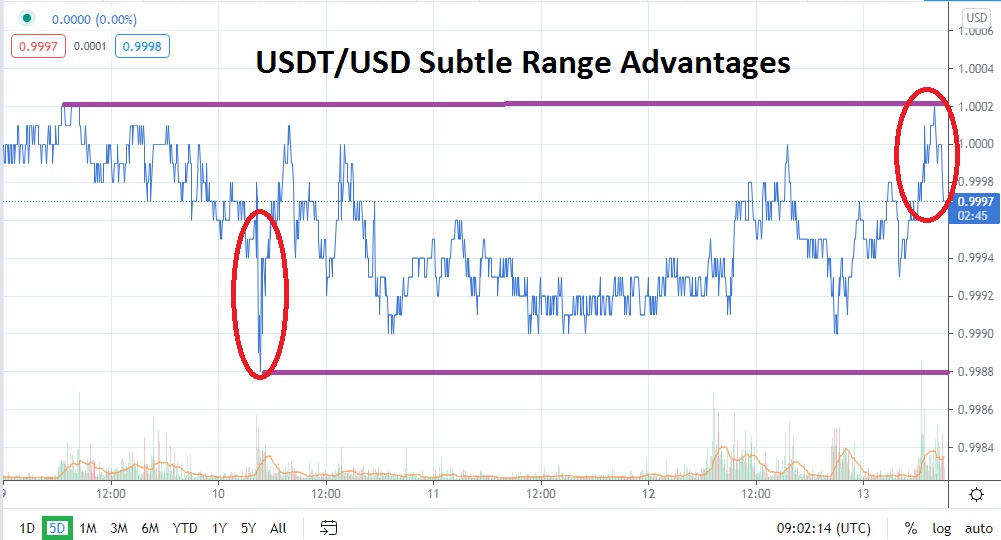

USDT/USD has been leaning in value towards values below the 1.0000 the past week and this may entice short term speculators who have the ability to trade Tether. Volatility is not natural within USDT/USD and traders should not expect wild flourishes to suddenly materialize, but the rather tight range of USDT/USD does create the allure of technical outlooks based on existing market sentiment.

As the major cryptocurrencies climb within eyesight of record highs, Tether has produced a rather modest value range the past week. This morning’s trading within USDT/USD continues to demonstrate an ability to remain slightly below the 1.0000 mark even as Bitcoin and Ethereum are flexing their muscles and are challenging higher marks. From a speculative viewpoint, the potential of purchasing USDT/USD on the notion the cryptocurrency market and particularly BTC remains exuberant could lead to positive speculative buying of USDT/USD.

Traders are certainly cautioned to use limit orders when participating in the USDT/USD market. However, placing take profits above the current price action while looking for slightly higher moves may be a logical decision based on the amount of volume and results of trading within the broad cryptocurrency market at the moment. If USDT/USD can trade at the 1.0001 and see its value sustained above this level, a test of higher resistance values may prove to be a rather logical speculative wager.

Traders within USDT/USD need to remain patient and they certainly need to use limit orders to cash out winning positions based on their expectations and goals. Traders should not target super high values from USDT/USD to suddenly emerge and break record values, it must be remembered Tether trades in a manner that functions as a stable coin and hovers near the 1.0000 consistently. Looking for values far beyond these levels is not realistic.

However, traders who believe the positive momentum within the cryptocurrency market will generate positive price movement slightly above the 1.0000 near term cannot be faulted. Traders who can buy USDT/USD around 0.9990 and look for movement higher might be making the correct speculative wager. The past week of trading within USDT/USD has produced muted results, but perhaps a slight change in trend based on speculative enthusiasm may occur sooner rather than later.

Tether Short Term Outlook:

Current Resistance: 1.0001

Current Support: 0.9993

High Target: 1.0004

Low Target: 0.9990