The continuous and robust economic stimulus plans by the US administration allowed the US dollar to reap more gains against the other major currencies. The USD/JPY made a breakthrough towards the resistance level at 111.00, with a difference of only 3 points, before the currency pair settled around 110.77 at the beginning of trading on Thursday. The Japanese yen was negatively affected by investor risk appetite and disappointing results for Japanese economic releases, which confirm that the Japanese economy continues to be negatively affected by the effects of the COVID-19 pandemic.

The Japanese yen was one of the worst-performing currencies in the Forex markets, as it fell more than 7% against the dollar. With officials acknowledging that the impact of the COVID-19 pandemic on the world's third largest economy will last longer than expected, investors may turn away from Japan.

According to the Ministry of Economy, Trade and Industry (METI), Japanese industrial production fell by -2.1% in February, worse than the average estimate of -1.2%. This was down from the 4.3% increase in January. On an annual basis, Japanese industrial production fell 2.6%, driven by lower production of cars, electrical machinery, chemicals and pharmaceuticals. Elsewhere, construction orders rose 2.5% year-on-year in February, less than the 14.1% increase in January. The market had expected growth of 3.2%.

Housing starts in Japan decreased at an annual rate of 3.7% last month, down from 3.1% year-on-year in January. Earlier this week, annual retail sales were reported to decline at a better-than-expected rate of -1.5%.

With the first quarter of 2021 on the books, market analysts are beginning to determine the future of GDP growth. The expectation is that the period from January to March will record a contraction in GDP, and experts believe that additional coronavirus waves and new variables could affect the Japanese economy for many years to come.

For its part, the Japanese central bank indicated that it would begin to tighten policy to stabilize prices, with Bank Governor Haruhiko Kuroda optimistic about the country's economic recovery in the new fiscal year that begins in April. Japan's economic growth is linked to the world. The recovery in the US economy is positive for both Japan and global growth.

We will closely monitor markets as well as external and domestic economic developments, as various uncertainties remain about the impact of the COVID-19 pandemic.

But if the Japanese economy is struggling to grow, it is unlikely that the BoJ will raise interest rates and ease the form of quantitative easing. The April 26-27 meeting should provide more formal insight into the bank's policy stance.

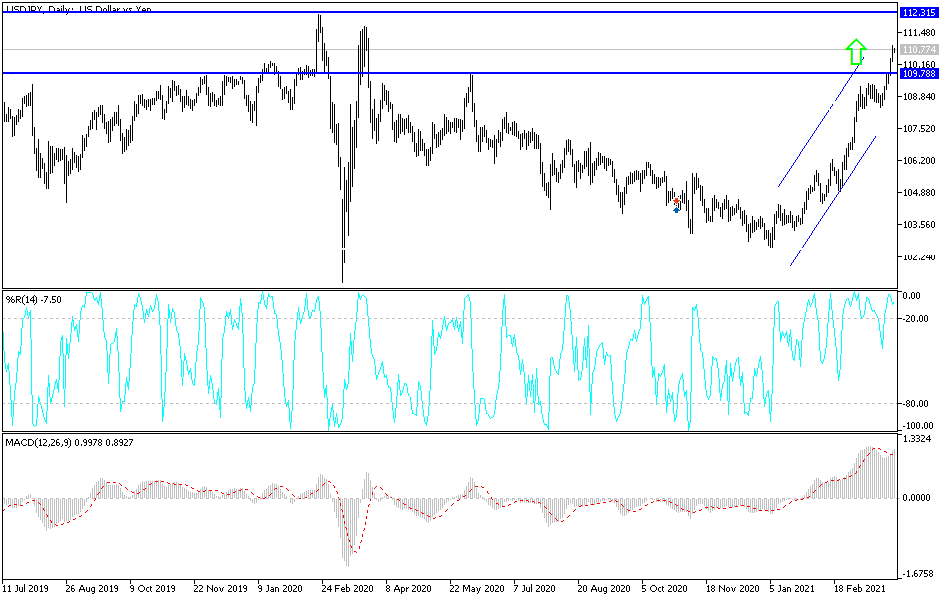

Technical analysis of the pair:

On the daily chart, bulls control the performance of the USD/JPY, and the recent gains have pushed the technical indicators to strong overbought levels. If the pair does not get more momentum, profit-taking may ensue imminently. The closest targets for the bulls are currently 111.20 and 112.00. The dollar’s gains against the rest of the other major currencies will be subject to reaction from the US labor market details announcement tomorrow. On the downside, the bears will not be in control of the performance without testing the psychological support level of 108.00 again.

The Japanese yen will be affected today by the announcement of the TANKAN industrial reading, and the US dollar will be affected today by the announcement of the number of weekly jobless claims, ISM Manufacturing PMI and Construction Spending Index.