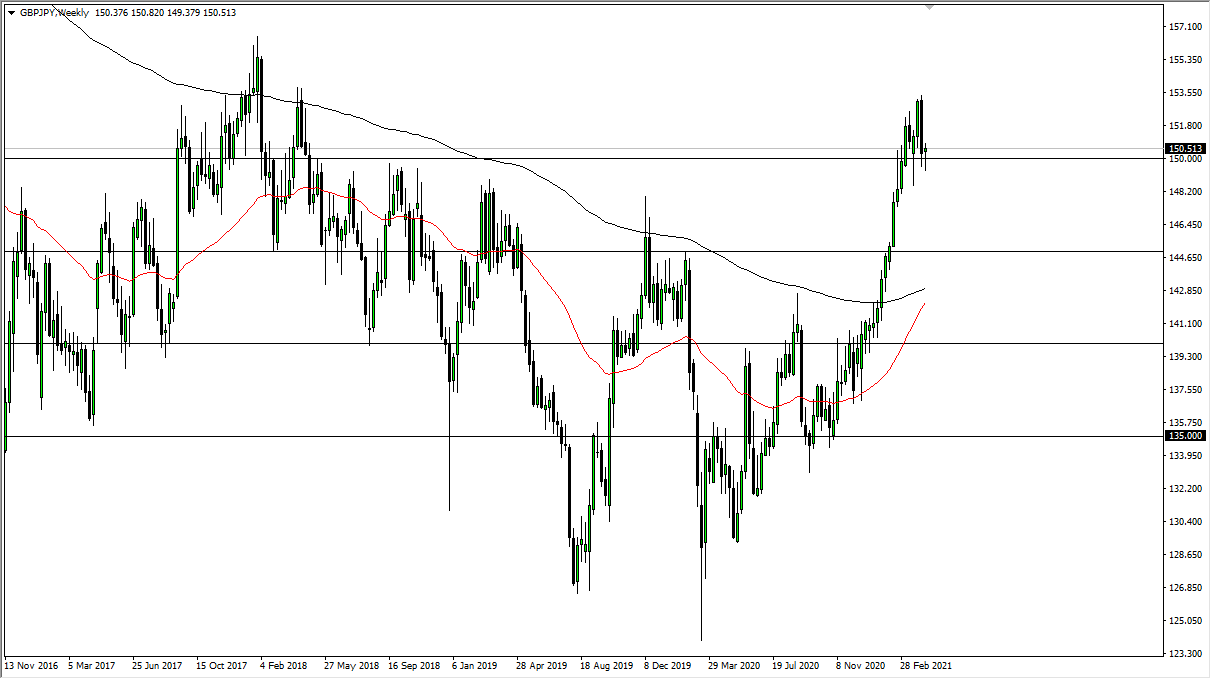

GBP/JPY

The British pound initially fell during the course of the week to dip below the ¥150 level, but now it looks as if the buyers have come back in full force. We have formed a massive hammer, so if we can break above the top of the weekly candlestick, it is likely that we will go looking towards the ¥153 level. This is a market that is trying to figure out where to go next and will be solely driven on risk appetite in general. The easier path is almost certainly to the upside, but we are a bit overextended, so I expect to be range-bound.

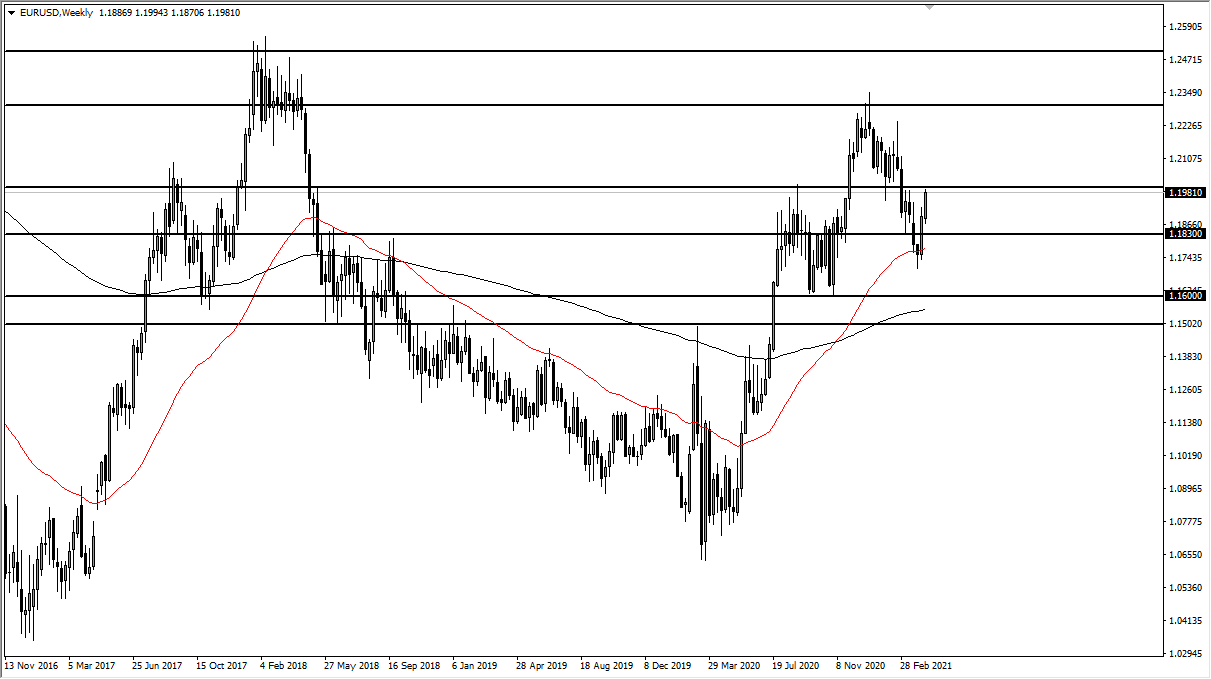

EUR/USD

The euro rallied a bit during the course of the week, and now it looks like we are to continue going higher given enough time. The 1.20 level is without a doubt the most important level that people are paying attention to and therefore if we get above the 1.20 handle, the market is likely to go higher. In the short term, we could be looking at a short-term pullback, but that will be bought into as it is becoming obvious that the markets are trying to pick this market up for some time. Massive amounts of liquidity continue to stymie the US dollar.

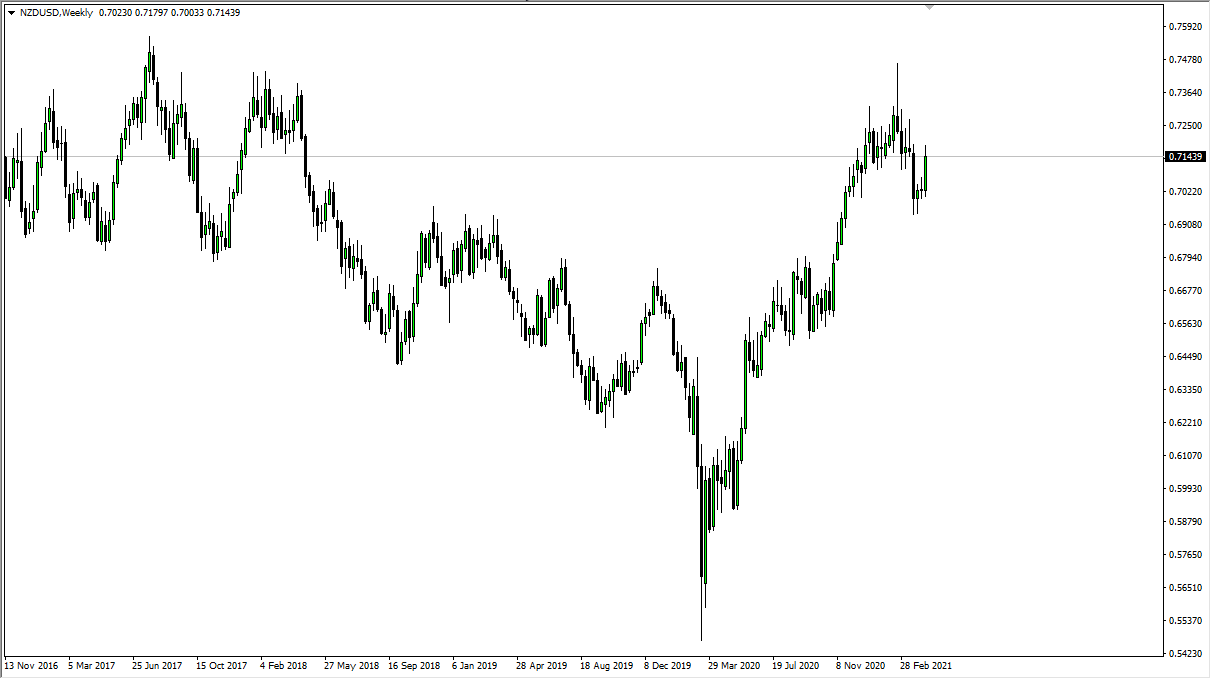

NZD/USD

The New Zealand dollar exploded to the upside during the course of the trading week to reach towards the 0.72 level. We have failed at that point though, and now the question is whether or not we can continue to go higher. It certainly looks as if we are going to struggle, so I would not be surprised at all to see a short-term pullback during the course of the week. If we break down below the 0.70 level, then the sellers are truly going to take over.

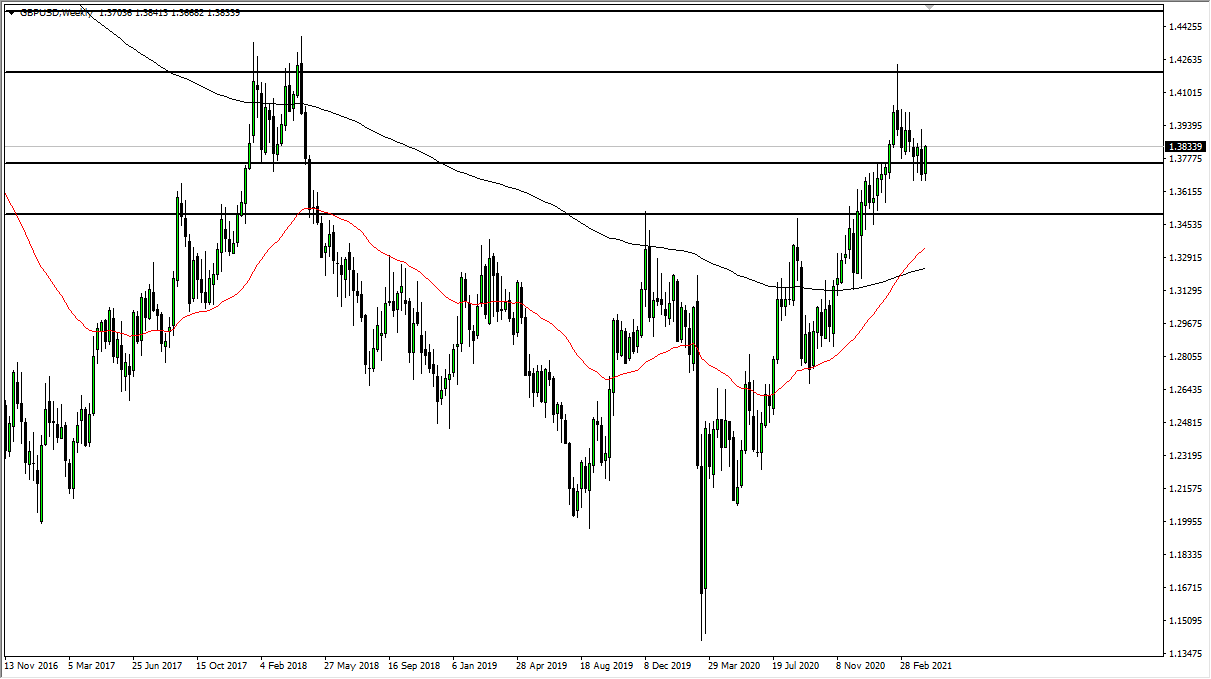

GBP/USD

The British pound has rallied significantly during the course of the week, but it should be noted that most of the gains were actually had on Friday. The market looks as if it is trying to reach higher, and a little bit of a flag pattern is being informed. I think that dips will continue to be bought into as the British pound is without a doubt one of the favorite currencies out there. I have no interest in shorting this market until we get at least below the 1.35 handle.