USDT/USD is hovering near the one-dollar sphere closely in early trading today. Speculators who like to trade Tether understand that as a stable coin, USDT/USD only moves in slight increments, and in order to take advantage of its changes in values, the use of limit orders is often a necessity, particularly depending on the timeframe that is desired.

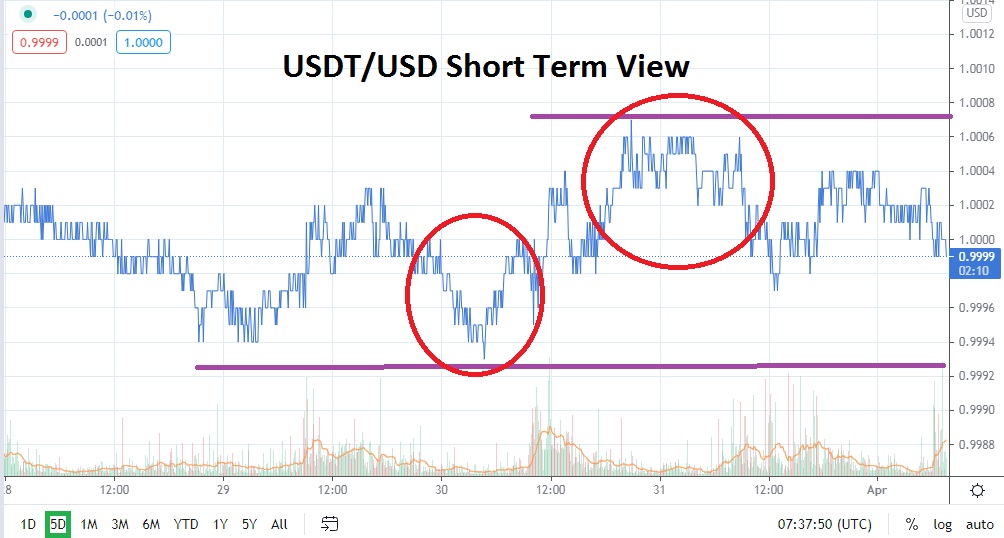

The broad cryptocurrency market is within another spell of exuberant buying and the past five trading days have provided a test of resistance and values being punctured higher. USDT/USD has also seen this demonstrated with a move upwards when taking into consideration that marks of 0.9993 and 0.9994 were being tested a few days ago.

If the broad cryptocurrency market continues to challenge highs and shows the ability to register new records near term, from a speculative point of view USDT/USD may offer the potential of climbing slightly higher and recording better values. Traders should consider buying USDT/USD on slight pullbacks and use current technical support levels near 0.9999 and 0.9998 as a place to buy the stable coin and look for incremental moves higher. USDT/USD may have the ability to test the 1.0002 to 1.0003 junctures near term.

Trading USDT/USD is not for everyone; patience and good risk-taking tactics are essential. In order to profit from Tether, a trader needs to understand the use of leverage and the mechanics of limit orders, and have the ability to patiently let trades work. USDT/USD moves in a fashion which is transparent but also rather uninspiring for many people. However, Tether is certainly a solid speculative endeavor for those who understand that the stable coin’s incremental moves can be taken advantage of with correct trading frameworks and goals being used.

If USDT/USD trades at 0.9999 and below short term, it looks like a buying opportunity. Current broad cryptocurrency sentiment appears exuberant and the next few days are likely to produce a vast sea of volatility, particularly if record high levels continue to be tested by a handful of the major digital currencies. Tether offer speculators a chance to use the stable coin as a solid wager as USDT/USD performs as a good barometer regarding sentiment and has the ability to climb slightly higher.

Tether Short-Term Outlook:

Current Resistance: 1.0003

Current Support: 0.9998

High Target: 1.0006

Low Target: 0.9996