong oversold levels and await the expected rebound. Therefore, I still prefer to buy the currency pair from every downside. On the upside, the first retracement and the start of the bulls' control will be the breach of the psychological resistance of 110.00. Otherwise, the bearish trend will remain in place.