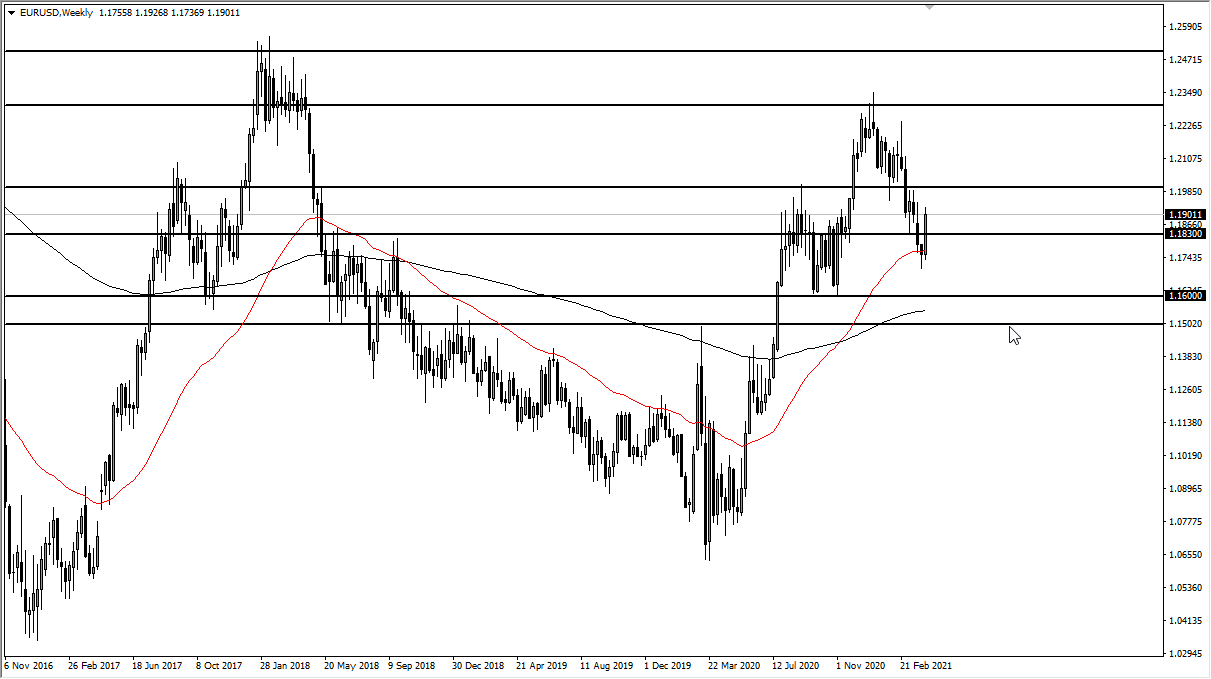

EUR/USD

The euro rallied significantly during the course of the week, breaking above the top of the hammer from the previous week. By doing so, the market then broke above the 1.19 level after that. At this point, the market is likely to see a lot of choppiness just above. After all, we have just filled a gap for the second time, so now I think we are probably going to spend the next couple of weeks going back and forth. The 1.20 level above being broken would be a very bullish sign, and it certainly should be noted that it looks like we have recovered quite nicely during this previous week. However, if I am going to buy the euro this coming week, I am probably going to do so against other currencies.

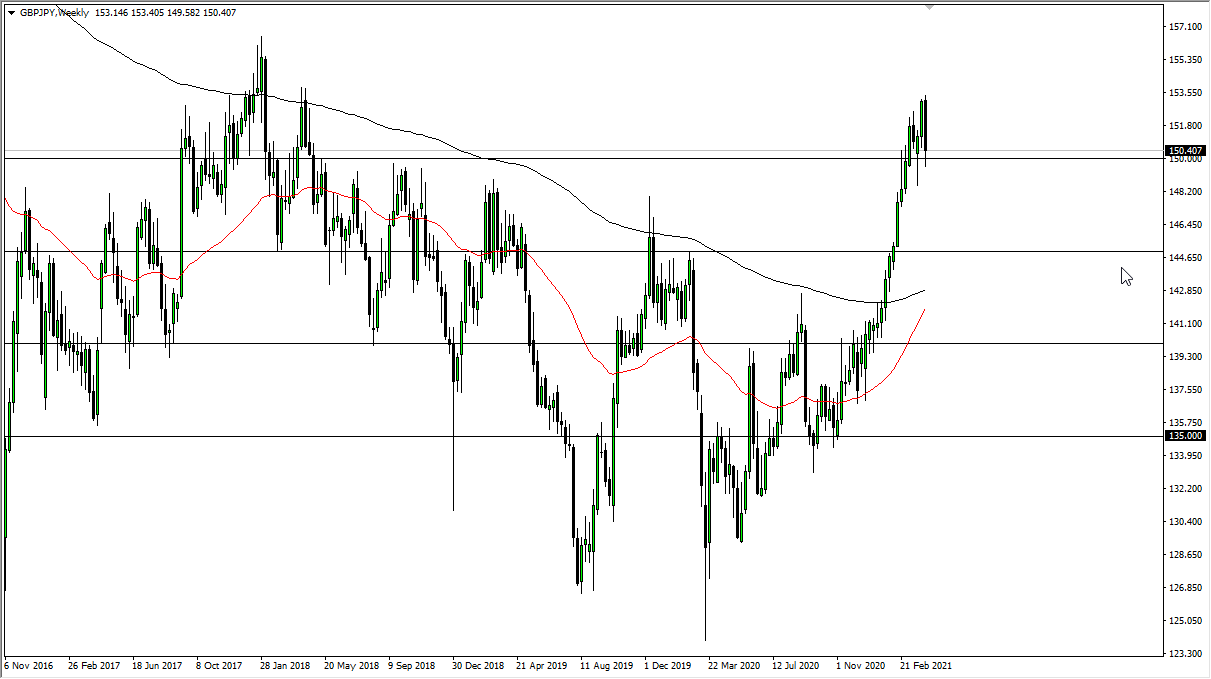

GBP/JPY

The British pound fell significantly during the course of the week to reach down close to the ¥150 level. However, we have bounced just a little bit from that level on Friday, so the question now is whether or not that will truly hold. If we break down below the hammer from a couple of weeks ago, then I think this pair will go looking towards the ¥145 level. On the other hand, if we can stay above the ¥150 level, then it is likely that we will continue to grind sideways back and forth between ¥150 and 153.50.

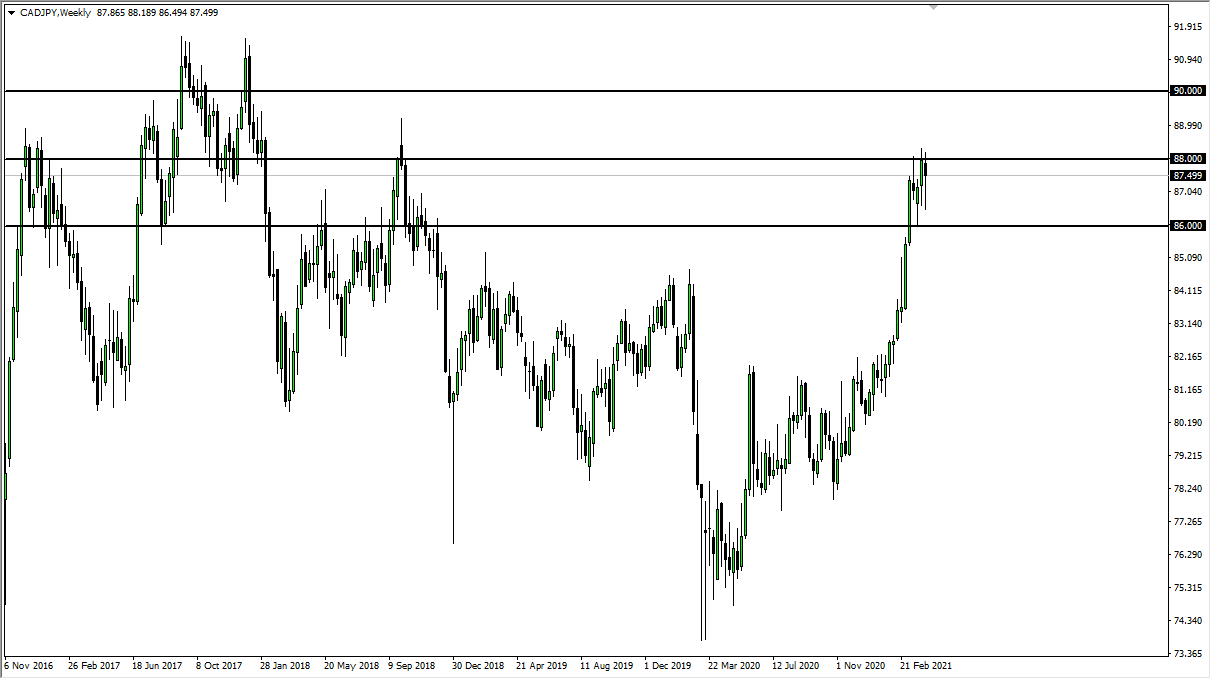

CAD/JPY

The Canadian dollar spent most of the week falling against the Japanese yen but then recovered quite sharply. What is going to be interesting to watch is the oil market and how it behaves, because it will have a direct influence on what this pair does. Currently, I see it as trading between the 86 and the 88 handles, so therefore I think that is the range we have for this week. However, if we break above the highs of the previous week, then this market is very likely to go higher and reaching towards the 90 level after that.

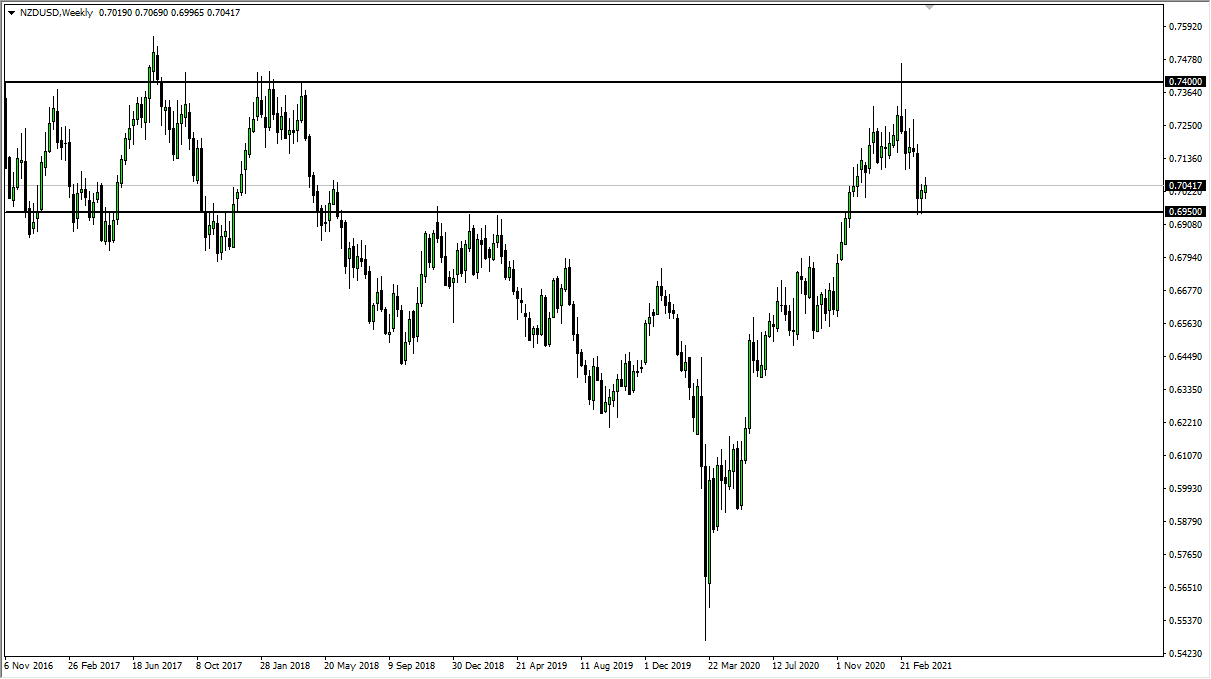

NZD/USD

The New Zealand dollar has spent the last couple of weeks trying to recover against the greenback, and although it has been very quiet, its stability is a very good sign. If we break above the top of the candlestick from this week, it is very likely that we will then go looking towards the 0.74 handle. To the downside, the 0.6950 level has been significant support over the last couple of weeks, so if we were to break down below there it is likely that we go looking towards the 0.68 level. This pair will more than likely move right along with risk appetite.